Bi-Weekly. February 2022 I

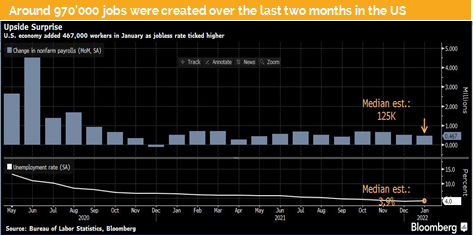

Macro Update: Strong US job data gives the Fed more room to tackle inflation faster

Last weeks we were surprised by the US job data. In January 467’000 jobs were created, while December jobs creation statistic was adjusted to 511’000 new places. Although this is now already history it has an impact on the expected US rate hiking path. One of the two Fed goals (full employment and price stability) is under control. Now the Fed can turn towards inflation and might consider a faster rate hiking pace to tackle inflation.

However, this let us fear that the Fed might raise rates too fast, and cloud push the economy into a recession over the coming 12-24 months. It is to be seen if the Fed will stick to its announced rate rising cycle or if they overshoot by rising too much.

In Europe, the situation has changeв too after the ECB did not rule out to start earlier with its rate hiking. However, peripheral 10-year government bond yields have risen sharply. In Italy, the 10-year government bond yield has reach 1.8%, in Portugal it has risen to 1% and in Spain we have seen even 1.05%. That compares to the German Bund yield of around +0.2% and Franc of around +0.7%. This is definitively a threat to the Eurozone economic outlook.

Market bets now on the ECB rate hike in September which is more hawkish than most comments from ECB members. Mr. Klaas Knot, one of the ECB’s most hawkish policy makers, said in a TV interview over the weekend that a first rate hike could come in the fourth quarter and a second one possibly in spring 2023.

We do appreciate that the ECB finally admits that inflation is not just transitory but has around 50% of its component which is structural and driven by market distortion due to the negative impact of COVID on global trade.

Having said that, we also see in Europe that the BOE and the ECB might make policy errors during the coming months.

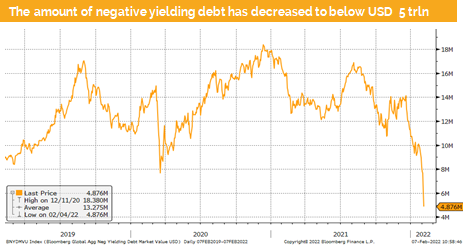

On the flip side we do see less and less negative yielding global debts. A normalisation is in the cards. But we continue to see inflation to be higher than central bank policy rates or 10-year government bond yields for the foreseeable future.

This rising yield level comes at a time during which we see deteriorating global PMI data. While in Europe and the USA we still have the survey data in the growth area, we do see in almost all countries falling curves, which could lead to a significant slowdown of global growth in 2023 together with less supportive central bank policies.

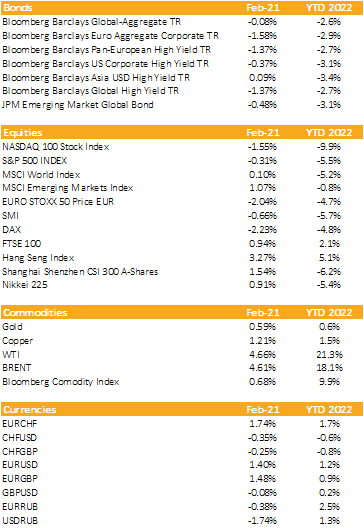

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Uptrend after the overdue equity market correction?

Liquidity

CHF has been range bound against the USD. But after the more hawkish ECB comments we have seen a sharp raise of the EURCHF rate.

Since the middle of December, the EUR has gained against the USD from around 1.12 to above 1.14. The recent ECB policy outlook has pushed the EUR further up.

The USD measured by the DXY index has fallen back to its 100-day average but stayed in the middle of its trading range of around 94-98.

Equities

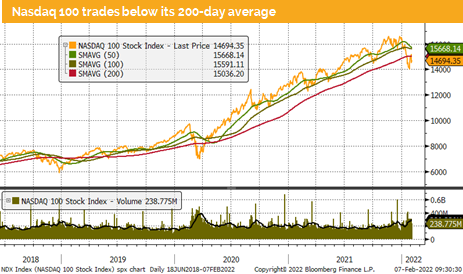

The Nasdaq 100 has lost more than 15% since the beginning of the year. The key question is: will we regain the 200-day average? This is still very uncertain as most of the FANG+ stocks are trading at very high multiples even after the strong drop in prices. However, besides these 10 stocks the rest of the market had not only a sharp correction but also is now trading at low multiples. It must be seen if the Nasdaq can regain its recently seen record level based on a sector rotation.

As the US equity market capitalization represents more than 60% in the MSCI world, we expect that this will mid-term mean revert. Therefore, some parts of the rest of the world might outperform the US market during 2022. The most controversial market is China A-share, where we do expect higher price supported by more government driven fiscal and monetary stimulus.

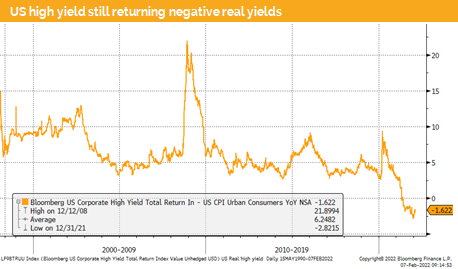

Fixed Income

10-year treasury yield have risen above 1.9% after the unexpected strong job data. We do expect some additional institutional buying at this yield level. Short-term we still have the Fed buying government bonds and might therefore hinder yields to rise substantially above 2%. Nevertheless, in spring the bond purchased program will end and we will then see where the non distorted yields will level off. Most analysts including ourselves believe that US and European government bond yields will stay far below their relevant inflation measure.

Alternative Investments

Gold has once again mean-reverted by falling from around USD 1’850 to below USD 1’800. Rising US yields and a strong USD are two key headwinds for a substantial break out of this narrow trading range.

Over the last two weeks copper has traded around the USD 9’800 level. However, the price stayed above the 50- and 200-day average.

WTI and Brent futures have risen further, neglecting the fact that OPEC+ has announce to increase oil supply. However, it looks like that most countries are not able to increase production. Most market participants do expect that US shale oil production will close the supply gap during 2022.

Investments covered:

IBM 2.72% 2032

Teva 6% 2024

NVIDIA

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate