FOMO – S&P 500 and CSI 300 have seen both a rally into the closing

Since last year’s September, we have not seen a pullback in the S&P 500 of more than 5%. This week we do see some minor pullbacks in both CSI 300 (China A-shares) and in the S&P 500. FOMO is back. Yesterday in the US we had 8 earnings warnings of which 4 came from major Wall Street strategist that predict a correction in September. Still S&P 500 shows a lot of resilience.

The fear of missing out is the dominant topic among investors, while strategists or hedge fund managers warn of a meltdown. Ray Dalio, co-CIO of Bridgewater, and Michael Burry (from the Big Short) have both several times warned this year that markets are at the edge of a sharp correction, worse than the one we have seen during the GFC in 2008-2009.

Fig. 1: CSI 300 closed at the day’s high after a strong buying the dip rally in to the close

Nobody can know the future and espoecially the exact time of the start of a market crash. Both have valid points and they will be right in the future, but when is completelly unkown.

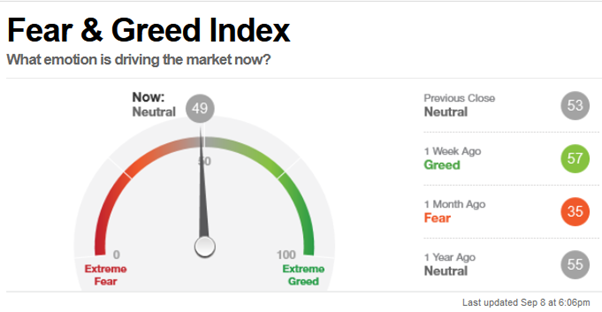

At the moment we do see mini pullbacks which were immediately reflected in the fear and greet index, which was in the greed area one week ago, while we are already back in the fear area after two minor negative days. There is more room for pullbacks, but as long as we get so much support from the fiscal and monetary side we would not bet against the Fed or the market pariticipants, who are in the “buying the dip” mood.

Fig. 2: CNBC Fear and Greed Index back in the fear area after a short time in the greed space

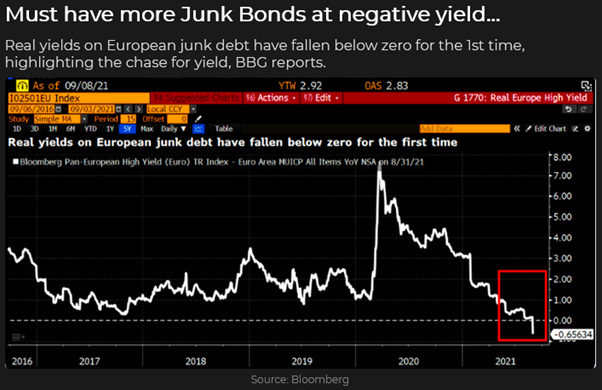

Fig. 3: European High Yield bonds are now delivering negative real yields

Equities are seeing money inflows from bond martkets as well. The dividend yield in Europe is bewteen 2-3% while European corporate non investment grade bonds deliver negative real yields. It is the first time in history that you are not compensated while holding European junk bonds.

For diversivication purposes and to protect wealth mining and industrial metals are recommended across the board. We did see a rally in aluminium while silver and copper (both needed for the green revolution) lost gound. Meanwhile uranium and its mining companies have seen a strong rally. The trend is going to last as around 100 nuclear power station will start producing electricity untill 2025.

Fig. 4: Global Uranium ETF rose more than 40% in 2 weeks

But gold keeps disappointing investors. We did see another attempt to break out of the trading range only to be followed by another drop below USD 1’800 per ounce. There was no news supporting this price movement. Gold mining shares are trading at very low price to book ratios and most pay a divided. However, without a higher gold price these stocks will not substantially rise. We would keep physical gold as a protection in the portfolios, but in the mining area we do expect mid-term a recovery in copper miners and would as well expect uranium miners to go further up after a mean reversion.

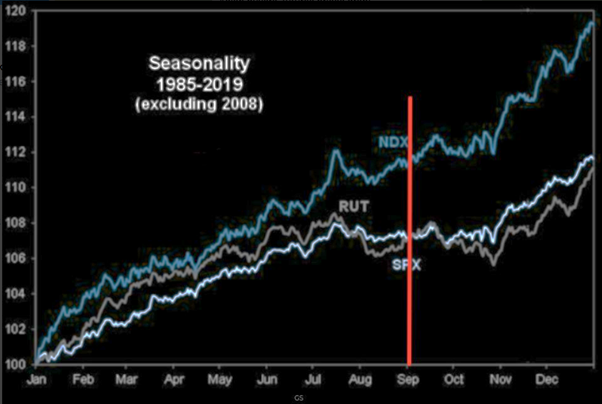

People who follow seasonality patterns are divided into two camps – some say that September is the weakest month of the year on average, while others expect a strong September in the Nasdaq 100 followed by a difficult October (figure 6).

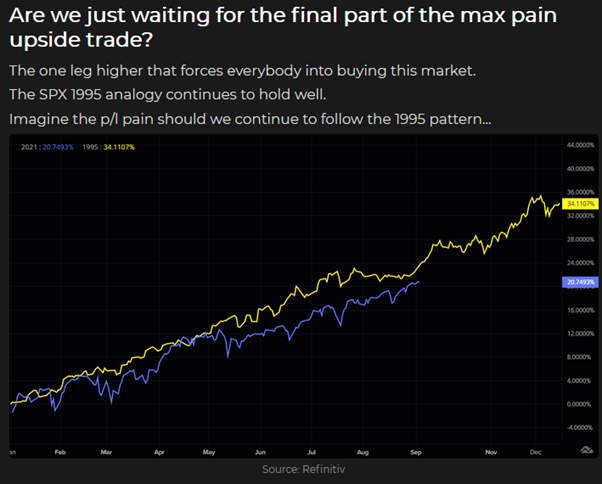

The Market Ear goes a step further and reckons that the actual US market movements look very similar to 1995. Therefore, they have been saying for some months that we might see a melt up until year end. If so, we do remember that 1996 was a difficult year for equity markets.

Fig. 5: Gold has dropped below USD 1’800

Fig. 6: Seasonality patterns do point to a strong year end

Fig. 7: Will we see a melt up like we have seen in 1995 (www.themarketear.com)?

We simply think you cannot foresee the next 8 weeks and foretell that in one month we go up and in the other down. We would however still say that until year end higher equity markets are quite likely as we have not seen any major melt up. On top, driven by retail investors least the US markets have seen several buy the dip market movements.

Overall, you should stay invested and be globally diversified. Asian equities are in the process of mean reverting. European equites should continue to perform well, but only if the US is not correcting sharply.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties, and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate