Bi-Weekly. Blackfort. January 2022 (I)

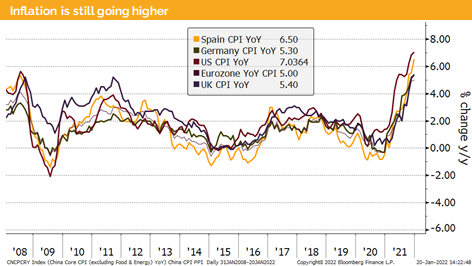

Macro Update: Global government bond yields rise due to higher inflation

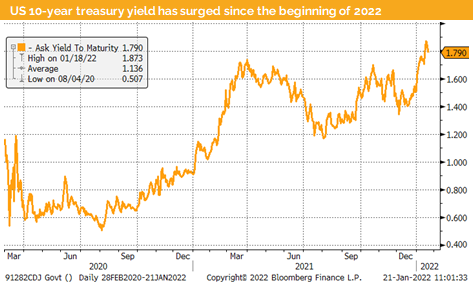

This week the German 10-year bund had a positive yield for the first time since 2019. Similarly, in the US after the latest print of 7% CPI, the 10-year government bond yield is approaching the 2% level. Before Christmas we did see some demand for US government bonds at a yield level of 1.8%. As of this writing we do see some institutional buying at yield around 1.89% and therefore slightly decreasing yields to below 1.8%.

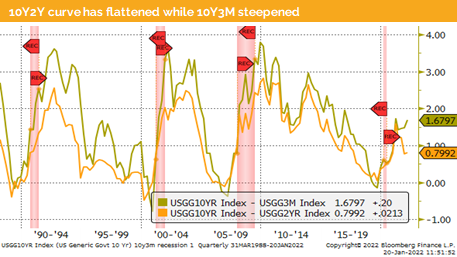

It has to be seen if this trend continues. Nevertheless, the real yield of treasuries is still below minus 5%. But due to regulation and investment restrictions institutional buyers are forced to invest. We expect that we are going to see negative real yielding high-quality bonds through the whole 2022.

While this recent spike of inflation has pushed the BOE to raise its policy rate, the Fed to announce the ending of its bond purchasing program and the beginning of the rate hiking patch in 2022, the ECB and the People’s Bank of China do go anther route. The ECB might consider its first-rate hikes in 2023, while in China we have seen several mini steps to reduce policy rates.

The move in China comes with no surprise as they have not only tightened over the last 2-years but also slowed down the economy with various new regulations in multiple corporate sectors.

Nevertheless China’s Q4 GDP data has surprised with an unexpected 4% YoY growth rate and the first estimate for the whole 2021 growth was a touch above 8%. But due to a significant expected slowdown during 2022 we do expected more monetary stimulus in China over the coming months.

The latest German ZEW indicator surged unexpectedly which might lead to a very strong GDP development not only in Germany but also in the rest of the Eurozone. However, the further development of the economy depends on the speed of normalization. Most governments do tell us that we are in the final stage of the pandemic and we will soon see an acceleration of the public life and with it the economic activities. Virologists are not so outspoken and see good chance that this might happen, but at the same time they warn that it cannot be ruled out that we get another wave later in 2022.

We can say that people are fast in adapting to new situations. The global growth impact of the pandemic was on average much less sever than all the bleak forecasts we had seen over the last 24 months. This view was accompanied by resilient PMI data, which even now points to solid growth for 2022.

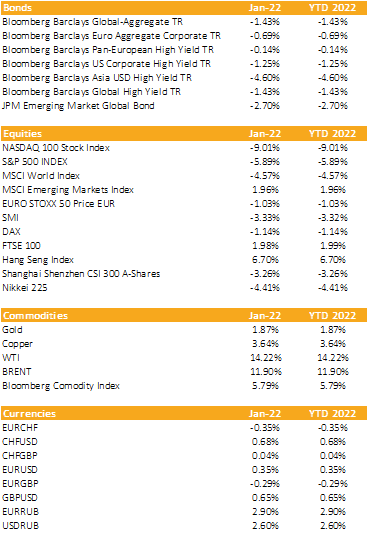

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Equity markets are oversold and might rebound

Liquidity

CHF has fallen back below 1.04 against the EUR and as well below 0.92 against the USD. It is however trading in a narrow trading range. As expected, the Swiss National bank has let the EUR/CHF rate to decrease as the Swiss inflation data around 1.5% is substantially lower than its European pendants.

Since the middle of December, the EUR has gained against the USD from around 1.12 to 1.135.

The USD measured by the DXY index has slightly decreased over the last 4 weeks but stayed however in its new trading range of around 94-98.

Equities

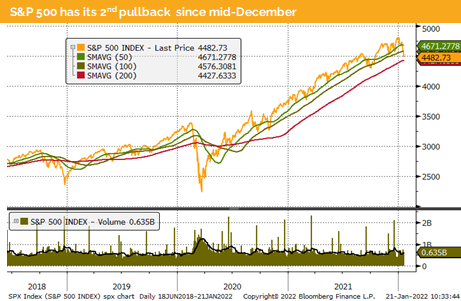

The Nasdaq 100 had its 4th worst start of the year in history. Together with the Russel 2000 both indices have now dropped more than 12% and are at the edge to fall into a bear market.

Even at the beginning of the year when we have seen new record levels, the fundamentals in US equity markets were weak as most stocks were trading below their 200-day average, i.e., they were in a correction.

As of this writing we do see a strong recovery attempt in Asia, led by China mainland shares. Similarly, in Brazil markets have as well bounced in 2022 disregarding weak economic fundamentals.

Same situation is observed in Russian indices which lost between 20-30% from the top. It is quite likely that the 4 BRIC countries might see a continuation of this bounce.

Fixed Income

10-year treasury yield have risen sharply over the last 3 weeks. Concerns about a further rise of inflation and a flight to quality while equities dropped have both driven this money flow into treasuries.

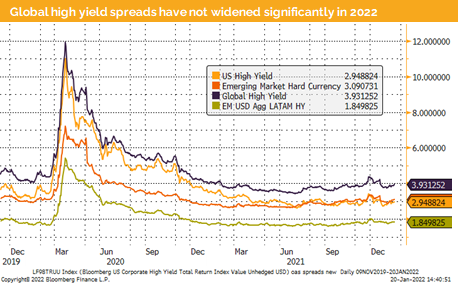

Meanwhile the global investment grade corporates lost around 1.5% since the beginning of the year, while US high yields surprised as they lost a touch less than global investment grade bonds. We do expect that during 2022 government bonds and investment grade bonds will underperform equities for the 2nd year in a row.

Alternative Investments

Gold is reaching the higher end of its trading range. It is surprising to see higher US real yields, a strong USD and higher gold price at the same time. Mid-term we continue to expect gold to go further up due to a continuation of elevated inflation data across the globe.

Since our last publication copper has risen from around USD 9’200 to above USD 9’800. We do expect mid-term that copper will trade above 10’000.

WTI and Brent futures have risen further, and we expect that to continue as demand is picking up. The latest Russian production data shows a decline and OPEC+ keeps the supply deliberately tight.

Investments covered:

New Issue: Prosus N. V.

Update: EnLink Midstream

Update: Activision Blizzard

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate