Bi-Weekly. July II

Macro Update: Strong macro indicators in the Eurozone

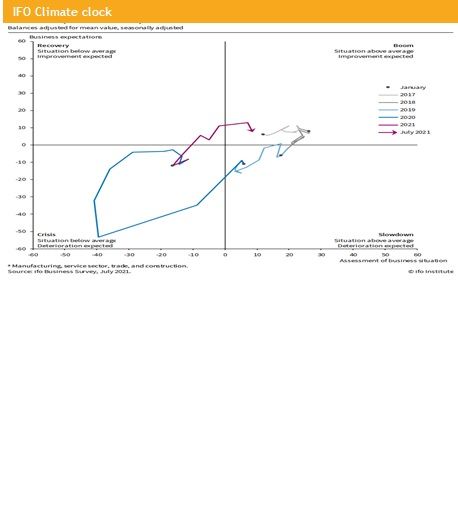

The latest releases of macro data and forward-looking macro indicators do still show a picture of solid but slower global growth ahead of us. The latest IFO climate clock stayed in the bottom quadrant and indicated a slowdown. However, healthy but slightly slower growth is a very good environment not only for the economy but also for stocks.

Eurozone PMI has reached a 21-year high. The IHS Markit flash composite purchasing managers’ index (PMI) rose to 60.6 in July. In the US the composite flash PMI fell from above 60 to 59.7. Although both figures are close to each other, the narrative is completely different. In the Eurozone we finally see some growth ahead of us, while in the US we slow down from an overheating situation. However, both regions are in the acceleration area, and we can still expect potential growth over the coming 12-18 months.

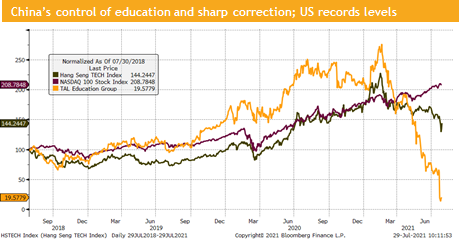

Meanwhile China is strangulating its economy with first regulation of the large tech sector. The government is now taking the control over education services from private companies. In hindsight, the latest monetary stimulus from the Peoples bank of China makes perfect sense to dampen this negative effect.

Meanwhile Australia with only 10% of the people vaccinated does show very weak PMI data due to the continuation of the lockdown.

On the other hand, Japan, where the Olympic Games take place, shows a strong economic rebound although the area of Tokyo is in another lookdown. The good news in Japan is that the vaccination rate is finally fast growing and we do have more than 30% of the population vaccinated.

Overall we do see encouraging signs of growth. The pent-up demand from the consumer is large for goods but especially large for leisure services. Travel oriented businesses have problems to deliver sufficient supply to the consumer.

One key risk for the next two years is that due to the lack of access to vaccine and the sharp increase of debts in a lot of emerging markets we might see a lot of defaults and restructuring of international government debt.

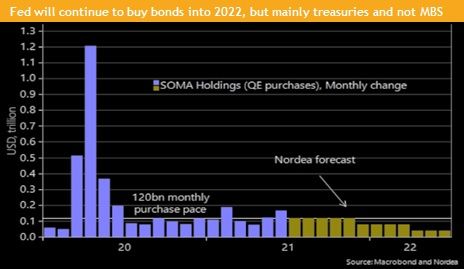

The Fed will soon announce when they will start tapering, but we do expect that the bond purchasing program will continue into 2023. So the policy stance stays accommodative not only int the US but also in most G10 countries.

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

China causes a regulation crackdown. Starting with the tech sector and continuing with margin and price controls in the real estate sector and pharma the government ended forcing all education services companies to become NGOs (non-government organizations).

What looks shocking from a western standpoint does have a clear strategy – to cut costs for consumers and to give the Chinese consumer more financial freedom.

The after-school tutorials were the only way to ensure that the single child can go to an elite university. The recently implemented 2 and then 3 child policy caused no reaction in the population. Due to the extremely high education and living costs almost nobody wants more than one child.

The real estate sector got slightly more regulated and profit margins can not rise further, but the sector can still work relatively free and generate profits.

In tech space the policy is antitrust and data-protective. For instance, Tencent Music must give up their exclusive streaming rights of Chinese bands. This will increase the streaming competition and reduces the costs.

The education sector was in a bubble and extremely profitable. In order to ensure that all children have access to high quality education the state intervened and banned companies from getting new capital from the markets

Short-term this all hurts investors, but mid-term this should create more wealth and growth in China.

Investment Outlook: Summer turbulences ahead of us

Liquidity

CHF has played out its role as a save haven currency. During the 2nd mini pullback in the equity markets, we have seen a stronger CHF against the USD and EUR. So far, the SNB has not intervened which is a sign that they do not expect further strengthening.

The EUR gained against the USD during the last trading days. It looks like the USD continues to weaken.

Similarly, the USD measured by the DXY lost ground after the hedge funds positioning got long USD. A mean reversion is in the cards.

Equities

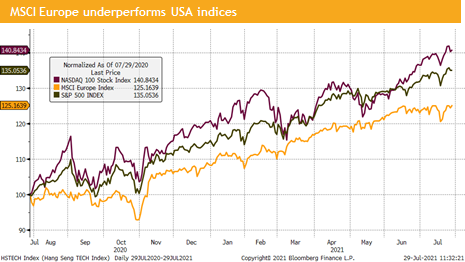

This year Europe is up around 15% and only slightly outpaced by the Nasdaq and the S&P 500 but is sill underperforming the largest stock market of the world. Valuation and recent macro indictors support continuation of strong European equity market. US markets did not react to recent strong tech earnings. We expect a consolidation into autumn but would also expect higher prices into 2022 as the S&P 500 PE ratio has fallen to around 22x from 28x.

China mainland indices and Hong Kong Hang Seng have both seen a strong correction after the recent market intervention of China’s government. While education stocks are non investable, we do see opportunities in the tech sector and in the real estate sector which both have suffered stricter regulation.

Fixed Income

10-year treasuries have seen a falling yields pushing the real yield further into the negative territory. A mean reversion is expected by most market participants. However, if we are going to see further equity market turbulences due to growth concerns or new stricter regulation in China (e.g., a delisting of all China stocks from the US exchanges), we would see a flight to safety, and this would push yields further down.

Meanwhile US high yield spreads were basically unchanged, which is surprising given the US equity market turbulences over the last two weeks.

Alternative Investments

Gold: Gold has so far not profited from lower real yields. One of the headwinds was the stronger USD. Mid-term we should see higher prices, if US real yields will stay below zero due to sticky inflation.

Copper: Over the last trading days we have seen a surge in copper price due to the hope of rising demand from the green revolution. This move was supported by another positive research report from Goldman Sachs which sees an upside of more than 30% over the coming 3-5 years.

WTI and Brent lost more than 10% after the OPEC+ agreement which happened during the mini equity pullback. Since then, we have regained most of the losses and do see slightly higher prices over the coming moths.

Investments covered:

China Shandong Hi-Speed

San Miguel Industrias

Lonza Group

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate