Bi-Weekly. Blackfort. September 2021 (I)

Macro Update: Jackson Hole meeting – 2021 tapering and no rate hikes till 2023

Jerome Powell, Fed chair, gave a very dovish speech at Jackson Hole conference in August. On one hand he delivered the expected message that at the end of 2021 the Fed will start with the tapering, but on the other hand he surprised with his statement that before 2023 there will be most likely no rate hike. This had immediate impact on corporate spreads and US equities. Both market segments rallied.

Powell’s dovish assessment about transitory nature of the current inflationary pressures was supported by the latest US PCE inflation data which did not rise further. Europe, where the latest inflation data was unexpectedly high, is in a completely different situation.

In Europe, the fiscal stimulus is just at beginning and the bond buying program of ECB is still up and running. There is no plan or timeline announced when ECB might start with tapering.

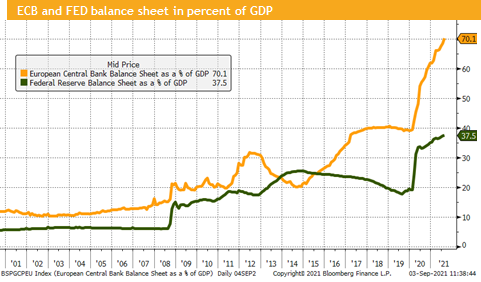

Therefore, the monetary stimulus will continue in both areas. However, in the US it will be slower due to the expected start of the tapering process. Meanwhile the ECB balance sheet keeps expanding at a rapid pace. The ratio of the ECB balance sheet to the Eurozone GDP is at an unhealthy level of around 80%, while in the US the ratio is below 37%.

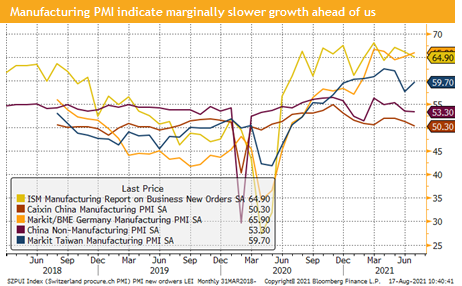

If we look at the PMI data, we do see a continuation of uneven global growth expectation. China repots data below the growth area, while Europe excluding the UK, keeps on accelerating.

In the US we do see signs of a slowdown but at very high levels. Recent events in New York where part of the city was under water have increased the chances that infrastructure and climate tax stimulus packages will pass US parliaments; This should support economy over the coming years.

The dampening growth effect of the Delta COVID version has been replaced with news that companies and government institutions will force their employees to get vaccinated in order to normalize the working process.

It must be seen what will happen to those who refuse to get vaccinated. French hospitals personnel and most airline crews will be fully vaccinated over the coming weeks. That can only mean that you might lose your job if you refuse.

China has announced zero tolerance policy and outbreaks will not be followed by lockdowns any longer. Now individuals are rather sent into quarantine.

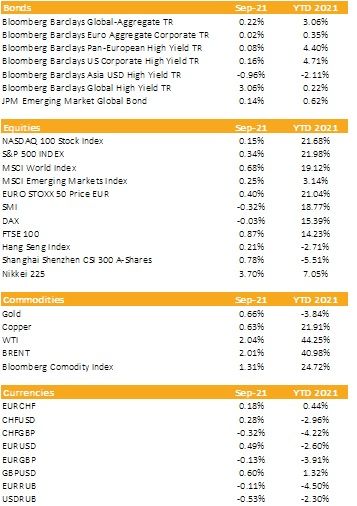

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

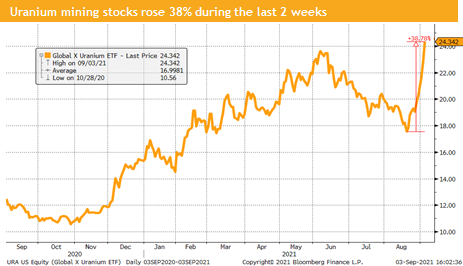

The green revolution will create winners and losers. The obvious winners are silver and cooper miners as both metals are heavily needed to produce electrical vehicles (EVs).

However, EV’s need to be charged with green electricity. We see a shifting from coal and gas produced electricity to wind and solar production. The battery storage capacity is not sufficient (yet) to store enough energy during the day or during summer to use it during nights and winters.

Therefore, physicists keep repeating that nuclear power stations 4.0 are the cleanest solution to produce electricity and are carbon neutral.

Uranium is an input factor, and its price has been in a 10-year decline. But over 2021 we did see a surge in the price of uranium and uranium miners.

Except for Germany and Switzerland most other countries are building or plan to build nuclear power stations. We therefore expect this trend to last. Although we are concerned with the produced atomic waste, we do see that the isolated production electricity is one of the cleanest technology which is available right now.

Investment Outlook: Minor pullback in equities and expected higher prices

Liquidity

CHF has strengthened again against the USD and EUR before we see a mean reversion. Most likely the SNB has at least twice intervened to weaken the CHF.

The EUR has lost some ground against the USD, but we might see a pullback of the USD against the EUR over the coming weeks.

DXY index is trading slightly down over the last two weeks. We expect that it will stay in its sideways trend channel and would therefore see mostly lower prices.

Equities

In the 2nd half of August, we did see a strong rally in US and European equities followed by strong Asian markets in recent trading day.

Asian tech, which was hammered by the Chinese regulation, have strongly recovered. We do expect a minor consolidation and in case of no further negative regulation we would expect a strong rebound of Chinese large cap tech stocks.

Europe keeps surprising not only on the inflation front but also on the earnings side. European stocks trade at a discount to US equites and might therefore continue to rise. Over the last weeks the German Dax or the Swiss SMI have both reached new record levels. There is also a further upside.

Fixed Income

10-year treasury yields were range bound between 1.23 – 1.31%. We are today back at the 1.3% level. The main driver was the dovish Fed speech at the Jackson Hole conference.

Global corporate high yield spreads have slightly tightened following the strong equity market movement.

Real yields have fallen further, and at the forefront we do see now Europe where recent inflation data was surprisingly strong. Bill Gross, former bond start portfolio manager, has just declared that all bond investment belong to the litter bin due to the bleak outlook for positive returns.

Alternative Investments

Gold was in a roller coaster but as of this writing has once more regained the 1’800 level. We do expect that gold will try to break above the 1’850 level over the coming weeks.

The price of uranium has risen from around USD 30 to USD 37 since 16 August . We expect further upside after a 10-year bear market, although at a slower pace than over the last 2 weeks.

Copper has corrected to its 200-day average and is now trading in an upwards channel. Due to the green revolution copper will see a rising demand over the coming years and might find further rise.

WTI and Brent have both traded slightly up over the last two weeks. We continue to see higher prices in both futures over the coming weeks.

Investments covered:

Open Text Corporation

Adani Green Energy

Baker Hughes Holdings

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate