Bi-Weekly. August I

Macro Update: Slower growth and higher inflation due to Delta strain

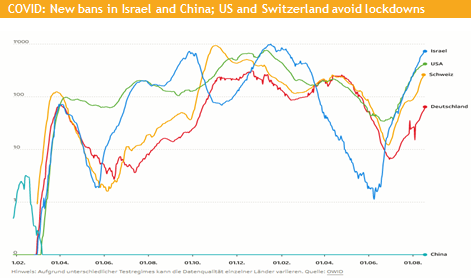

Due to rising COVID cases, Israel might be forced to enter another lockdown. In the US the 4th wave has almost reached the level of the 3rd wave. To make matters worse, some scientists claim that the immunity of vaccinated people is gone after 146 days, i.e. a 3rd vaccination may be needed, while more than 70% of the world population have not yet got the first shot.

Goldman Sachs uses this information to cut their US GDP forecast to 6% for 2021, to 1.9% for 2022 and 2.1% for 2023. All these new estimates are a touch below the consensus.

If we look at the real life in the US, so far the negative growth impact of the 3rd wave was limited, and most market watchers do believe that the impact of the 4th wave will be limited too.

Having said that, we would like to add that the Fed does have a perfect argument to postpone the start of the tapering now, which supports the economy and especially financial markets.

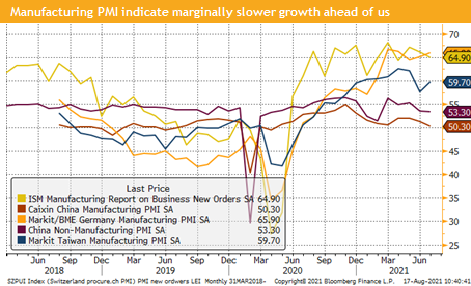

Looking at the latest PMI data we can confidently say that the service sector gains momentum across the globe, while the industrial sector marginally slows down.

The US PMI data is still in acceleration area and German industrial data is at new record levels. Therefore, we would argue that the GS economic forecast might be too cautious. Meanwhile, the Goldman US equity strategist has risen his US EPS forecast and the S&P 500 index target, but such growth can only take place if we see a strong US GDP growth in the next quarters.

The real worrying news come from China, where various industries are stricter regulated and now even billionaires are in the government spotlight. We would like to add, that stricter regulation is nothing new in China, but so far the government had always made sure that their tech companies could survive and continue to produce strong profits after business model adaptation.

It is worrisome that due to one positive tested harbour worker a port terminal for freight containers was shut down for 2 weeks in China. This will further delay urgently needed deliveries of import factors to the western world. Ford had to send their workers on a two week holidays due to missing parts.

We believe, however, that most countries will not go into another loсkdown and have limited measures like home office or restaurants closures.

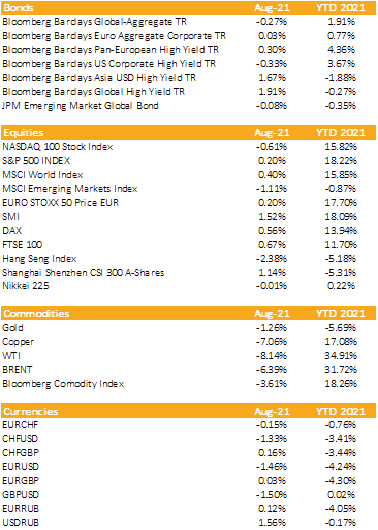

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

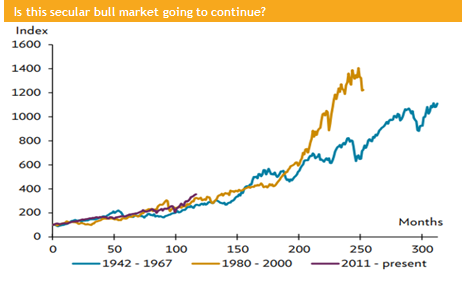

The answer to above question is probably yes, but only with hindsight we will know the answer. For know we would argue that due to the strong rising earnings in the US and Europe, markets are now cheaper than at the beginning of Q2 based on the PE ratio.

Last year due to corona we had a strong market correction accompanied by a short-lived recession and since then we are in a new bull run.

The weaker but still good economic data will support EPS growth and give the Fed good arguments to postpone the beginning of the tapering, which we might only see in 2o23 (a first-rate hike).

China might announce new monetary stimulus due to weaker data and a falling equity markets (i.e., to protect the leveraged retail investor). In case of a strong new COVID wave additional fiscal stimulus cannot be ruled out.

The CNBC fear & greed index is still it the fear area. There is little euphoria and professional money mangers have reduced their equity allocation.

All these arguments let us conclude that most likely this bull market is continuing and will die in euphoria.

Short-term we are overbought and close to record levels, therefore pullback must be expected and would be healthy.

Investment Outlook: Political tensions let the USD and CHF rise

Liquidity

CHF has played out its role as a save haven currency for another time. The SNB has intervened, but the CHF continues to strengthen against the EUR. We were range bound against the USD and currently the price level is unchanged compared to 2 weeks ago.

The EUR lost heavily against the USD due to the political uncertainty.

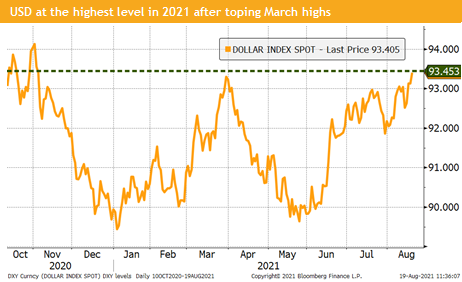

USD: DXY index has just reached a new year high. It might continue to rise due to ongoing market turbulences and political insecurity in Afghanistan, the tension with China and the expected Fed-tapering start.

Equities

Recently US and European equity markets have risen to new record levels followed by a 2-3% ongoing pullback. The news flow on CNBC or Bloomberg TV is amazing, as now we talk of significant slowdown, peak growth and peak earnings. This is all true but already known for weeks during which markets went up.

Our take is: markets are ready for a consolidation and should continue to go further up.

Asian markets lead by China are in a correction since weeks. The main driver is the Chinese regulation wave, but also a higher USD and some central banks which had to raise policy rates due to higher inflation. We expect that the situation will calm down in Q4.

Fixed Income

10-year treasury yield has fallen over the last two weeks from around 1.38% to below 1.24%. The recent move can be explained by the political tension with Afghanistan, but we have seen falling yields before that. It is a conundrum as US CPI is above 5% and PPI above 7%. The real yield has fallen further into the red. The Fed is not unhappy about this as it inflates away the US debt burden.

US corporate high yield spreads have widened over the last two weeks around 20 basis point, while the global high yield spreads have seen a much stronger rise is bond spreads driven by China corporates.

Alternative Investments

Gold has seen a mini crash during Asian trading Thursday morning . It dropped by more than USD 100 to below USD 1’700 and has then slowly risen towards 1’785, but even the recent US debacle in Afghanistan did not significantly support the gold price. The stronger USD can only partially explain this. Gold seems to be out of favor although some emerging market central banks keep increasing their holdings.

Copper: Over the last trading days copper has broken through its 200-day average and might therefore trade lower over the coming weeks. Global growth concerns due to the spread of Delta in China, the US and the rest of world are the main drivers behind this unexpected move.

WTI and Brent lost around USD 8-10 per barrel since our last bi-weekly. The main driver is the concern of the negative impact of COVID on global growth as with the other commodities.

Investments covered:

Azure Power Energy

Wolverine World Wide

Tencent Holdings

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate