After the storm & before the next leg up?

After the recent global selloff and panic during one trading day the key question is whether we are just before the next leg up? Recent history gives this scenario with a high probability (fig. 1). The pullbacks get shorter and less pronounced as the “buy the dip mentality” still dominates.

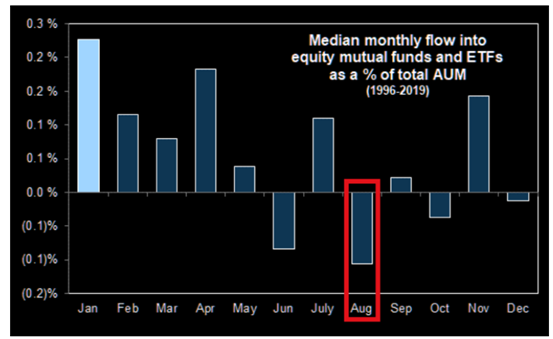

However, since 1996 August (fig. 2) happened the biggest equity outflow month of the year, which is a headwind for higher equity markets. At least it will increase market volatility. Inflows into equities in 2021 have been a huge story and might mean revert. The weakest period of the year for equity markets (fig. 4) has just started and therefore we expect volatility to stay at slightly higher levels compared to the last weeks.

Fig. 1: Is the next bigger move up?

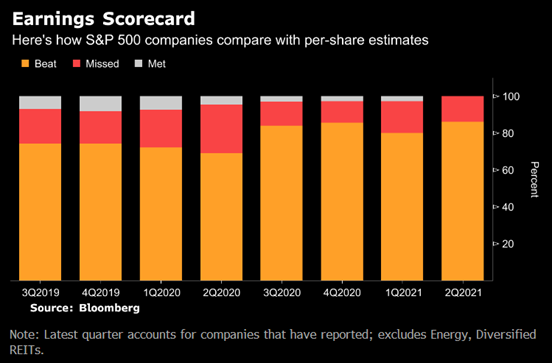

This time is slightly different, due to the fact that we have a huge fiscal stimulus packages supporting the economy and we are in the midst of a tecnological revolution. The disruptive effect on the economy cannot be forecasted accurately, but we belive that anaysts have not adjusted their earnings forecast enough for it. This can be seen at the actual earnings season in the US: So far 86% of all US companies have beaten the consunsus forecasts by a wide marging! This is problay going to last for some more quarters. In Europe the picture is similar where strong Q2 earnigns are expected. However, market paricipants do look into 2022, where we expect the Fed to tapper and the growth to moderate. But may be it will be still much stronger than the actual forecasts.

Fig. 2: August is on average the month with the most outflow in equities

Fig. 3: Almost 90% of US companies beat their consensus estimates

Fig. 4: S&P 500 seasonality price cluster

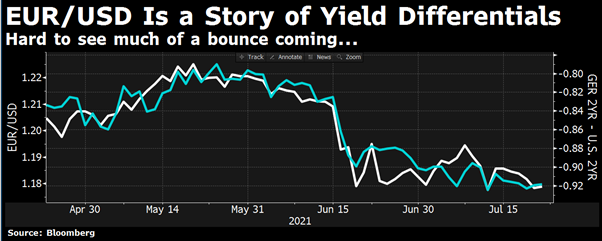

The tapering is not going to end the accommodative monetary stance of the Fed. The ECB is going to announce more stimulus and therefore we do expect that the relative yield differential between the Euro and the US area is going to widen (fig. 5). This most likely will push the EUR/USD exchange rate further down.

Fig. 5: EUR/USD might weaken further

This USD strength is one of the key headwinds for gold, which has done basically nothing. Even during the one-day selloff gold did not rise significantly. Goldman Sachs has published their new gold outlook. They do expect that during 2021 we will see gold rising to USD 2’000 from around 1’800.

Fig. 6: Dax has regained levels above its 50-day average

Turning back to the initial question – the next leg is rather up than down. Short-term it can well be that we will go first up from the actual level followed by a pullback in autumn. The fear and greed index or the put call ratio are both indicating that there is no selling pressure and that there is a lot of angst among investors. This however is a good ground for climbing the wall of worry. Also, the technical picture looks promising, for instance the DAX (fig. 6) has corrected to the 100-day average and trades after the snap back above tis 50-day average while the RSI is in the neutral (around 50) area. Similarly, the S&P500, besides there the pullback was just down to the 50-day average from where it regained almost all the losses we have seen during the pullback. This move is supported by strong earnings.

Finally, the cause of the pullback was fear about the spread of the delta COVID version. In the meantime, we do see that although the number of cases rises significantly in the western world the number of hospitalizations or death has not significantly increased. Therefore, the market participants do not expect a significant impact on the economy. However, the situation in most countries, except for the US, UK and Eurozone is that much less than 50% of the population is vaccinated and therefore we do expect that the corona situation will worsen over the winter and will still be with us next year.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties, and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate