Bi-Weekly. July 2022 I

Bi-Weekly. July 2022 I

Macro Update: A recession seams unavoidable in Europe, like stagflation in the US

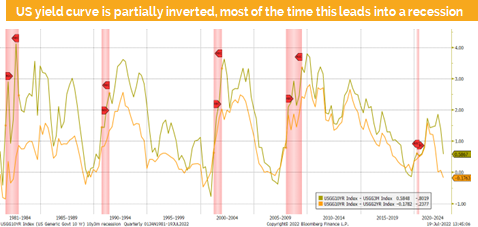

v§After a weak Q1 US GDP we do expect a low but positive figure for Q2. Forward-looking however we fear that the US will fall into a stagflation. Where the real GDP will be around zero, but the nominal GDP should stay at least at around 5%. Once such bad news crosses the wire and if the fed has reached its terminal rate of maybe 3.5%, we could then see during 2023 the fed which restarts stimulation the economy.

vIn Europe, the situation is completely different. The ECB is still at zero percent and might now be forced to raise rates at a faster pace than previously communicated. But these rate hikes will push the economy further into a recession. On top the ECB has announced to control the yield spread of 10-year government bonds of southern countries.

vThat means they will try to control the yield curve by buying bonds meanwhile at the short end of the yield curve they will raise rates.

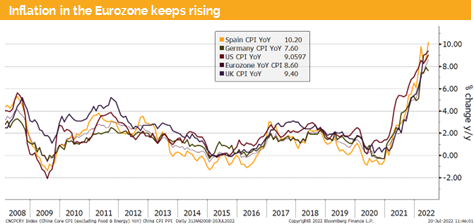

vThe ECB is as some put it “check mate” as the economy is slowing down significantly, sanctions are hurting the Eurozone the most and inflation is at extreme high levels.

vThe fight against inflation has become the main task for most central banks, but they can only influence the cyclical part of it. The structural inflation and the part driven by distorted delivery chains cannot be influenced by central banks monetary policy.

vIt therefore depends mainly on the development of new sanctions against Russia and of the COVID situation in China. We do hear that delivery chains start to work better since China has started to end most Covid restrictions.

vBesides the uncontrollable Covid sanction in China we do face another fear that gas delivery from Russia to Europe will be cut substantially and therefore reduce the already low GDP outlook further.

vIn Europe during winter, we might see a shortage of natural gas and of electricity production. Both events will not only slow down the economy but also keep inflation up at high levels.

vThis rather gloomy outlook is driven by the assumption we keep a stable geopolitical status quo. However, there is the risk that the conflict between China and the US could worsen. But there is also the opportunity that a solution in the Ukraine conflict will be announced over the coming months which would boost the economic outlook for Europe.

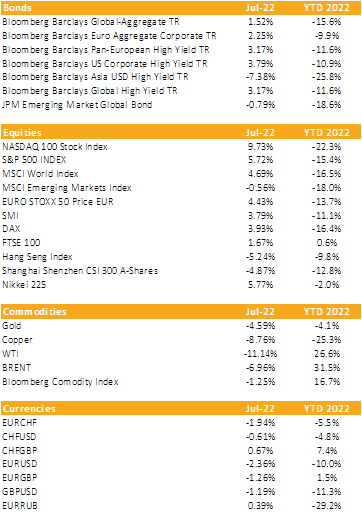

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

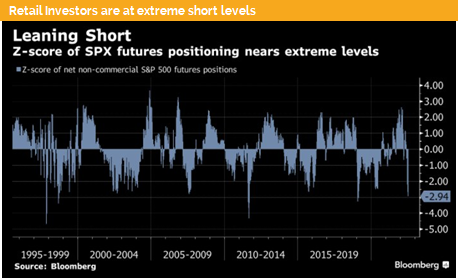

The trough of this equity bear market has not yet been reached

Liquid

vThe CHF has after the unexpected 50 basis point rate hike appreciated against most currency pairs.

vThe EUR has depreciated against the US dollar, Swiss franc and the pound due to the loose ECB policy. However, since some days we do see a counter trend due to rumors that the ECB will adjust its policy and speed up its rate hiking path.

vThe USD measured by the DXY index has risen above 109 from around 95 at the beginning of the year. The dollar is now in a consolidation phase and slightly overvalued. But we might see due to the expected next two 75 basis points rate hikes still a higher index levels over the coming weeks.

Equities

vSince February global equities are in a downtrend, which will last for longer than all the corrections we have seen since March 2009. We do expect that during Q3 markets will find a bottom from which we will see a relief rally which can go up to levels last seen this January. Nevertheless, if this is a secular bear market, we will then retest this low. Such a market environment was last seen after 1972 (picture on the right-hand side) or after 1933.

vGoldman calls it a “fat and flat” environment. Basically, without dividends markets will go sideways for a longer time period. From 1968 until 1982 the S&P 500 was flat (excluding dividends), but inflation was significantly up. There are a lot of similarities between the actual period and the seventies.

v

Fixed Income

vThe US 10-year treasury yield is still around 3%. But during the last weeks it was possible to buy 10-year treasury bonds with a yield of almost 3.5% and profiting from the mean reverting process as US yields have dropped around 50 bps.

vUS high yield bond and emerging market hard currency bond indices have both a running yield above 7%. This looks at first sight interesting, we would however add that in case of a recession a further spread widening of at least 150-200 bps must be expected. Having said that such a yield is still worth while considering as these bonds are offering an alternative to plain vanilla equities.

Investment overview:

T-Mobile 5.375% 2027

Tata Steel 5.45% 2028

Novartis

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate