Blackfort Income Defensive

Explained

Blackfort’s investment strategies build on investment approaches, which are well established with large Swiss institutional investors. Hence, our clients benefit from long-term experience in the context of tailor-made and holistic solutions, developed in personal dialogue and designed to truly fit each client’s needs.

Blackfort Income Defensive

Defensive liquid alternative highly suitable as a core investment

Blackfort Swiss Real Estate Debt

Regular, stable and to the capital markets uncorrelated returns in CHF

Blackfort Tech Triple X

Systematic performance boost offering over-proportional participation in the US tech market

Tailor-Made Investment Mandates

Covering different investment goals reaching from capital protection to capital growth

For investors who want to invest their assets in a capital-preserving way, Blackfort Income Defensive offers a liquid alternative well suited as a core investment to replace cash and bonds.

Equity markets still have potential to generate returns. Over the long run the mean expected return of equities of the developed markets is approximately 6% p.a. However, the downside risks are considerable. The strategy builds on investment approaches, which are well established with large Swiss institutional investors. Capital growth is achieved by an option overlay allowing the participation in a

broadly diversified equity basket within a corridor. By regularly rolling the corridor, the positive long-term premium of equities can be harvested.

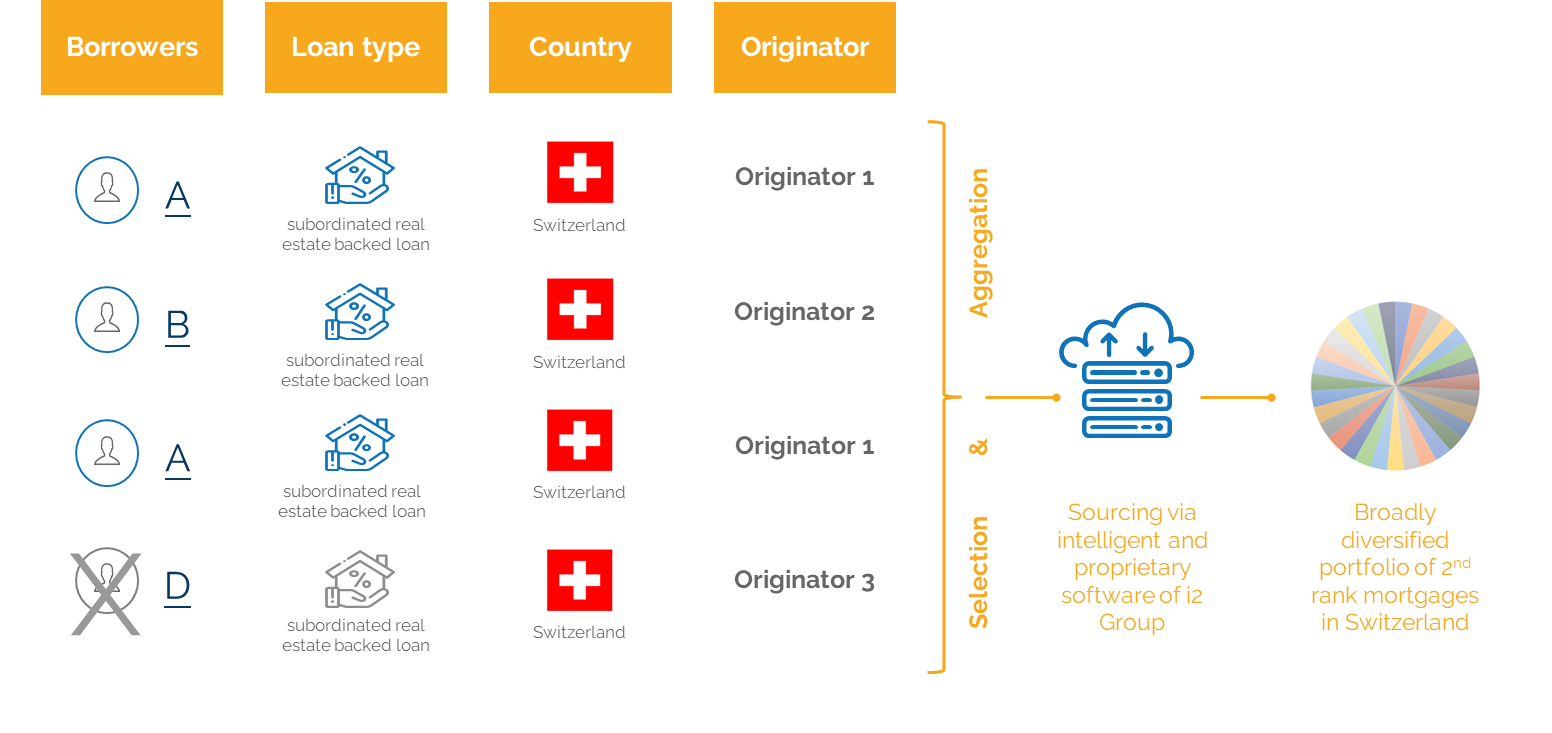

Blackfort Swiss Real Estate Debt

Blackfort Swiss Real Estate Debt is an alternative to traditional real estate investments and an uncorrelated portfolio diversifier

Key Facts:

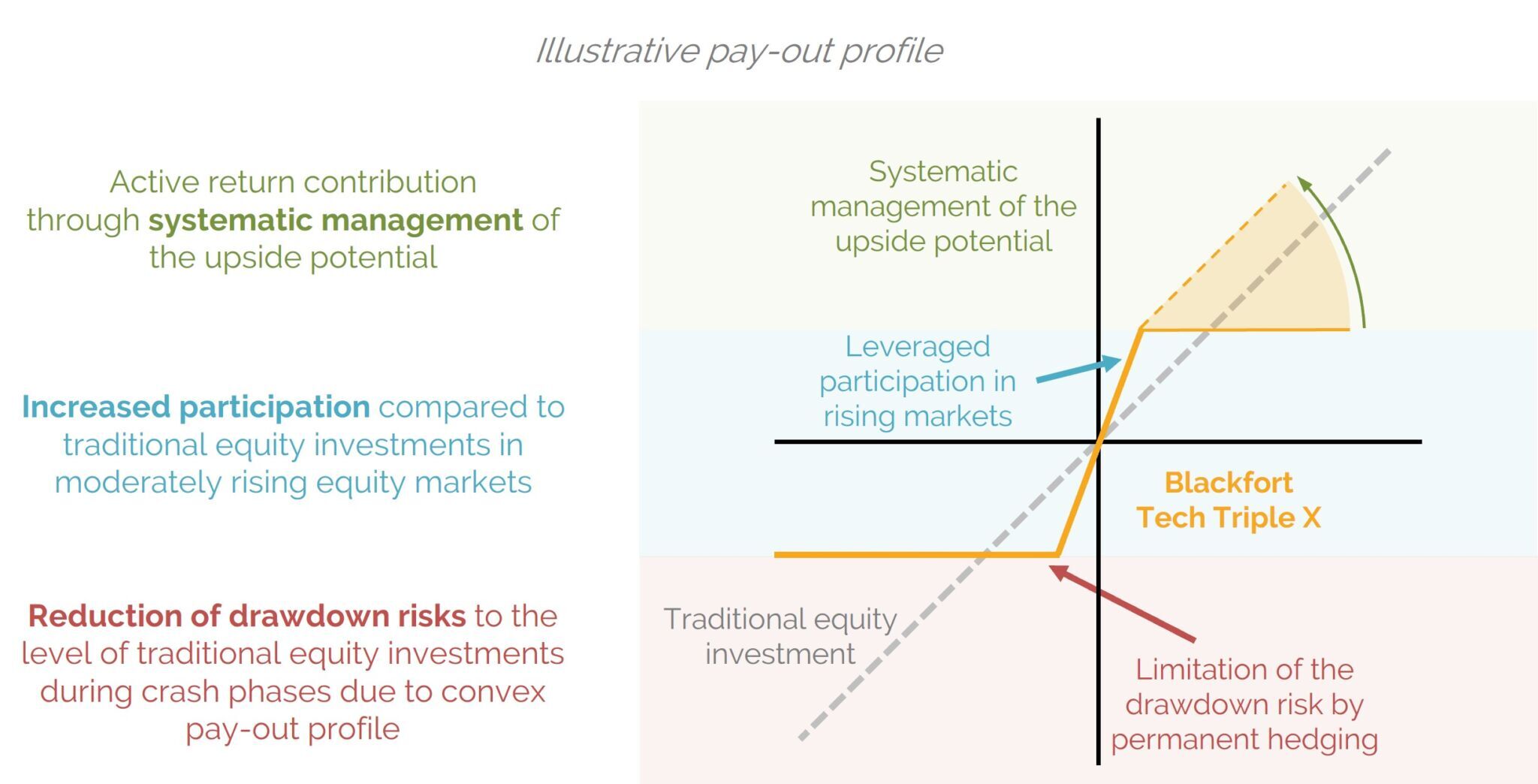

For investors who search a broad exposure to US Tech stocks, Blackfort Tech Triple X offers a performance boost in combination with a systematic downside protection mechanism.

Key Facts:

Concept of the strategy Blackfort Tech Triple X

Blackfort Tech Triple X offers a performance boost on technology stocks in combination with a systematic downside protection mechanism.

We offer investment solutions to both private investors as well as institutional investors such as pension funds, foundations, companies and other institutions of all sizes. Based on many years of experience with major Swiss institutional investors, we focus on the individual needs of each specific client and offer tailor-made solutions. Thereby, we provide both systematic and discretionary investment approaches as well as combinations thereof. All investment mandates can draw on our expert judgement and house view, based on fundamental analysis and state-of-the-art macroeconomic projections.

For investors with higher risk tolerance and/or longer investment horizons, opportunistic investment approaches offer increased return potential. The primary investment objective is capital growth. Typically, opportunistic investment approaches mainly rely on equities, commodities, real estate, and other alternative asset classes.

For investors with lower risk tolerance and/or shorter investment horizons, defensive investment approaches offer a regular source of income. The primary investment objective is capital protection. Historically, defensive investment approaches mainly relied on fixed income instruments. However, in an environment of negative interest rates, innovative solutions and alternative strategies are needed to ensure continued capital protection of the investment.

In addition to these mixed mandates, we also offer investment solutions on asset class levels. Based on in- depth expertise and years of experience in various asset classes, we offer customized solutions for your equity, bond, alternative or crypto quota.

As an independent provider of asset management solutions, we are not bound in our choice of custodian bank and work together with all established institutions. Upon request, we will support you in your choice of custodian bank and provide you with an overview of the conditions and services offered by the individual banks.

We would be happy to inform you about our track record in an individual offer and provide you with a sample portfolio on request.