After a rollercoaster in global equities we might see a yearend rally

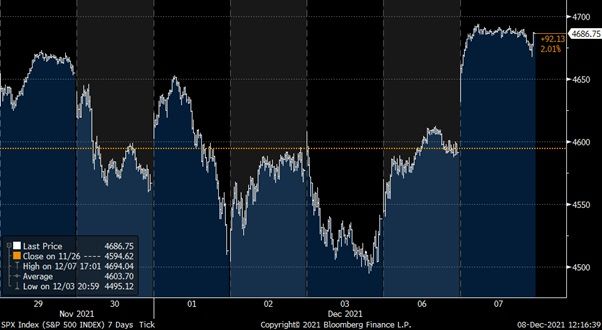

Over the last 7 trading days the S&P 500 moved 6 times more than 1%. The up and down days are evenly split. Such high volatility was last seen in November 2020. During the five weeks before we haven’t seen any days with index moves bigger than 1%. This volatile trading pattern is mirrored in the Vix index which has spiked from around 15% to 30%. Yesterday however the strong equity rebound made Vix fall back to 22.5%. Nevertheless, based on this implied volatility data market participants do expect further market turbulences.

Fig 1: 6 times during the last 7 trading days has the S&P 500 moved more than 1%

It seems that the strong market movements were triggered by quant strategies who went short followed by yesterday ‘s short squeeze. In the US this movement was intensified by retail investors who are around 30% of the total trading volume. For 2022 the outlook depends heavily on the number of rate hikes the fed will do. If like 90% believe the first step will occur in September and maybe a 2nd one until the end of 2022 US market can easily cope with that.

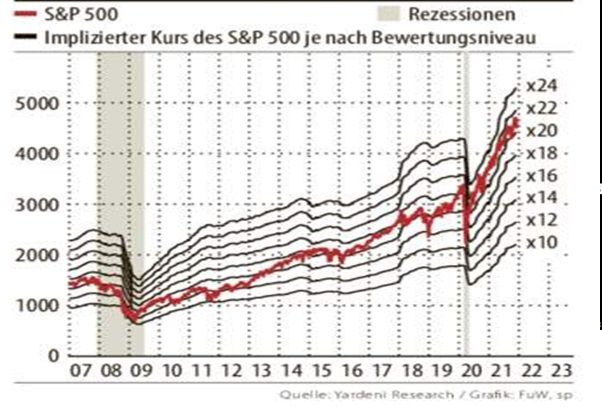

If, however, we will see 3 rate hikes like more than 50% of what market strategists expect, we would see a contraction of PE. With the actual earnings outlook the S&P 500 trades around 20-21 times. But with 3 rate hikes the valuation had to fall to around 16-18 times. We still expect the fed to wait longer with the first rate hike and make an error by underestimating inflation.

Fig 2: The Vix index has doubled during the last 10 trading days.

Fig. 3 If we were to see 3 rate hikes in 2022 the S&P 500 would fall below 4’000 and would trade at a PE range of around 16 – 18 times

We would like to add that next year US corporate earnings will rise around 8-10%. Therefore we expect that US markets, and with them the rest of the world, are well supported from bigger and longer lasting bear markets. Bear markets are normally going hand in hand with recessions. For the time being there is no recession in sight for Europe and the US for 2022.

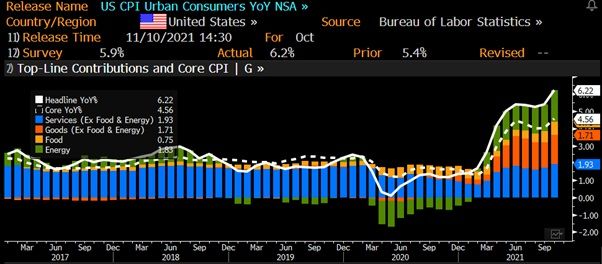

One key risk is inflation, while Europe has seen already higher CPI data the next US CPI release will be this Friday. Market participants expect that we will see 6.8% YoY growth. This consensus view has forced the Fed to delete the word “transitory” from their communication. This came to us as no surprise, we have already several times said that inflation will be sticky and stay above the 2% level for much longer than the Fed communicates.

Fig 4: US CPI data is expected to rise to 6.8% from last month’s reading of 6.2%

This means as well the real yield will drop further and should support gold. But gold faces the headwind from a stronger dollar and the expected further rise of US treasury yields. Nevertheless, during the Omicron selloff we have seen a strong rally in US treasuries, which have dropped their yield from around 1.68% to below 1.35%. During the actual equity rebound 10-year yields stayed below 1.5%.

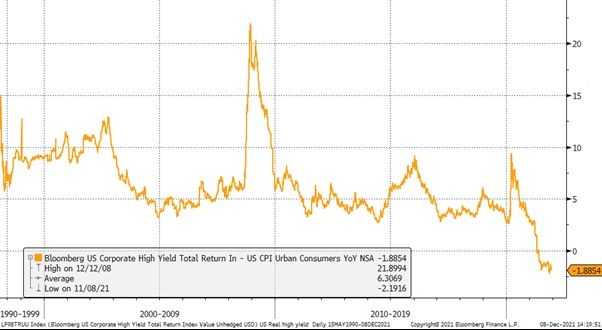

The real yield for 10-year treasuries is below 4.5% but also US high yield bonds trade at around-minus 1.8% yield after adjusting for inflation. If we were to see US CPI going to 6.8% US junk bonds would have a real yield of around minus 2.5%. This is definitely not a compelling investment opportunity. We’d rather recommend taking plain vanilla equity risk than similar indirect equity risk by investing into US high yield bonds.

Fig. 5: US 10-year treasury yields at 1.48% means real yields are below 4.5%

Fig 6: US high yield real yields at -1.8%

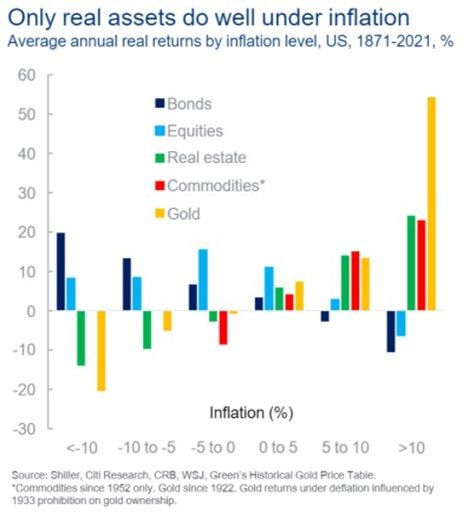

Fig. 7: Real assets do (partially) protect from inflation

Therefore, we repeat our recommendation to replace cash and bonds with real assets to protect you from inflation. We assume that next year US CPI will fall below 5% and therefore equites, real estate commodities and to a lesser extent gold will serve investors well.

We must however add that a correction of more than 10% in equity markets is as well in the cards. Since the corona correction in spring 2020 we haven’t seen such a price drop. A lot of young and first time investors might panic during such a selloff, which on the other hand will give long-term investors the opportunity to add more equity risk at a more favorable valuation than today.

Disclaimer: This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate