2023 Year End Market Watch

Mixed economic signals but US economy is solid. FED, ECB and SNB are expected to cut rates

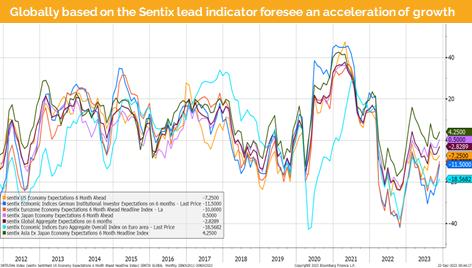

A very special year comes to an end. The expected US recession has not taken place. Additionally, in Europe, with the exception of Germany, the recession has not been confirmed so far.

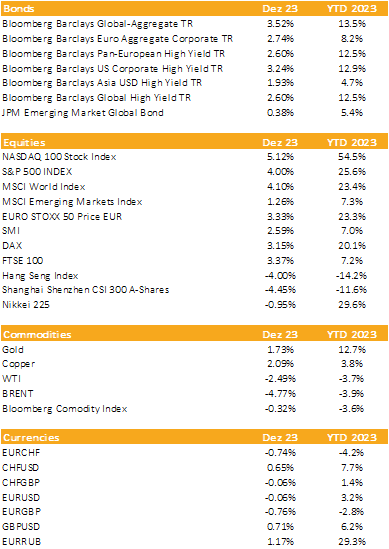

Headline inflation in developed countries has fallen in recent months, leading to a decline in government bond yields since the beginning of November. This has triggered a global rally in both bonds and equities.

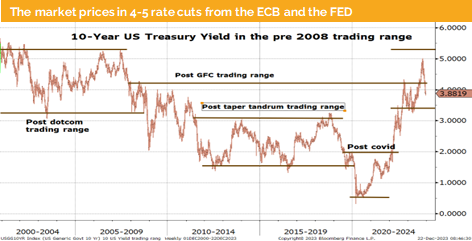

This was followed by a regime change at the Fed in December. Mr. Powell stated two weeks before the Fed meeting that it was premature to consider rate cuts in the spring of 2024. However, little did we know that the outcome of the Fed meeting would reveal a dot plot indicating three rate cuts expected for 2024 by the voting members.

However, market participants immediately changed their stance on this, and as of this writing, at least 6 rate cuts by the Fed are anticipated. We would, however, stress that this is not consistent with a U.S. economy growing at a reasonable pace of around 2%. We therefore expect 2-3 rate cuts, and given the U.S. election in November, one or two must be implemented before autumn.

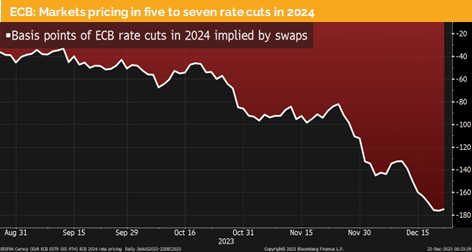

The ECB has also changed their policy stance in December and now considers rate cuts in the first six months of 2024. We have always argued that the ECB would be forced to cut rates earlier due to the weak economy and the large public debt-to-GDP ratios in France and Italy.

While in Europe headline inflation is also falling faster than anticipated, the ECB has crafted a narrative to justify these anticipated rate cuts. However, we would stress that core inflation remains sticky and might not decline to 2% over the next 12 months.

Similarly, the situation for the Swiss SNB is notable. As inflation is expected to stay below 2% for the next two years, they now have room to cut rates. The recent further strengthening of the Swiss franc against the EUR and USD might prompt them to cut sooner than previously anticipated.

Japan maintains its accommodative monetary policy stance even though inflation has finally risen toward 3%. Additionally, core inflation here is more than 1% higher than headline inflation.

Last but not least, in China, disinflation has accelerated, and the government is reluctant to stimulate the economy through fiscal measures. This will keep inflation below zero and hinder the economy from recovering substantially.

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

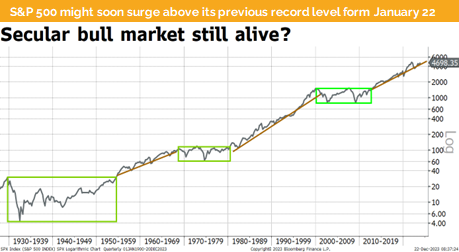

The year-end rally will be followed by a minor pullback, but the bull market will continue

Liquidity

The Swiss Franc has further appreciated against both the EUR and the USD. Given that both the Fed and ECB are now considering rate cuts, we might see an unexpectedly early rate cut by the SNB.

The EUR appreciated against the USD.

The USD, measured by the DXY, has further depreciated and continues to be trapped in a downward trading channel, suggesting further weakness.

Equities

The S&P 500 continues to rise in December. Momentum is very strong, and we could see this rally lasting into January. The last two weeks of December are, on average, the 4th best period for US stock markets, while the first two weeks of January are the 5th best. Therefore, it’s possible that we remain overbought until then and only see a pullback afterward.

Based on insights from almost all US strategists, any pullback is expected to be used as an opportunity to “buy the dip,” as the consensus forecasts a 10% upside for 2024. We share this view but are now concerned that so many US firms hold the same outlook. However, continental Euopean strategists remain cautious about US equities, with most still anticipating a US recession—a view we do not share.

Fixed Income

The US 10-year government bond yield continued to decline in December and saw an acceleration once the Fed announced possible rate cuts for 2024. We expect that the treasury yield will fluctuate within its pre-global financial crisis (GFC) trading range. Consequently, we see limited downside and anticipate some mean reversion in the coming weeks.

Corporate bond spreads in global bond indices have further narrowed in line with the declining global government bond yields. As a result, both segments of the bond markets witnessed a strong rally during November and December.

Alternative Investments

As of this writing, gold trades above USD 2050 and is retesting the recently seen record of USD 2072. We expect the gold price to continue rising due to a weaker US dollar and anticipated rate cuts by the Fed and other major central banks.

The price of copper continues to exhibit volatility, remaining within the trading range of USD 8,000 to USD 8,600. We are now back at the upper end of this trading range. If there’s an acceleration in global industrial production, copper might break above this trading range.

Both oil futures prices have been range-bound and are roughly at the same level as they were a month ago. The ongoing dispute within OPEC has led to increased supply, which, surprisingly, has prevented both oil futures from rising as is typically seen during the heating season in the northern hemisphere.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate