Bi-Weekly. February 2022 II

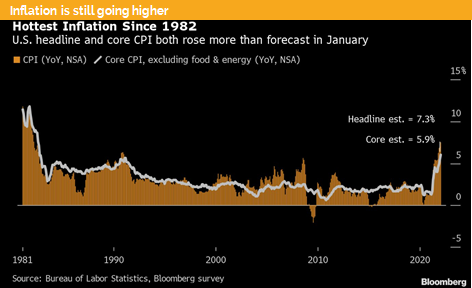

Macro Update: Higher headline inflation increases the risk of central bank policy errors

The latest Fed’s release was “a masterpiece of saying what markets already know”, as UBS stated. March rate hike and quantitative policy tightening faster than before was discussed. They question of how many rate hikes will we see during 2022 is still open. The forecasts ranging from 3 to 9 are worrisome. The predictability of the Fed policy has decreased significantly and with it the risk that they might do too much in a too short time period has grown.

We are also to see that in April US CPI data will decrease and not rise above 8%. Short-term however the risk is that the next two data points will be even higher than the latest print of 7.5%.

While we have seen strong export and import data in Germany and in China confirming our growth outlook, we do see a completely different central bank policy stance in China. In the western world we observe tightening all around while China has restarted to stimulate its economy. The latest Chinese money supply statistic surprised as M2 grew 9% YoY. After two years of tighter monetary and fiscal policy stance we do see clear sings of stimulus now. Also, credit growth has picked up, due to the rescue help for Chinese real estate developers which represent around 30% of GDP.

This leaves us with the recession question. Given that the two largest economies are either still growing fast like the US or stimulating a slowing down economy like China we are confident that until mid 2023 there is a very low probability of a recession.

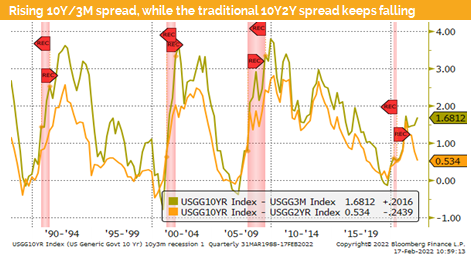

But then it really depends how much will the western central banks tighten during the coming 12-18 months. Bond markets do send contradicting signals. In most countries the 10-year-2-year government bond yield spread keeps falling and are reaching levels where a recession cannot be ruled out later during 2023. This spread used to be a good predictor of an upcoming recession. However, since we still have central banks who buy bonds, the signal might be distorted. We also see that in the US the 10-year-3-month spread send a constructive signal. This spread has had in the past a better prediction power than the traditional 10-year-2-year spread.

This encouraging signal is partially supported by soft leading indicator like PMIs. Short-term we do see the end of COVID restrictions which will give the economy a boost into summer. We therefore stay constructive for the growth outlook for 2023, but we must regularly reassess the situation.

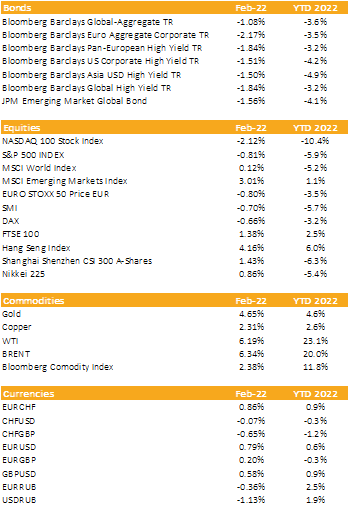

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

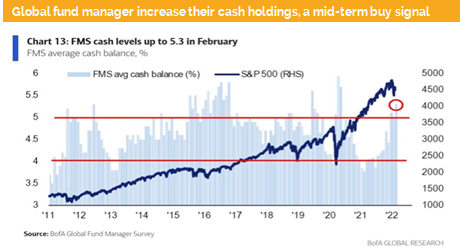

Investment Outlook: Equity market might rebound further if geopolitical concerns ease

Liquidity

CHF continue to trade in a narrow trading range against the USD. The last seen sharp rise of the EUR against the CHF has mostly mean reverted since the ECB has recently soften their hawkish statements.

The EUR lost after the ECB backed off their very hawkish statements against the USD and CHF. Against the USD that might continue as markets do expect more than 4 rate hikes from the Fed this year.

The USD measured by the DXY index hasn’t moved much since our last publication. It stayed in the middle of its trading range of around 94-98.

Equities

Stocks have rebounded as geopolitical concerns have eased. But the positive impact lasted for only about 24 hours. Uncertainty and contradicting news flow hinder markets to rebound further. We expect more volatility and no clear direction until we get more certainty regarding the Ukrainian crisis. Even an invasion would be a good base for markets to calm down after initial shock.

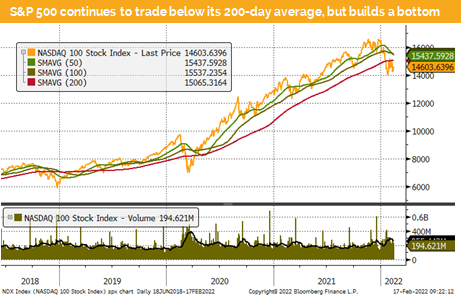

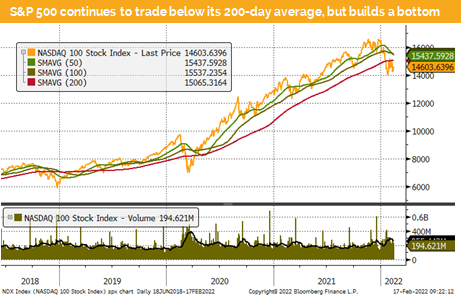

Technically we see most indices below their 200-day average as they try to find bottom. Mid-term we are still constructive given that we expect positive EPS growth for the 2022 and 2023.

While developed equity markets except for the FTSE 100 have all lost ground since the beginning of the year, emerging markets in Asia, Latin America and Middle East are up. In Eastern Europe Russia is the market with the lowest return due to political tension.

Fixed Income

10-year treasury yield have risen above 2.0% after the fast-evolving dispute between Russia and the NATO. On top US CPI has risen to 7.5% and PPI even to 9.7%. This keeps real yields in the negative territory.

US corporate bonds lost around 3-4% since the beginning of the year, which is in line with US government bond indices which lost a touch more than 3% as well. We still expect that for the whole 2022 these bond indices will deliver a negative return.

Alternative Investments

vGold is approaching the 1’890 level as of this writing due to concerns that the Ukrainian conflict is not over yet. It is now the 2nd time this month that gold tries to break out of its trading range disregarding higher US yields and a stronger USD. We expect that gold will serve well in preserving the purchasing power in the light of globally rising inflation.

vCopper has fallen from around USD 10’300 to 9’700. but since some days it creeps further up and is re-approaching the 10’000 due to strong demand and an expected shortage in production over next 12-18 months.

vWTI and Brent futures have risen further due to the Ukrainian dispute and the fact that OPEC+ has problems increasing their oil output. US fracking might close the gap, but if we have geopolitical tension oil and gas prices will stay at high levels and might even rise further.

Investments covered:

Kia 2.75% 2027

Hess 5.125% 2028

Applied Materials

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate