Bi-Weekly August 2022

Macro Update: The US Service sector slows down significantly in August

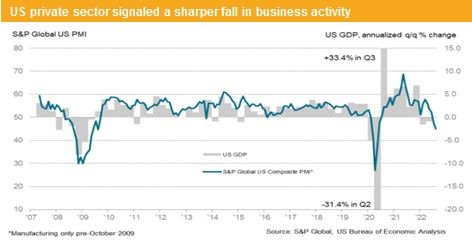

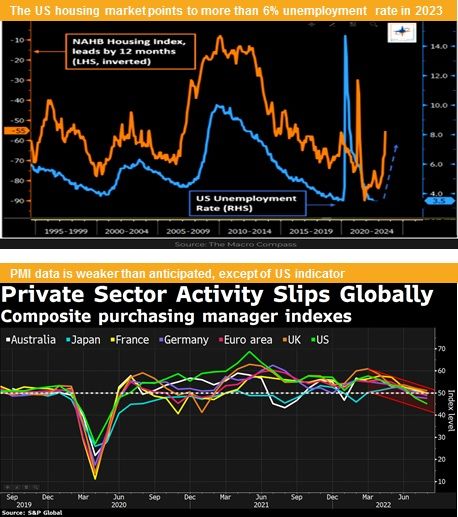

The US economy is facing more headwinds during the last weeks. The service sector has pushed the whole economy into a significant slowdown. Technically we can argue that after two quarters with negative US GDP growth rates during 1H 2022 we might be already in recession.

However, a very strong US job market speaks against a traditional recession. Nevertheless, if the recent flash PMI survey is reflected in the real economy over the coming months, we might see finally a weaker job market.

On the flip side the flash PMI data in Europe were very resilient and still do not reflect the expected recession. We stick, however, to our assessment that over the coming months Europe will face a lot of headwinds and fall in a recession.

This leaves both the ECB and the Fed in a dilemma. As on one hand due to the slowing economy both would need to stimulate their economy, but on the other hand inflation is still too high to reverse or to stop the tightening process.

The fed is after the recent strong hiking steps in a better position than the ECB. But both have failed to start tightening when the economy was still strong, and inflation had started to rise. It is now clear that inflation was not transitory, but on top around 50% of it is due to external shocks.

The two main CPI drivers are the negative impact of lockdowns on delivery chains and the negative economic impact of the Ukraine conflict. It is with a certain irony to see that sanctions have hit most the Eurozone although the main driver behind them is the US which is hardly affected by sanctions against Russia.

In Europe we do see a helpless campaign we to motivate citizens to save electricity and fossil energy. It can happen that we might have electricity blackouts during the winter. Meanwhile at the end of August Nord Stream 1 will be shut down for a three-day maintenance, which has immediately pushed natural gas prices up by more than 20%. This will have a significant impact on European inflation data and might as well reduce growth.

In China we do see the negative impact of the zero covid tolerance policy in the latest economic data. The Chinese government was forced to reduce its growth forecast for 2022 and the central bank cut its policy rate twice within a week. The main goal was to stabilize the real estate sector and to stimulate economy as well as the job market for young adults.

As president Xi participates at the next G20 meeting in person, we do expect that after his re-election we will see some loosening steps in the zero-tolerance policy, which would stimulate the economic growth.

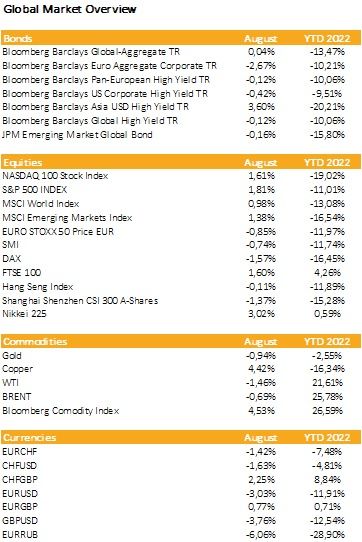

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Volatility to stay, equities to consolidate in the coming weeks

Liquidity

The CHF has continued to strengthen against most currency pairs. Still based on a low inflation rate of 3.4% and a hawkish SNB.

The EUR continues to weaken. The distrust in the ECB has been one of the main driver of this weakening. We should see a 50-bps rate hike at the next ECB meeting which would threaten the economy. However, it will not be sufficient to reduce the inflation.

The USD measured by the DXY Index has fallen since the middle of July around 3.5% but since the 10th of August regained all losses and trades now at a new year high. We see further upside for the DXY Index.

Equities

The global summer equity market rally has come to a standstill. The US Index has rebounded first up to its 100-day average and after the lower-than-expected US CPI data has gone straight up to the 200-day average, where the rally was paused.

We are now in a consolidation phase and expect to see lower prices over the coming weeks. The open question is; will we go below the lows seen this spring or not? From a fundamental standpoint that would make a lot of sense as the valuation is still very elevated. US large cap trade at a PE ratio around 18 times for 2022. During a recession this is far too high. We must expect levels at around 12 times, i.e., prices at around 3200 in the S&P 500. But from a technical standpoint we could see just a minor pullback and will not go down to the levels which fundamental data implies.

Fixed Income

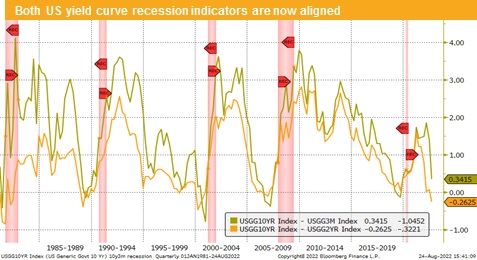

The US 10-year treasury yield has risen since the beginning of August from below 2.75% to around 3.1%. Market participants expect it will not go above 3.5% over the coming weeks. The weaker global growth outlook supports this consensus view.

Nevertheless, this implies that we continue to see negative real yields in the US and as well in the Eurozone as the 10-year government bond yields are substantial lower than the inflation in the relevant region. We expect that this situation will last over the coming months.

Alternative Investments

The Gold price has risen from 1700 to 1800 since the middle of July followed by an actual drop below 1750 due to higher US yields and a strong US dollar. We continue to see the price to be range bound.

Copper has been like gold since the middle of July a strong rally. But different to gold the pullback in August was minor. We expect due to a weaker global growth outlook only modest gains over the coming months but would still see higher prices.

Both oil futures have seen very volatile price movements. First due to a worsening global growth outlook; we went down only to be followed by the recent price spike. The OPEC has announced that after the recent price drop to consider a reduction in supply to stabilize the oil price. With prices of WTI of around 95 USD and brent at 100 dollar we can see that the OPEC tries to maximize the profit of its members and it wants to keep the oil price at such elevated levels.

Investments covered

Hyatt Hotels Corporation, 5.375%, 2025

JSW Steel, 5.95%, 2024

General Motors

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate