Bi-Weekly. Blackfort. September 2021 (II)

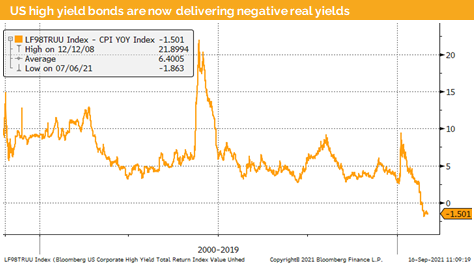

Macro Update: Sticky high US inflation data pushes junk bond yields below zero

Is inflation transitory? We still don’t know. But the latest US CPI data shows 5.3% year-on-year price changes. We would call that sticky at elevated levels.

As a result, high yield bonds do deliver negative real returns just as the European ones. The formerly called “junk” bonds are therefore not protecting you against the negative impact of the inflation of your purchasing power.

In the Eurozone inflation is reaching 3%, while bond yields stay at low levels. Differently to the Eurozone, USD bonds are still over a positive nominal yield. EUR dominated investment grade bonds do have a negative nominal yield just as Eurozone government bonds.

Commodity prices keep on rising, and we therefore expect that published inflation data will stay at elevated level due to 2nd round effects, i.e., rising prices for consumption goods due to higher prices of raw materials. On top of that, higher gas and oil prices could put corporate margins under pressure.

In both areas the Fed and the ECB have announced a mini tapering, but both keep on telling us that rate hikes are not planed for 2022 and they might stay even beyond that at the current levels.

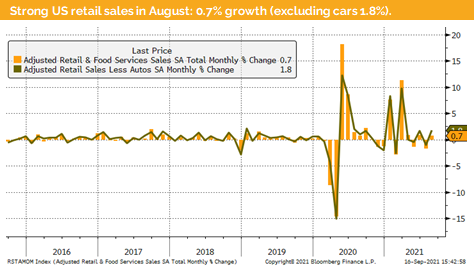

The latest consumer data (retail sales) in the US shows rising consumption, whilst a decrease was expected due to the negative impact of the COVID Delta version. Excluding cars, where the shortages of microchips prevents growth, we do see an increase of consumption of 1.8% month over month while the forecast was at zero percent growth.

Similarly, in India companies keep surprising with strong growth and the consumption was strong too. Consequently, we do see new record levels in the Indian equity markets which have decoupled from the Chinese equity bear market and are even outperforming MSCI World by a wide margin.

China continues to be the “elephant in the room”: besides more regulations we do see another outbreak of Delta and lockdowns in some provinces. This might even put the Olympic winter games at risk. All this will slowdown the Chinese economic recovery and might spill over to the rest of the world. Nevertheless, the latest Chinese trade statistic

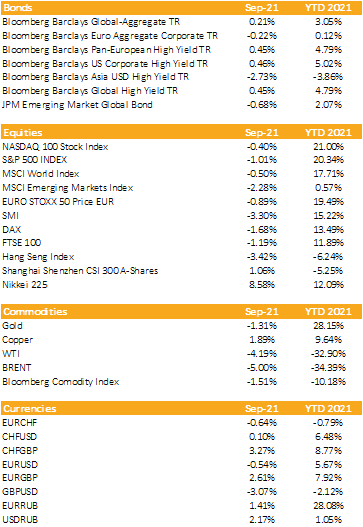

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Will we finally see a pullback of US markets by more than 5%?

Liquidity

CHF has depreciated against the USD and EUR. Whilst we do see a general strength of the USD, we do believe that the weakness against the EUR might be driven by another intervention of the SNB.

The EUR against the USD lost over the last two weeks from around 1.19 to 1.176. From a purely technical view, we do see a support at the current level. But if we were to break through it, 1.1675 is next support level to watch out.

DXY index is reflecting the short-term USD strength as it has risen from 92 to 93. However, we are still in a sideways trading range from around 90-94 and would therefore not be surprised to see another leg down within this 12-month-old trading range.

Equities

The S&P 500 has slightly decreased since our last publication but has managed to stay above its 50-day average. We do expect that we will see another test of this support line. As we haven’t seen any pullback bigger than 5% since last October, we would still be happy to see a minor pullback before the next move up later during Q4.

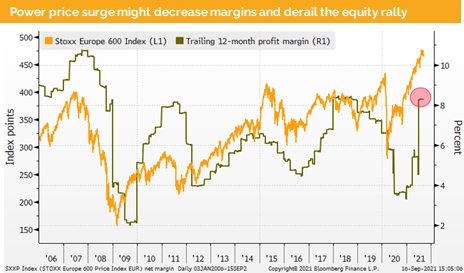

In Europe Bloomberg news rises its concerns about rising gas and power prices for the coming winter seasons which might decrease the profit margin of European companies and threaten the equity rally. We would add that this applies to all companies across the globe and would not limit it to Europe.

Fixed Income

10-year treasury yields has oscillated between 1.26% to 1.38%. Even after the latest US CPI data we did not see any significant rise in yields. By the contrary 10-year US government bond yields dropped from around 1.34% to 1.26% during the trading session after the publication of the US inflation data. This headline figure at 5.3% was a touch below the data one month ago and was in line with market expectations.

European and US high yield bonds do deliver a negative real yield after inflation. For both markets this is the first time in history that you get not rewarded for taking non-investment grade credit risk.

Alternative Investments

Gold continues to be in a roller coaster but is now trading at the lower end of the trading range below 1’760, mainly driven by slightly higher treasury yields. However, it is noteworthy that gold mining shares have decoupled and have risen slightly over the last two week, which might continue as they trade at a very low price to book multiple.

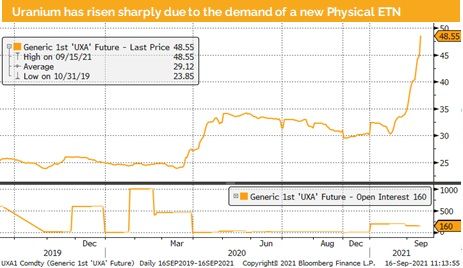

The price of uranium has risen from around USD 30 to above USD 48 since the middle of August, The main reason was the demand for physical uranium from the newly created Canadian Sprott Physical Uranium Trust which raised more than USD 500 mil and continues to grow. The goal is to reach USD 1 bn within the next weeks.

WTI and Brent have both continued to trade slightly up over the last two weeks like they did during the two weeks before. We continue to see slightly rising prices over the coming weeks.

Investments covered:

Shimao Group Holdings

SUEK

Visa Inc

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate