Bi-Weekly. May 2021 II

Macro Update: The Fed and rates in 2021

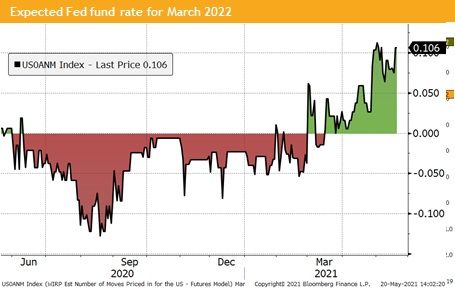

The expected Fed fund rate for March 2022 has risen after the release of higher-than-expected US inflation data. As a result, a rate hike during the next 12 months is expected. The US breakeven inflation is anticipating much higher 10-year treasury yields. We believe that both markets are misleading.

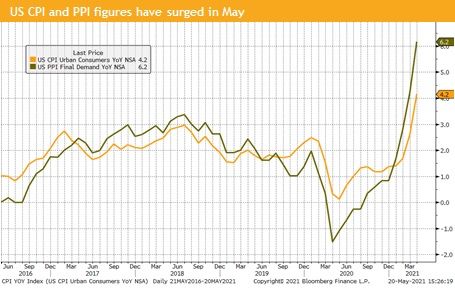

These two market prices are distorted due to a heavy reaction after the recently published US CPI and PPI data.

In the latest Fed minutes, we can see that there is an ongoing discussion about reducing the USD 120 bn bond buying program later in 2021. But there is no discussion about raising rates. On the contrary, the Fed will let the US economy run hot and consider an inflation overshooting.

This deliberately taken decision might partially inflate away the US real debt burden (financial repression). High US inflation data is explained by a statistic base effect. Last year oil futures prices fell below zero, and we have seen a sharp decrease of CPI after the lockdown. Both are now mean reverting.

Therefore, we do not expect any Fed rate hikes over the next 12 months and continue to believe the Fed will follow its previously announced strategy, which indicates that the earliest rate hike will be in 2023. We do, however, expect that the Fed will reduce its bond purchases over the next 12 months.

In the US we stick to our positive economic outlook, as the lead indicators have stayed at very elevated levels. Similar can be said about Europe, where the indicators are still rising.

In China, however, the story looks different. While PMI data has shown a minor uptick, credit conditions are clearly indicating a restrictive fiscal policy. China does not want to repeat its mistake made during the global financial crisis when they initiated a real estate boom due to too loose credit conditions.

This restrictive policy is mirrored in the latest economic data. Export and construction data were still strong, but lower than the consensus forecast.

Also, Chinese retail sales were not growing as much as expected, but still all economic data is pointing to a strong GDP growth above 5%.

Emerging markets do profit from a weakening USD and rising commodity prices. Brazil and Russia are among those who will most likely surprise with strong economic growth in H1 2021.

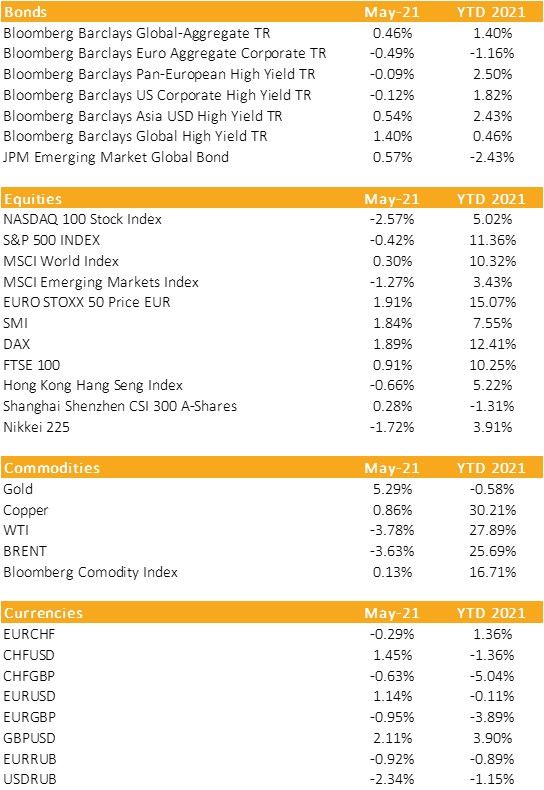

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

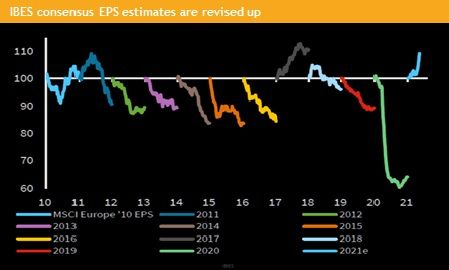

Usually, quarter by quarter consensus estimates are revised down during a reporting season. As the chart shows, we do see a rise of estimates in Europe, which is unusual and only happened in 2017 in the last decade.

In the US, the S&P 500 consensus earnings stood at around USD 189 at the beginning of the Q1 earnings season. Now, after a very strong earnings season, the estimates have gone up to USD 207 for 2022, which brings the PE-ratio down from above 25x to below 20x.

Once we had a similar situation in 2017 equity markets: had a very strong year and the VIX collapsed.

We expect that, just as reported in our last bi-weekly, equity analysts still underestimate the strength of this recovery, and that we should see a similar picture of strong earnings surprises in Q2 and most likely also during H2 2021.

We therefore continue to see value in equities although major US and Eurozone indices have risen more than 10% since the beginning of the year.

Investment Outlook: Sector rotation and potential rebound of IT in US and China

Liquidity

CHF has gained value against the USD and EUR. Equity market turbulences and the selloff of crypto assets have led to inflows into this safe haven currency.

EUR has gained value against the USD after the release of higher-than-expected US inflation data.

Since Goldman Sachs became bullish on the USD, we do see across the board a weaker USD, as we predicted in our last bi-weekly. The DXY index is at its lower trading range, and might short-term mean revert before mid-term we see a further weakening of USD.

Equities

The sector rotation is ongoing. The FANG+ index and Chinese tech companies have consolidated while cyclicals, small caps and value stocks have outperformed. We do expect that short-term tech could rebound but would not sell stocks which profit from the reopening of the economy.

Small caps across the globe had a very good run, we continue to see value in this space. From a valuation standpoint European small caps and emerging market small caps are lower valued compared to US small caps and we would recommend overweighting non-US small caps.

Fixed Income

US 10-year government bond yields are slightly lower compared to the beginning of May, but real yields have fallen after recent US inflation data.

Globally the amount of negative yielding debt has further decreased from around USD 14 trn to USD 12.3 trn due to rising global yields.

Corporate non-investment grade USD bonds are slightly up as the option adjusted spreads did not widen. This is surprising given the weak performance due to higher yields and wider spreads of IG USD bonds. The chasing of yields keeps HY spreads depressed and have so far let this sub asset class outperform most other bond markets.

Alternative Investments

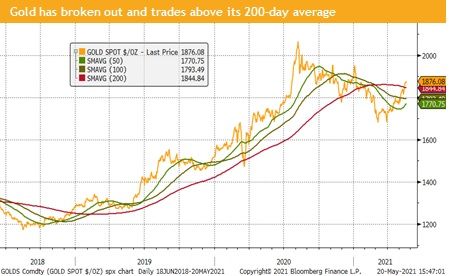

Gold: The gold price has finally overcame the 1’800 threshold and trades above its 200-day average. A re-test of this former resistance level is still ahead, but we stick to our assessment that gold will trade higher over the coming 12 months.

Copper: During May we have seen a rally towards 10’500 before a minor pullback when higher PPI data and rumors about raising Fed fund rates were across the news. Mid-term due to the green revolution copper will continue to go higher as the supply is not matching the rising demand for it.

WTI and Brent futures are range bound. Recent news of more production coming to the market from Iran has put some pressure on both future prices. However, both stayed above USD 60 per barrel so far and we expect slightly higher prices later in 2021.

Investments covered:

China Water Affairs Group

Agile Group

Yanlord Land

Tencent Holdings

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate