Bi-Weekly. Blackfort. November 2021 (I)

Macro Update: US inflation hit 30-year high, while retail sales surge to 1.7% YOY

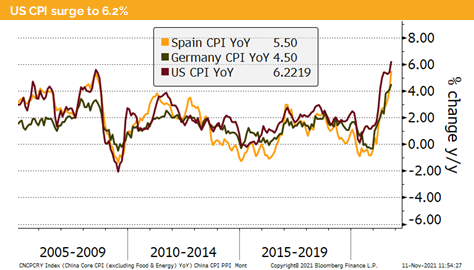

US CPI at 6.2% was the key news over the last days. This is the highest level since 1990. It shows more and more that inflation will be sticky at higher levels. Some central bankers are now preparing the audience that during H1 2022 the inflation data will continue to be elevated.

We continue to expect that inflation will stay at higher levels than the yield of quality bonds for a long time. Therefore, we are to get used to negative real yields. In other words, we do see that the quality analysts jump on the topic of financial repression. Russel Napier, a UK strategist and economist, expected that we will have at least 15-years of higher inflation in order to slowly decrease the debt to GDP ratio in real terms. Or to put it very directly the state is stealing money from the savers. People with debt are profiting and people with nominal assets like cash and bonds will pay the bill by constantly losing their purchasing power .

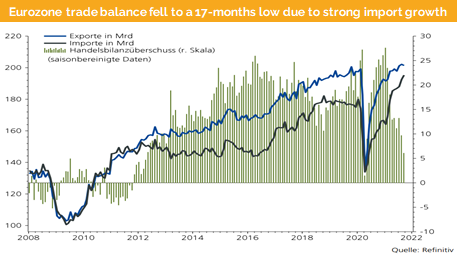

Inflation in the Eurozone is up as well. The main drivers were imported goods and energy prices. We do see other signs of a production slowdown due to disrupted delivery chains. Exports were flat while at the same time more consumption goods were imported. In combination with higher energy prices this has decreased the trade balance to EUR 6.1 bn (11.5 bn expected), which is the lowest level since almost 2 years.

Unfortunately in the Eurozone most leading indicators are decreasing and we must expect less growth and higher inflation over the coming months, while in the US we do see more growth besides higher inflation.

Another difference between the US and Eurozone are retail sales. The US consumer just spends even if it is all on credit. The latest US retail sales figures confirm a further acceleration to 1.7% YoY from 0.7% and beating the consensus forecasts. The last retail sales in Germany was indicating a decrease of 0.7% compared to last year while the estimates were expecting a strong growth of almost 2%.

In the UK the latest CPI rose to 4.2% up from 2.9% also toping consensus forecasts by 0.3%. Therefore the BoE is expected to rise its policy rate soon.

China has still a tight monetary policy, but we do expect that they will loosen it over the coming months in order to support the real estate sector. Similar to the US we do see solid retails sales which are slightly accelerating although China has a tight monetary policy. The single day was the best on record.

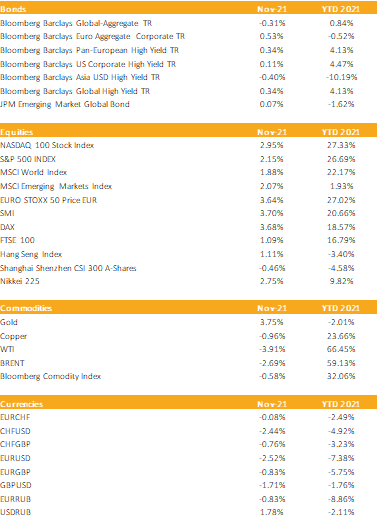

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Seasonality speaks for higher equity markets

Liquidity

CHF has appreciated against EUR although the SNB has intervened. Surprisingly, the expected strength of the USD is ongoing also against the CHF. We have seen a rise from 0.91 USD/CHF to above 0.93 USD/CHF

EUR lost against most currencies after the ECB announced that they do see no urgency in raising policy rates next year.

The DXY USD index has risen since our last publication from around 93 to almost 96. From a technical standpoint a mean reversion is in the cards, but maybe we will only see this in January once asset mangers are back to work.

Equities

The S&P 500 has continued to climb the wall of worry, driven by strong money flow and successful IPOs. Rivian, a car producer, which has not sold a single car so far, raised USD 100 bn through its IPO and is now valued higher than GM or Ford. If we add the money raising via SPACS to the IPOs, we have now reached a higher volume in IPOs than we had during the dot.com bubble.

Goldman Sachs has raised its S&P 500 target to 5’100 for 2022, which means a 10% upside potential including dividends. It is remarkable that the consensus EPS have risen too so this level would bring the S&P 500 PE ratio to around 20-21, which is the actual level. Therefore, analysts expect that the strong US GDP growth might materialize in a similar EPS growth for corporate America.

Fixed Income

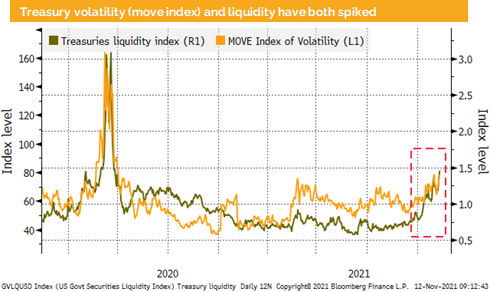

10-year treasury yields have risen above 1.6% after the high US CPI data were released. Nevertheless, the real yield has fallen further to around 4.5%. If we were right financial repression is here to stay over the coming 10-15 years and inflation will stay in a range of 4-6%. In combination with nominal yields below inflation it makes little sense to invest into quality bonds.

Chinese corporate bonds have rebounded from the recent selloff. The Chinese banks were instructed to grant more credit to the real estate corporations in order to take stress out of the system.

Alternative Investments

Gold has risen after the surge in US inflation data and the fall of real yields. We do expect slightly higher prices but if the USD keeps rising there is limited upside potential.

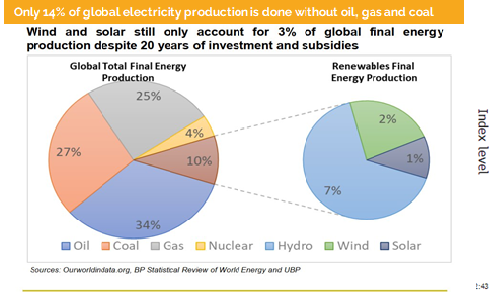

The uranium spot price has moved up around 10% over the last two weeks. Based on UBP’s analysis more than 80% of the global electricity production is done with coal, gas and oil. Only 14% is produced with alternatives. We therefore do not see how we can get fast down to this level without using nuclear power stations as part of the solution.

WTI and Brent futures were range bound. However, we do see slightly lower prices due to the strong USD, compared to our last publication.

Investments covered:

Jane Street Group

ReNew Power

Sika AG

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate