Bi-Weekly. Blackfort. December 2021 (I)

Macro Update: Omicron might not significantly impact the global GDP outlook

At the end of November, we were hit by the news of a much faster spreading of new COVID-19 mutation. While financial markets reacted sharply WHO experts reminded us that only in about 2-4 weeks experts will be able to assess how dangerous the virus is. Macro strategist of Goldman and UBS have therefore both stated that they do not change their forecasts, as they cannot model the impact of the new variant of corona.

Nevertheless, we can already say that due to strongly decreased energy prices (excluding gas prices in Europe) inflation will rise less than previously anticipated.

Anecdotal evidence tells us that all new reported Omicron cases were so far followed by a mild disease. But we must wait at least two more weeks that this trend gets confirmed.

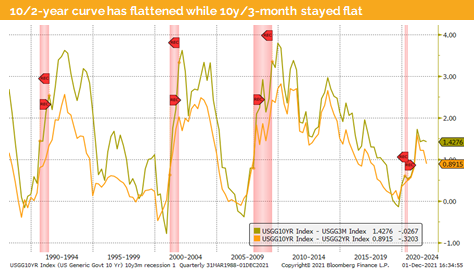

Meanwhile interest rates of government bonds dropped significantly, and yield curves flattened, both indicating a slow down of future growth. Based on the traditional 10-year 2-year spread a flattening of US yield curve can be observed, while the modern (and some claiming more accurate) 10-year 3-month yield spread stays at elevated levels. We can therefore not draw a clear conclusion. But if the latest research is still valid the outlook based on the 10-year 3 month spread looks stable.

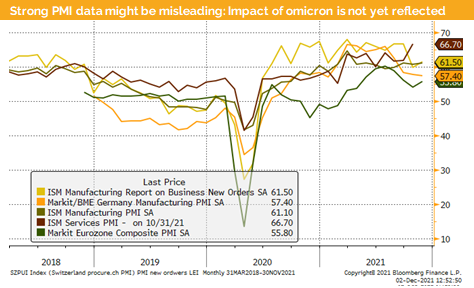

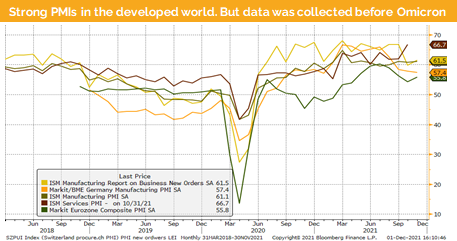

Meanwhile the latest PMI data came in surprisingly a touch stronger than one month ago. But the collection of data was conduced before the omicron news has reached us.

On the other hand the latest CPI data in German with 6% came for some economists as a surprise. This data is now higher than in Spain if we use the Eurozone definition. We expect that over the next 2-4 months the US CPI data will rise from the actual level of 6.2% towards 7%.

As long as we cannot assess how dangerous the omicron version is and especially how strict measurements will be taken across the globe we must live with even more uncertainty regarding the growth outlook. This has already impacted financial markets as we have seen much lower government bonds yields and lower equity prices. Short-term this will negatively affect consumer behaviour, but mid-term we expect that consumers will compensate that they are hindered to consume and travel right now.

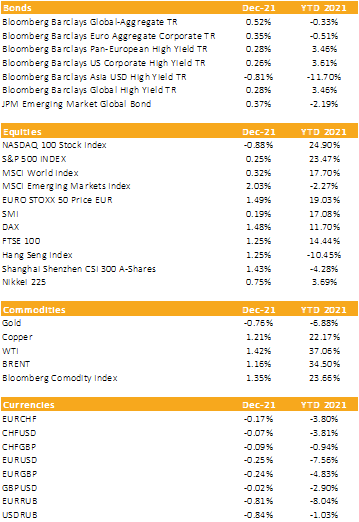

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Equity Markets hate uncertainty and selloff

Liquidity

CHF has further appreciated against EUR and is now below 1.05. It seems that the SNB has given up to defend the 1.05 level and is now accepting lower levels. This is possible as the Swiss inflation (1.5%) is much lower compared to the European one (mostly higher than 5%).

USD: The EUR drop against the USD to 1.12. But since then, we do see a mean reversion as of this writing we are trading around 1.135 and might get slightly further. Mid-term however the USD should strengthen against most currencies of developed markets due to the announced tapering and the expected rate hike of the Fed in 2022.

Equities

The S&P 500 continues to be trading down. The fed Powell’s tone has become more hawkish. He stated that the Fed will accelerate the taper in December and the market expects that they might raise the policy rate at least twice in 2022 to ensure inflation will come down.

This is a headwind for US and global equites. All the strong PMI data might be misleading as the data was collected before the new corona virus was detected.

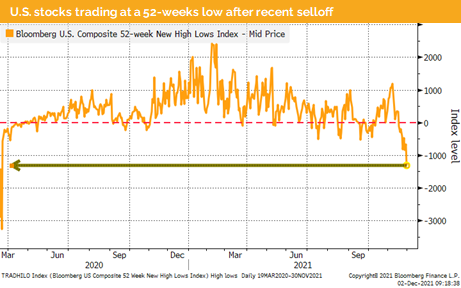

The US market so far has fallen and trades at a 52-weeks low, while European stocks broke though their 200-day average and look very vulnerable. Until we get more clarity about how dangerous the new variant of COVID is markets will stay on a roller costar.

Fixed Income

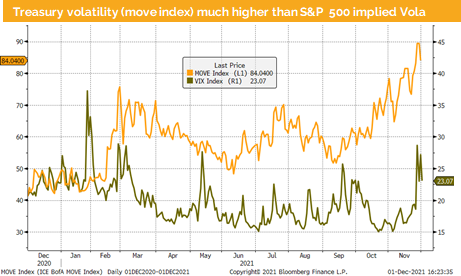

10-year treasury yields have rallied after the Omicron news was crossing the wire. In the context of a multi asset portfolio we have seen that negative yielding quality bonds still serve a purpose once risky assets go down.

Meanwhile Chinese corporate bonds measured by the broad index have rallied at the same time. This came as surprise. Looking however under the surface it really depends on the underlying company. For instance, Country Garden is a leading IG real estate company, and its bonds trade at 88-93 while Greenland, which has BB- rating and does not comply with any of the 3 imposed credit rules from the Chinese government went up from 69 to 85 at the same time.

Alternative Investments

Gold has regained its old lower trading range below USD 1’800. The main driver was the stronger USD.

The uranium spot price has risen and trades now above USD 46, but meanwhile uranium mining shares decreased together with the global equity market. We do expect that the prices of stocks will rise over the medium term.

WTI and Brent futures decreased by more than USD 10 after the news of Omicron spread. The OPEC+ has decided to wait with a further increase of production as the demand dropped substantially after travel and other COVID restrictions were announced.

Investments covered:

Interconexion Electrica

OCI

Visa

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate