Biden’s announcement and US cyclical stocks rally

President Biden wants to increase the federal spending to USD 6 trn in 2022, which would push the debt to GDP ratio up to around 117%. This at first sight astonishing high figure is based on the already announced and known president’s request of a minor increase of around USD 300 bn. The American Rescue Plan (ARP), the two-infrastructure packages of more than USD 4 trn and the pending request to Congress for USD 118 bn in addition to discretionary spending, sums already up to a total budget for FY2022 of around USD 5.7 trn. Therefore, this new announcement is just around USD 300 bn more. Nevertheless, this budget is unprecedented, and its financing is open. Short-term it will be financed with new issued US government debt. The plan to raise taxes for this will be opposed by the republicans in both US parliaments. We can also expect that not the whole amount of USD 6 trn will be approved by these parliaments.

But what is more important is how does the market react: We have seen steady prices in treasuries but rising US equity futures and already yesterday rising US small caps.

Fig. 1: Russel 2000 surge outpace the S&P 500 after Bidens new spending plan

The spending plan had as well an impact on industrial metals which rallied after the news was released. In Europe stocks are rising due to the hope that the ECB will not curb stimulus. This is mirrored in Stoxx Europe 600 which has reached a new record level. Similar pictures in the DAX and the SMI. In Germany market watchers expect that we are going to see more M&A activities like the merger between the two largest German real estate companies and more spinoffs like Siemens has done over the last years. Both would imply higher Dax prices

Fig. 2: Dax on its way up to 20’000?

Fig. 3: Semiconductor Indices before a new record?

We therefore expect that the Dax will break out of its sideways channel and might overpass the 16’000 level in the coming weeks. Germany is also profiting from the expected cyclical recovery which will support its export companies which are mainly summarized in the MDAX and SDAX. If this unfolds semiconductor producers will as well profit from this general growth trend and from the overhang of demand for microchips. The US semiconductor index or its global pendant have surge over the last trading days. Both indices are still below their record levels and these stocks are valued compared to their own history at attractive levels.

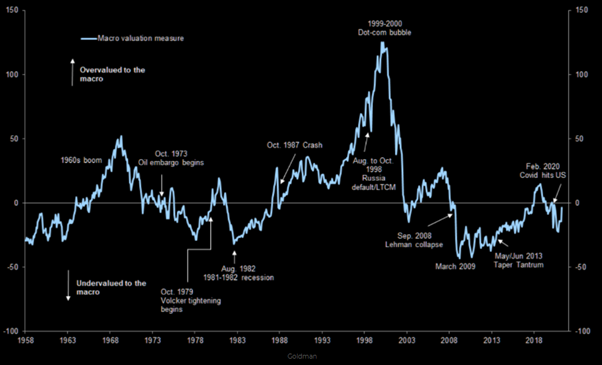

Turning to valuation, the 2022 S&P 500 PE ratio has fallen below 20x down from around 25x in January. Shiller PE on the other hand stands at 37x which is the 2nd highest level on record. Only in Spring 2000 we have seen higher levels of around 43x, Goldman Sachs has just published a valuation indicator for the S&P 500 and makes the point that US large caps are not overvalued. We therefore continue to see more upside for US stocks. The elephant in the room is what will happen once the Fed starts reducing its bond purchasing program. Recent “Fed talks” about possible reduction of the buying program caused positive reaction on US equity markets and US treasury markets.

Therefore, we might just see a hick up once the Fed starts its tapering talks.

Fig. 4: US stocks look attractively priced based on this Goldman Sachs model

Gold has overcome its resistance levels below USD 1’900 faster than expected. There were rumors that recent inflows into Gold ETFs came from sellers of bitcoin products. From a technical standpoint gold has a clear uptrend and rising fears of higher inflation should support a further rise.

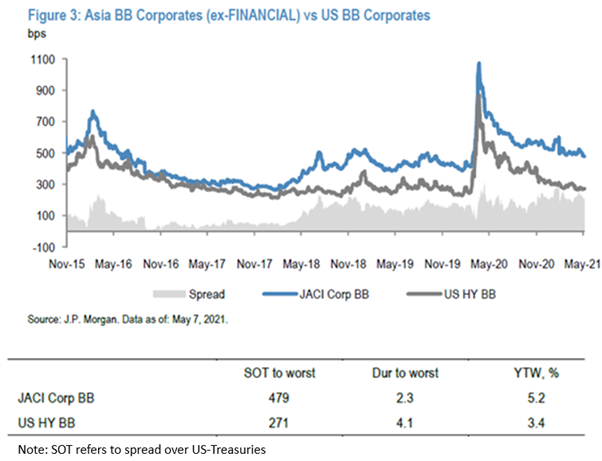

Corporate US HY bonds keep surprising with tight credit spreads and a positive return in 2021. The outlook for defaults has significantly improved due to the strong expected US recovery. We do not expect any significant turbulences in this market as long as the economy keeps growing at this strong pace. However, we do see in the BB space more opportunities in Asia than in the US. The yield pickup is still around 2% and the duration of 2.3 years almost 2 years shorter than in the US.

Fig. 5: Momentum speaks for a further rise of the Gold price

Fig. 6: Asian BB has a better risk / return than US BB corporates

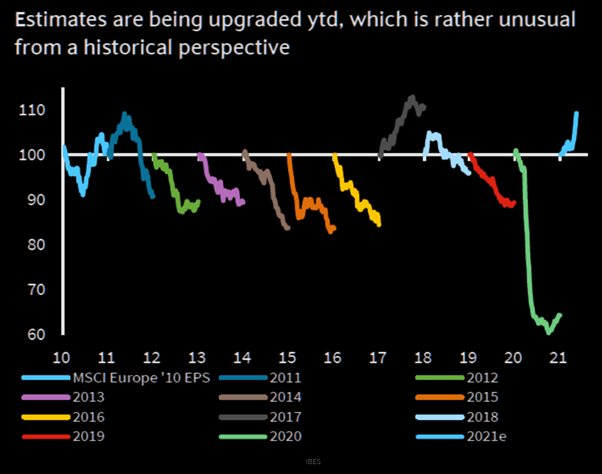

Fig. 7: Earnings estimates are upgraded after Q1 releases

Overall, our assessment that corporate bonds and global equity markets have moved to levels where a correction can be triggered any time stays unchanged. Having said that we would expect that into the summer we do see positive market developments. The earnings season in the US and in Europe was very strong and the aggregated EPS estimates for 2021 have further risen. This is very unusual, last time we had such a situation was in 2017 where the S&P 500 rose 19% without any significant correction and the Vix collapsed.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate