Bi-Weekly. Blackfort. October 2021 (I)

Macro Update: The US economy has gained momentum based on the latest ISM Data

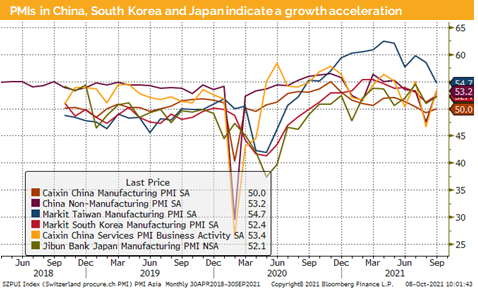

The news narrative over the last weeks was about a global slowdown led by China and followed by Europe and the US. Such statements are based on economic forecasts. Today’s latest Chinese PMI data, neglected by economists, came as surprise. All three indictors have jumped back above the dividing line between growth and slowdown.

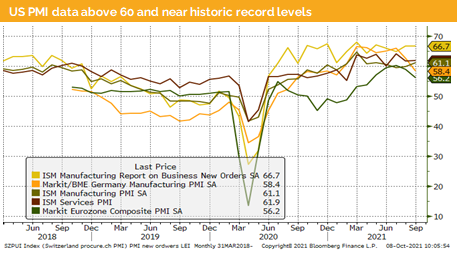

The real surprise came from the ISM PMI data in the US, that unexpectedly jumped above 60, and are now near historic record levels. These are encouraging signs for the two largest economies.

Turning to Europe, we see all major indicators above 55 in the acceleration area as well, which is a positive surprise, although we must admit that the indicators are still declining.

In Japan, still one of the major global economies, we did see a jump of the PMI indicator up into the growth area.

Overall purchasing managers do see the future development of their businesses much brighter than the economists. This comes as a surprise given the actual interrupted global delivery chains, which are also partially responsible for rising inflation.

Prices for used cars in the US went sharply up due to the lack of the new production. Chip shortages have impact not only on production delays, but also on their own price, which has skyrocketed.

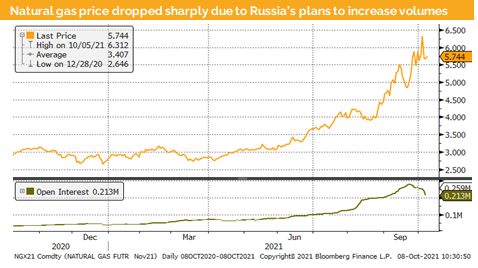

Rising oil and gas prices are Europe’s biggest problem. In the UK petrol cannot be distributed due to the shortage of truck drivers, and the OPEC+ cartel has decided to only partially increase production which has pushed WTI and Brent futures sharply up.

Last but not least, the shortage of natural gas in western Europe has not only moved up its price but has increased electricity prices. Vladimir Putin has announced that more gas will be delivered to the West, which was followed by decreasing gas futures prices. Some economists estimate that in Europe the negative impact on growth might be up to 2%.

Similarly, in China coal electrical power stations were shut down due to pollution and economists expected a 4% negative impact on GDP. We would just add that the latest PMI data (covered above) does contradict these negative estimates.

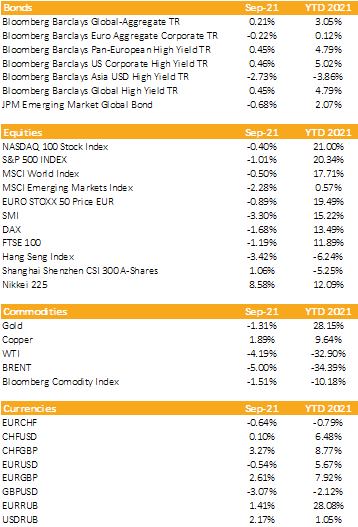

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: After a 6% pullback in the US, we might soon see higher markets

Liquidity

CHF has traded sideways against the USD, but appreciated against the EUR. The Swiss national bank might soon intervene to weaken the currency.

EUR lost against the USD, as we have seen globally larger money flows into the safe heaven currency during the equity pullback.

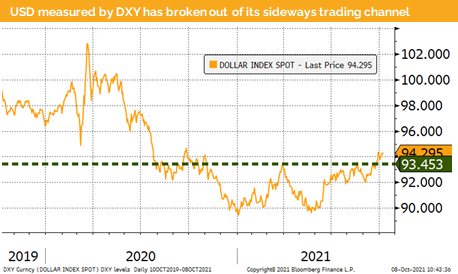

The DXY USD index has continued to rise over the last 2 weeks. DXY has broken out of its trading range, and we might test higher resistance levels. The USD is supported by higher treasury yields and a very strong growth outlook based on the latest US ISM data.

Equities

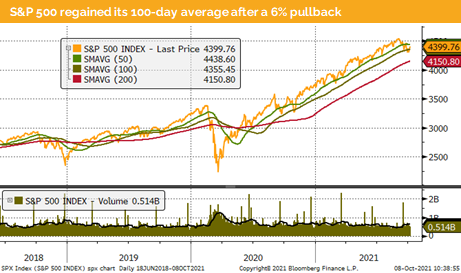

The S&P 500 has finally corrected by 6%, but after trading below its 100-day average we have seen another wave of ‘buy the dip’. This was accelerated once the republicans agreed to temporally solve the debt ceiling problem. However, we will have another discussion about the debt ceiling in the beginning of December. We do not expect that the US will fall off the tax cliff like many commentators have written recently.

In Europe the pullback was more pronounced than in the US, which is a normal behavior for markets.

China A-Shares have traded more than 1% up after the golden dragon week, which came as a surprise, as the markets were closed during the US and European pullback period. Latest news indicate that China’s government and the major banks have agreed to support real estate developers and we might soon see some monetary stimulus and may be even lower policy rates.

Fixed Income

10-year treasury yields are approaching the 1.6% level. Although the news flow is quite negative, we should not forget that in spring we were at 1.77%. We would add that this rise is supported by a strong growth outlook for the US.

Asian high yields have sold off over the last weeks. The Chinese Index lost around 12%. The main drivers were outstanding bonds of real estate developers. Based on the news flow from China the government has agreed with banks to support the real estate sector which is around 30% of the Chinese economy. Among others a reduction of mortgage rates is discussed.

Alternative Investments

Gold did not profit from the recent turbulences in the bond and equity markets. We do not see any catalyst which might boost the gold price.

The uranium spot price has pulled back from around USD 50 to USD 43. This consolidation was expected as recently we have seen an overshooting due to the strong demand created by Sprott Physical Uranium Trust in August.

WTI and Brent futures have both risen after the OPEC+ announced the increase in production only on a minor scale, which caught most traders on the wrong leg. The discipline among the cartel members is very high therefore we would still expect rising futures prices over the coming weeks. Considering that the heating period has not even started which will create addition demand while the supply will be kept artificially low.

Investments covered:

Match Group

Softbank Group

General Motors

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate