Bi-Weekly. March 2022 I

Macro Update: Spikes in commodity prices might push US into recession in H2 2022

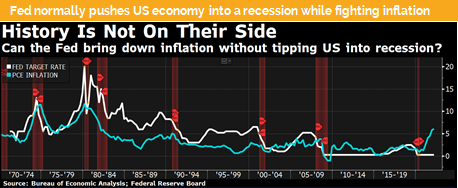

The US has little trade interaction with the Russian Federation, but they face now a severe risk of falling into a recession. On one hand commodity shocks coincident with recessions but on the other hand it might be the Fed who pushes the economy into a recession.

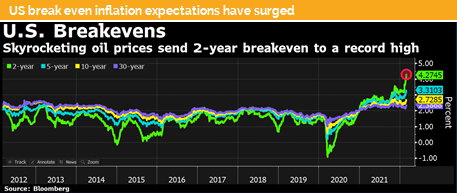

The global economy is facing an additional boost of inflation pressure due to supply chain disruptions caused by global sanctions. Therefore, the Fed must choose between fighting inflation and supporting the economy with liquidity.

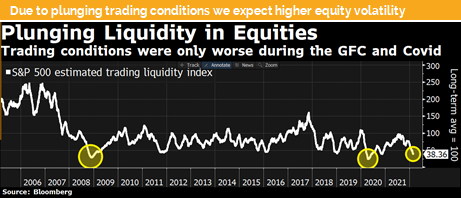

We do see stress in the inter banking system as overnight rates are surging while at the same time bond and equity markets are seeing worsening of trading conditions. In normal times western central banks would support the economy with a large concentrated monetary stimulus package. But that will not work this time. The latest inflation data in Europe have continued to rise. The US PMI Prices Paid sub index as well shows rising inflation expectations.

The Fed is behind the curve and has recently attuited this fact. Nevertheless, Fed’s chair Powell did a great job during his testimony in front of the US parliaments.

The market is now prepared for just a 25 bps hiking step in March and max 5 other steps during the coming 12 months. This however is very uncertain as we might see US CPI data reaching levels around 10% and that might force the Fed to implement a Paul Volcker strategy like it was in 1982, i.e. to raise rates significantly and much faster than anyone expects it right now. That would of course push the US economy into a recession.

The good news is that western PMI data have indicated strong growth before the Ukrainian conflict escalated. Therefore, we do have a certain buffer until we get into a recession.

For Russia however, the question is how severe and how long will the recession last. S&P has made today a clear statement and decreased the Russian government bond rating to CCC-. The goal of the sanctions is to push the Russian economy down to a level comparable with Iran. It is surprising how unanimously the western countries implemented sanctions. As of this writing more sanction were announced by the American administration.

However, the oil and gas exports from Russian are so far excluded from sanctions. Normally, such bleak forecasts from economists underestimate the resilience of the people to adapt to crisis and to find ways to keep the economy up and running.

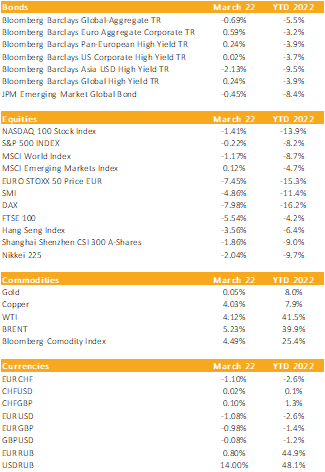

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Equity markets will fluctuate more due to scarce liquidity

Liquidity

The CHF and the USD have both strengthened over the last days due to their role as a safe haven currencies. The CHF still trades at a similar level of around 0.92 against the USD like at the beginning of 2022. But we are approaching parity against the EUR. Over the last two weeks the exchange rate has fallen from around 1.06 to 1.01 and might soon reach 1.00.

The EUR lost against the USD from around 1.14 to 1.10 due the expected negative impact of the sanctions against Russia on the European economy. Lower prices are still expected.

The USD measured by the DXY index has reached the upper end of its trading range and might continue to strengthen further.

Equities

Global equity markets are facing worsening trading conditions, but the YTD losses are with Asian and US markets down less than 10% while European markets are down around 10 to 15% which is surprisingly low. Nevertheless, we are in a risk of off-mode and trading volumes are very low.

Russian ADRs and GDRs are not traded any longer. Their price indications are at ridiculously low levels, and we expect once the Russian exchange reopens to see a surge in prices.

One of the winners in this crisis will be the Chinese economy and probably its stock market. The latest Chinese credit indictors do show a strong rebound of credit growth and other macro indictors like the money supply have increased by around 10% over the last 12-months.

Fixed Income

10-year treasury yields are on a roller coaster. Over the last two weeks we did see a drop of the yield from around 2.05% to below 1.8%. The volatility will stay high, but the flight to quality has distorted the prices of US government bonds.

Nevertheless, this US bond market segment does send a recession warning signal as well as we do see a further flattening of the yield curve.

On the bright side the Fed plans to shrink its balance sheet over the next three years and is not planning to aggressively sell its treasury bond holdings.

Alternative Investments

Gold has surged since the end of January from around USD 1’800 per ounce to around USD 1’940. Over the last 10 trading days it was fluctuating like most other commodities from around 1’880 to 1’990. Mid-term gold will play out its role as a wealth preservation asset.

Copper has surged back to levels last seen in January of around USD 10’300 from 9’700. However, this happened due to fear that delivery chains will be disrupted and not due to a strong economic outlook.

Uranium has surged by around 20% over the last two weeks for the same reason. We stick to our investment case, but short-term markets might continue to fluctuate in an erratic way.

WTI and Brent futures have surged to around USD 110 per barrel. The sanctions of not buying Russian Oil and an OPEC+ which only marginally increases its production are two main drivers. Iran might soon get the permission to export its oil to the western world to partially substitute the Russian oil exports.

Investments covered:

China Tourism Group Corporation 2.95% 2027

Cikarang Listrindo 4.95% 2026

Shell Plc

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate