How junk are junk bonds? By Blackfort CIO Dr. Andreas Bickel

How junk are junk bonds?

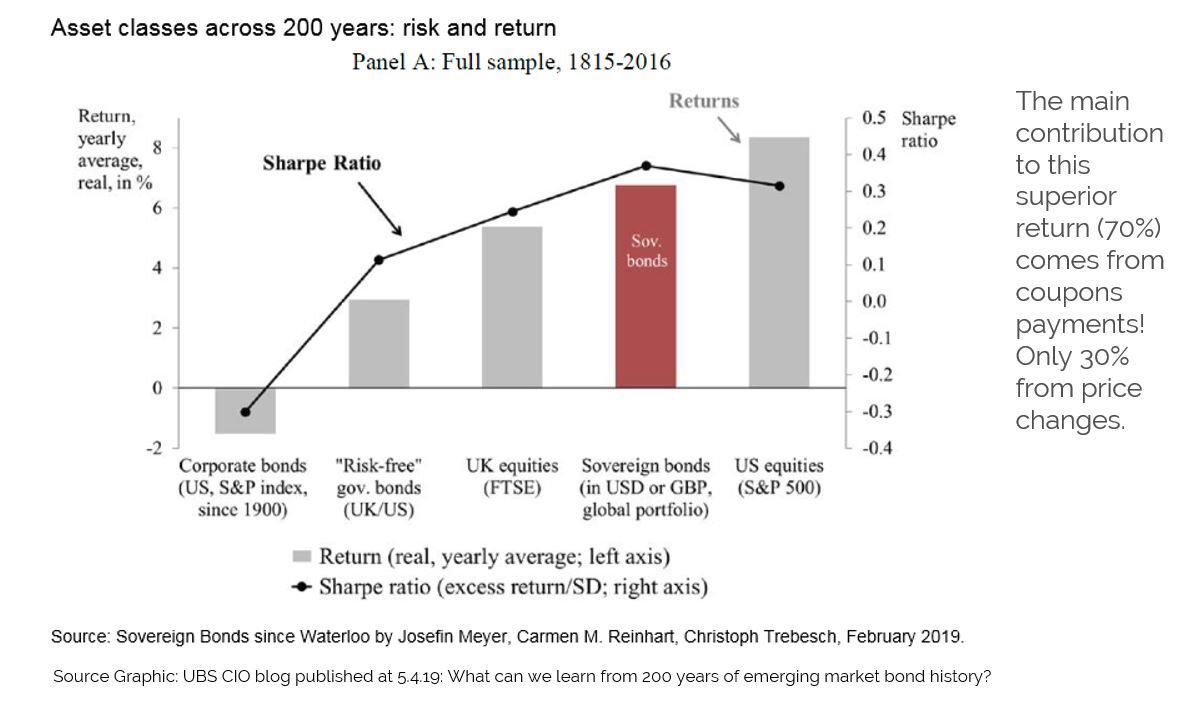

At Blackfort Capital we invest roughly 90% of our managed assets into high yielding hard currency bonds. If you will junk… but according to the below quoted study this does by no means mean higher risk and lower returns. By the contrary: Over 200-year, including all crisis and defaults, a portfolio with sovereign emerging market bonds would have delivered 6.8% real return p.a. slightly less than US equities. The interesting part is that on a risk-adjusted basis (measured by the Sharpe ratio) the risky bonds outperform all shown asset classes. Risk free government bonds delivered 4% p.a. with a lower Sharpe ratio. Noteworthy, US dollar corporate bonds (i.e. investment grade bonds) have delivered negative real returns. A weird outcome, but if history is any guide, consider to allocate more asset to junk bonds and US equities. Avoid low yielding IG corporate bonds.

Source: https://www.linkedin.com/feed/update/urn:li:activity:6530094415653011456

Published: 13.05.2019 by Blackfort CIO Dr. Andreas Bickel

Disclaimer

These Market Business Reviews (further BR) are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate