Tapering means a touch less stimulus and not tightening

The fed committee has decided to start with the tapering. In November 15 billion dollars less bond purchase and another 15 billion in December. After that the reduction will be data dependent. However, the expectation is that until the end of June 2022 the program might be terminated.

Ray Dalio, co-CIO of Bridgewater expects that the fed might be forced to restart the bond program later in 2022 due to a weak economy. In any case the fed has as well announced that it is not planned to raise rates in 2022. However, also this is data dependent, in particular on the participation of labor force in the job market and the level of inflation. Both are expected to normalize during 2022.

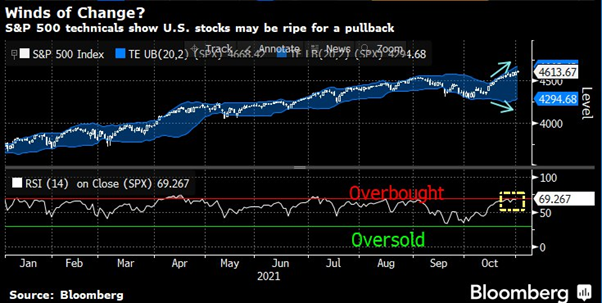

The reaction of equity markets were new record levels, while treasuries lost immediately value due to higher yields only to be followed over the coming 2 days by a mini rally. Equity markets are overbought and should correct. But we do see a high risk for a melt up and therefore they might not fall until Q1 2022.

Fig. 1: US equity markets are overbought

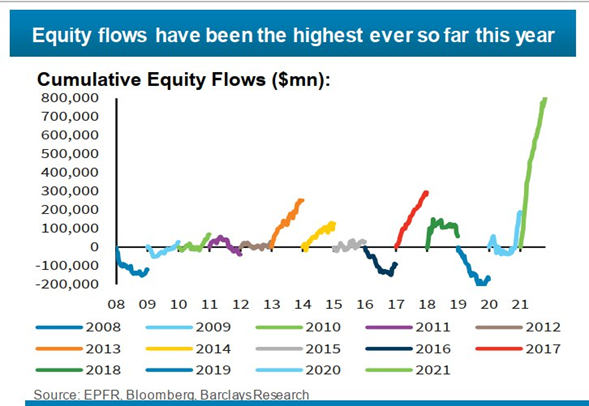

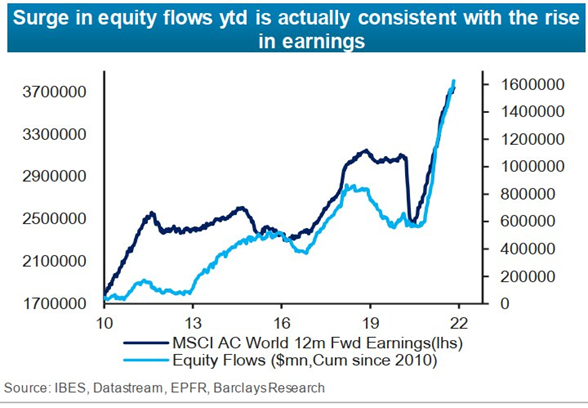

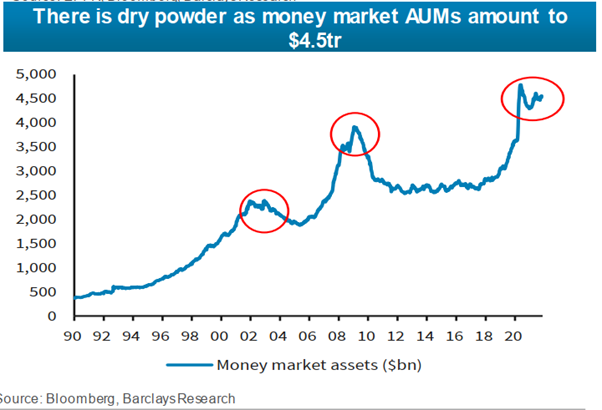

There was a record inflow into equites (fig 2) during 2021, which is well supported by strong earnings growth (fig 3). If we were to see a small pullback we do expect that the huge amount of parked money (fig 4) will flow into eqities. Buy the dip seems still to be the game we play.

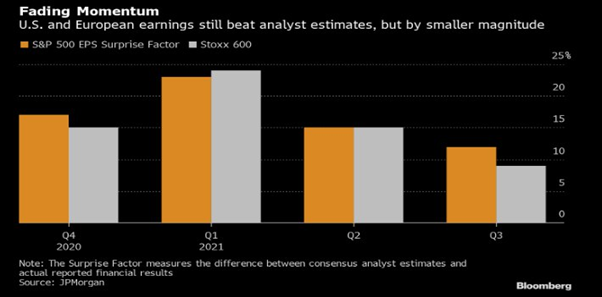

We do see very strong earnings growth in the US where still more than 80% of all companies beat their IBES forcasts. But in Europe only 68% have beaten their EPS forcasts and growth seems to fade. Therefore we prefer US equities over European equities.

Fig. 2: Record inflows into equity markets, pushed markets up

Fig. 3: The rising markets are well supported by strong earnings growth

Fig. 4: The money parked in cash products is still at very high levels

Fig. 5: Fading earnings momentum, more than 80% of the US and less than 70% in Europe beat analyst estimates, while the growth rate decreases faster in Europe

Fig. 6: 10-year US treasury yield spiked after the fed conference, but only to be followed by a mini bond rally (i.e., falling yields)

Interesting is that since the fed tapering announcement we have seen a rally in treasuries. We would however stress that high quality bonds and US high yield corporates do not deliver any positive yield after adjustment for inflation. Also, inflation linked bonds are very expensive and have a negative yield.

Fig. 7: Inflation linked bonds do return negative real yields

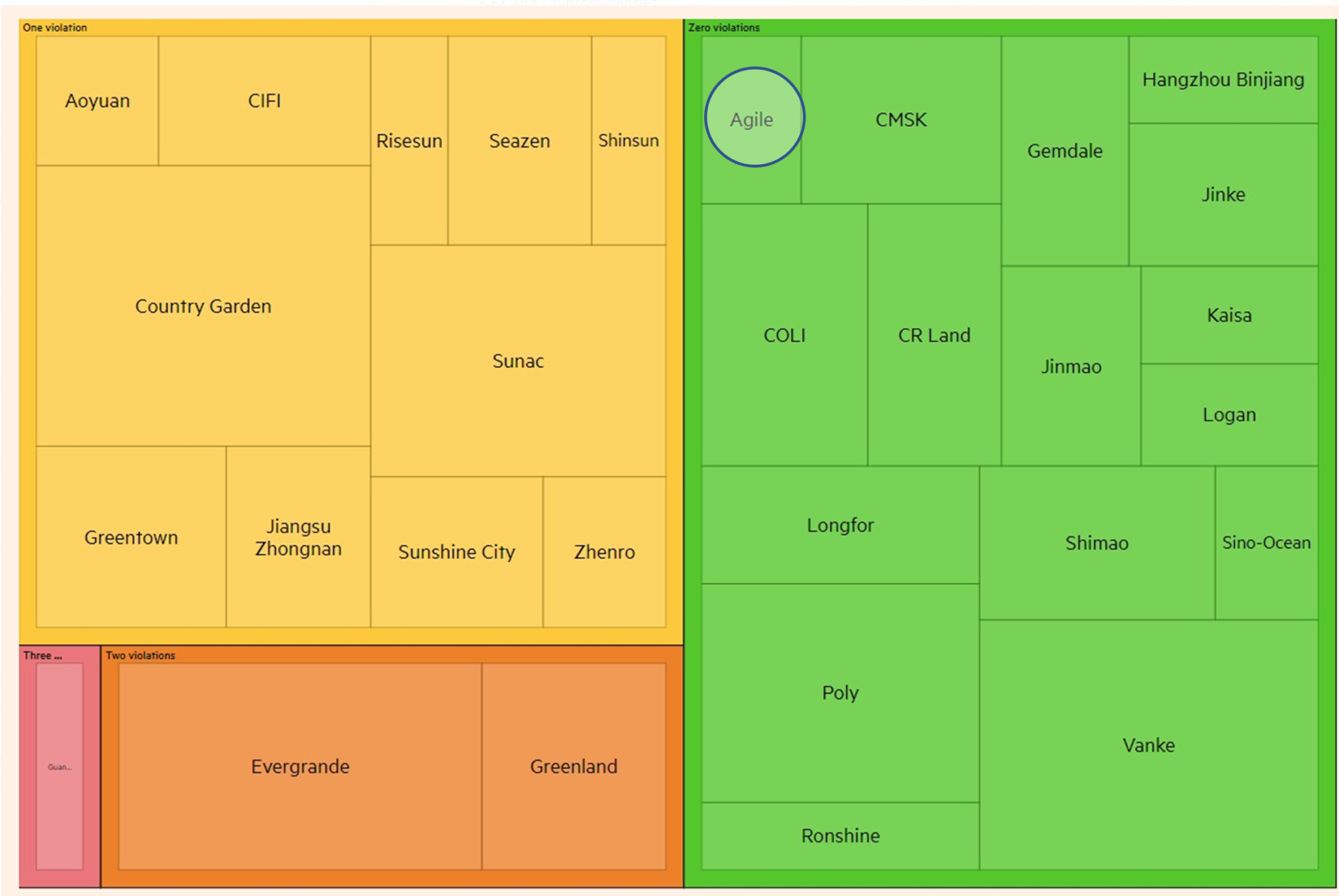

We have seen a huge market correction in Asian corporate bonds. The worst performing area was Chinese real estate. We do see opportunities in this area but also threats. Agile a company which meets all new credit criteria which they must comply with in 2023 has after an earnings warning dropped like a stone. One Agile bond which matures in March 2022 has fallen from around 100 to below 80%. Therefore, only the companies which will survive will deliver extremely high returns. Unfortunately, due to the low quality of the Chinese account system it is very difficult to foresee which ones will survive. Some cases are risky at the start like Evergrande but others like Agile or Country Garten (IG quality) have both suffered from the crisis.

Fig. 8: Chinese Property Credit heat map (Source Financial Times)

If you add this together, we end up with the TINA (there is no alternative) argument. But different to some months ago we are now at even higher levels. Markets are stretched, but due to the lack of interesting alternatives we do expect over the coming 3-6 months that equities will further rise. Also, government bond yields will most likely only modestly rise due to strong demand from institutional investors and the (at least for 8 months in the US) ongoing bond purchase programs of most larger central banks.

But let us repeat, this will end in a melt up and a burst of the everything bubble. However, we do only see some euphoria in some market segments but not (yet) broad based. Therefore, it is not over yet.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties, and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate