Bi-Weekly. December 2020 II

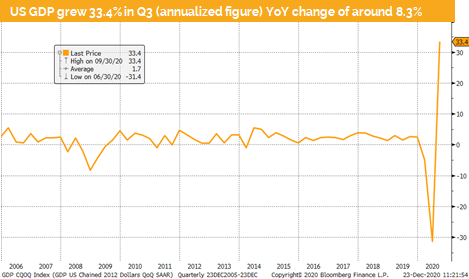

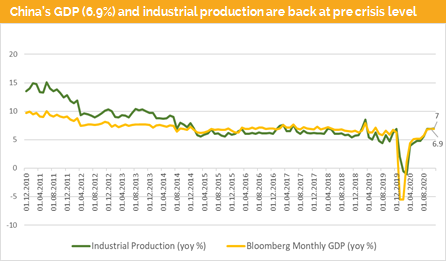

Q3 GDP data in China and in the US have surprised to the upside

The US parliaments have finally agreed on a fiscal stimulus package of around 4% of US GDP. This USD 900 bn stimulus is the 2nd largest in history. However, President Trump asked for a substantial increase of paychecks. He has not (yet) threatened with his veto. It cannot be ruled out that there will be a delay due to the latest presidential reaction. Markets, however, seem to ignore this threat. On January 22nd the new administration will take over and discussions about more stimulus should be expected.

The US economy grew in Q3 2020 33.4% annualized (i.e., around 8.3% in one quarter). This was higher than expected, which demonstrated two things. First, that the US economy doesn’t really need a stimulus. Second, that the economy is very resilient and has adapted to the pandemic situation.

We continue to see the US economy to expand more than 5% in 2021. We might even see an overshooting if we were to see more fiscal stimulus.

In China, the latest PMI data have reached a 10-year high, the fright index, which measures exports to Europe and America has surged. Both indicate that China will grow more than 5% in 2021.

The Chinese government has announced to stimulate the economy by further fiscal measurements.

The ECB has announced to substantially increase their bond buying program and its credit lending program. Meanwhile, the EU budget and the rescue packages were approved at an EU summit.

Most southern European countries have already announced that they will accept the unconditional one-off payments, but they are very hesitant to use conditional credit lines. The success of this program depends on the way these funds are used. Spain, for instance, will just finance its normal state budget and does not plan to invest into infrastructure to support the economy.

Therefore, the effectiveness is questionable, as the private sector is saving and not investing. These funds should be used for investments and not just for normal budget spending. The same argument holds true for the latest US fiscal package, but there we have a growing economy while in Europe we expect a significant negative effect of the lockdowns on the Eurozone’s GDP.

Emerging markets do profit from a falling US dollar and from rising commodity prices; both have positive growth effects.

Currencies, Commodities, Equity & Bond Indices

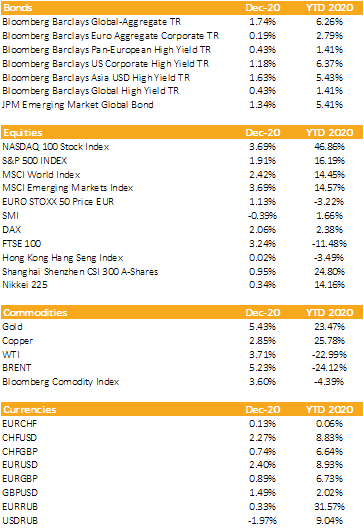

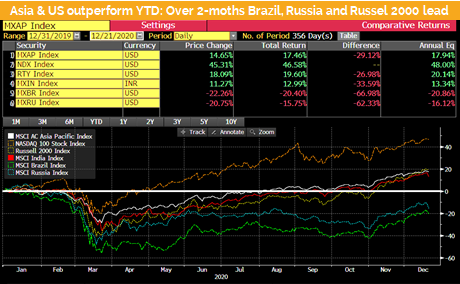

Global equites end the year on a positive note; MSCI World all countries and developed are up around 14% in USD. However, during Q1 we have seen (triggered by COVID-19) a 2-weeks bear market followed by a steady rebound.

MSCI Europe ended the year flat in USD and down measured in EUR. Our preferred regions, US and Asia, performed well. Since the beginning of November, we have seen a sector rotation into small caps, cyclical and value stocks on one side but on the other side a catch-up rally in emerging markets lead by Brazil and Russia.

US government bonds were up more than 5% only to be outperformed by US inflation linked bonds.

Corporate bonds in the non-investment grade area performed very well in 2020 but look like equity frothy, and we might see a correction over the coming months in both.

Hedge funds underperformed as a group equities and bonds. While Private equity sit currently on $1.5 trillion of cash, which they need to deploy over the coming months.

Copper is up more than 25% and indicates that the industrial sector has recovered from the various global lockdowns.

Risk-on has continued, but a pullback can occur any time

Liquidity

CHF: The US has classified Switzerland as a currency manipulator. This might hinder SNB to intervene on the FX market as much as they want. We expect a stronger CHF against the dollar and a range bound against the Euro.

The EUR/USD trades above 1.21 and might further strengthen.

The USD is expected to weaken. However, the incoming head of treasury Mrs. Yellen has announced that she would like to see a stronger dollar, while the Fed intervention will keep the dollar under pressure.

Equities

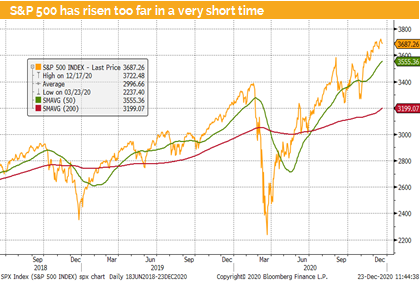

Based on a Bloomberg survey of 17 equity strategists, the expected average year-end target for the S&P 500 stands at 4035. The range of forecasts goes from 3800 to 4400. This represent an upside of around 6-7%. We believe that the consensus will be wrong as usual. And we expect a pullback of 5-15% but overall a positive year.

Having said that, we either see a massive overshooting due to the stimulus and an unexpected strong economic recovery, or a negative year with disappointments on stimulus and growth.

Our main theme keeps that this secular bull market is not over and based on a disruptive economy we will see surprises not only on the growth side but also on the stimulus side. The rally will end in a final melt up, but nobody can foresee when this is going to happen. Equities are based on the new Shiller Excess CAPE Yield compared to bonds attractive priced and might therefore continue to rise.

Fixed Income

Global investment grade corporates offer a yield to maturity of around 0.4%, while most developed government bonds have nominal negative yields or like in the US are after adjusting for inflation offering negative real yields.

We see some value in the high yield space, but the benchmark yields are low and range from around 3.9%- 4.6%. This is definitively too little but there are no alternatives in the liquid bond space. We keep our allocation, as we believe yields will stay low over the coming 12 months and on average, we do not expect a significant spread widening.

Alternative Investments

Gold: After the recent sell-off gold has started a recovery rally. We expect that the Gold price will stay above its 200-day average. We believe that Gold will serve as a protection against expected market turbulences .

REITS: Both commercial and residential real estates were rising over the last weeks. Short-term the price movement will depend on the development of the equity market. Mid-term we expect a further rise of REITS. We continue to see more downside protection in residential REITS.

Oil: The surge of the oil futures prices was interrupted by the news of a mutated corona virus. However, we expect that this is short lived and the WTI oil future will rise above 50 dollar over the coming months.

Investments covered:

Seazen Holdings

Adani International

Vodafone Group

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate