Bi-Weekly. Blackfort. October 2021 (II)

Macro Update: Inflation is here to stay at higher levels

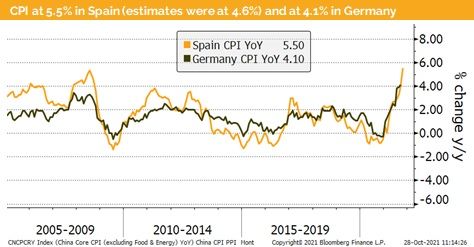

Is inflation transitory? Based on the central bank narrative, next year it should go back to levels between 2-3%. However, the latest CPI data of Spain at 5.5% YoY came as a shock (expected 4.6%). In Germany, the inflation data from last month stood at 4.1% and we do expect the next data released to be higher. Such a high German inflation data was last seen during the late 70-s and at the beginning of the 80-s.

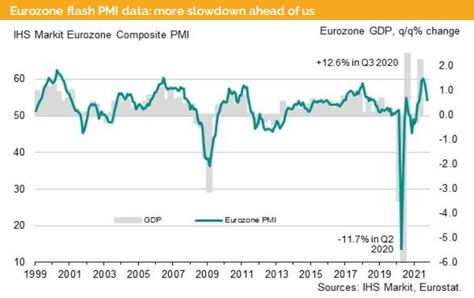

The ECB starts to have a problem, as these are first signs that we might get much higher inflation for a longer period than previously anticipated. To make maters worse, the latest flash PMI data do indicate a further slowdown in Europe.

This comes with the risk that the ECB falls behind the curve and might be forced to decide between fighting inflation and further stimulation of the economy.

In the US, the Fed is in a much better position as the economy keeps expanding at an accelerating pace. However, treasury secretary Janet Yellen recently admitted that for the 1st half of 2022 we will see inflation data at 4% or even higher before it should fall back in a range of around 2-3%. We would leave a big question mark for this part of the forecast. Oil is on its way up to USD 100 per barrel and natural gas keeps rising.

On top we do have a shortage of various input factors which push PPI globally up and will find its way into CPI data through 2nd round effects.

The good news is that the US and Asia, including China, do show signs of a recovery or, in the case of the US, even a continuation of healthy growth.

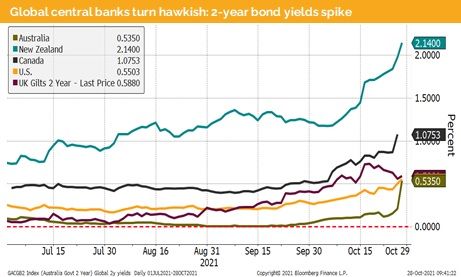

Bond markets have reacted to this macro trend. We do see a spike in 2-year government bond yields while at the same time the 10-year and 30-year yields have decreased.

The main reasons why we see higher 2-year yields in the Anglo-Saxon world are the thoughts of either tapering the bond purchasing program and/or raising the policy rates.

Meanwhile China faces another COVID wave, that is dealt with by means of a full lockdown in the affected regions. This will delay the recovery, but we do not expect to see a negative growth. The latest Q3 GDP data was below 5% and some analysts have claimed that they were disappointed. We would argue, given the zero tolerance policy in China, that a GDP growth at 4.9% was pretty solid.

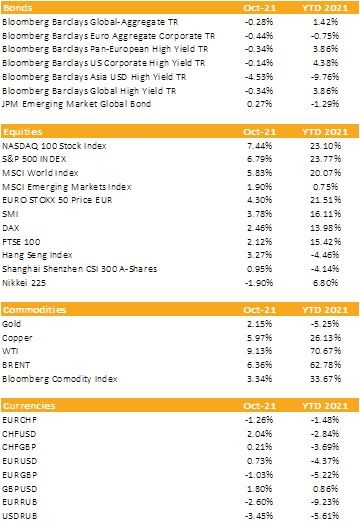

Markets in 2021: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: US equites keep climbing the wall of worry

Liquidity

CHF has appreciated against both USD and EUR. We do expect some intervention of the Swiss National Bank to weaken CHF against EUR.

EUR lost against the USD, as we have seen globally, money flows into the safe heaven currency during the equity pullback.

The DXY USD index has risen to around 94.5 and is now testing the older trading range at 93.4. If we were to fall below this level, we would return into the old trading range of around USD 90 – 93.

Equities

The S&P 500 has started to climb the wall of worry after the mini correction. At the time of writing this. we do see new record levels. There are a lot of political risks which can cause the next pullback, but as there is so much money on the sideline, we do believe we are going higher until the end of the year.

European equity markets have seen a minor consolidation since our last publication. The earnings season is strong, but stocks do not react positively to good figures, preferring results which meet or miss forecasts.

Vietnam, one of our regional bets, has seen a rise in equity markets. This is remarkable as parts of the industrial production are still closed due to COVID.

Fixed Income

10-year treasury yields have recently pulled back while the 2-year bucket has seen higher yields. Markets are pricing in a tapering process and do anticipate that in 2022 we might see an unexpected increase of the Fed rate.

Led by China Asian high yield bonds have seen a significant spread widening. The market is pricing in a collapse of 50% of the whole real estate corporate bond market. Some US investment houses have turned positive on the sector and recommend to buy higher quality real estate developers.

Alternative Investments

Gold was trading in a narrow trading range. We still do not see a catalyst why this should change.

The uranium spot price did not move much. Meanwhile, uranium mining ETFs have risen sharply due to the strong capital inflow into the products.

Copper lost over the last 3 weeks around 8% in line with weaker macro indicators.

WTI and Brent futures have both risen above USD 85 and are now consolidating. We do expect that we soon will see a test of the USD 90 threshold.

Investments covered:

Lukoil

JSW Steel

Facebook (Meta)

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate