Outlook 2022. Blackfort.

Global markets in 2021: A mixed bag

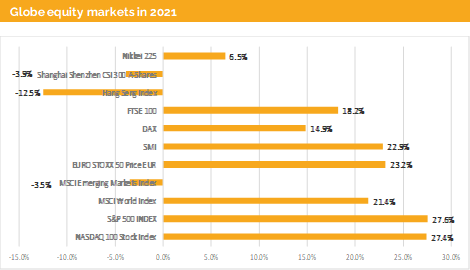

It was rather difficult to outperform broader indices as most constituents were down while the market was hovering at recorded levels. For instance, 95% of Nasdaq 100 stocks lost value in 2021, while the index reached new records.

Besides the negative impact of COVID-19 we have seen a lot of interest rate hikes in emerging markets being one of the key headwinds for equity markets. A stronger USD was coming on top of that.

In the second half of 2021 we have seen more tension from the west towards Russia and China. While in China the weak performance was mainly driven by stronger regulation of various sectors, the Russian equity markets lost almost half of its gains during H2. However, with a very low Shiller PE ratio and a high dividend yield, we would argue that from a valuation standpoint Russia looks attractive. From the BRICS countries probably, only India looks more appealing, given its growth potential and especially given that they do not have a higher inflation rate than government bond yields. We do expect therefore inflow into the Indian market over the coming months.

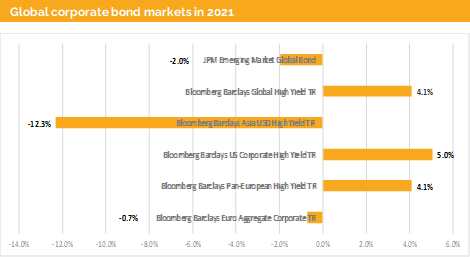

The development of global corporate bond markets reflects the development of the global equity markets. Asian high yield bonds lost around 12% in 2021, the major part came from Chinese property corporates.

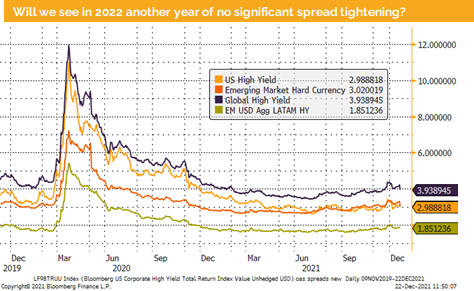

Surprisingly resilient was the reaction of global high yield bonds. We did not see any significant spread widening and US and European corporates returned the coupons.

High quality bonds like European corporates lost value during 2021. European investment grade bonds lost only around 0.5% while their US pendants lost 1.6%. The weak performance of this asset class was expected.

When we turn to US government bonds which lost 2.3%, we must repeat our warning that this asset class will continue to perform poorly. If you consider US inflation with 6.8% your loss of purchasing power in 2021 was almost 9%.

Government bonds in EUR, GBP, JPY or CHF have even a less compelling starting point as all these bonds are negative yielding and they all face high inflation pressures as well.

Headwinds for the global economy: No recession in sight

The development of global corporate bond markets reflects the development of the global equity markets. Asian high yield bonds lost around 12% in 2021, the major part came from Chinese property corporates.

Surprisingly resilient was the reaction of global high yield bonds. We did not see any significant spread widening and US and European corporates returned the coupons.

High quality bonds like European corporates lost value during 2021. European investment grade bonds lost only around 0.5% while their US pendants lost 1.6%. The weak performance of this asset class was expected.

When we turn to US government bonds which lost 2.3%, we must repeat our warning that this asset class will continue to perform poorly. If you consider US inflation with 6.8% your loss of purchasing power in 2021 was almost 9%.

Government bonds in EUR, GBP, JPY or CHF have even a less compelling starting point as all these bonds are negative yielding and they all face high inflation pressures as well.

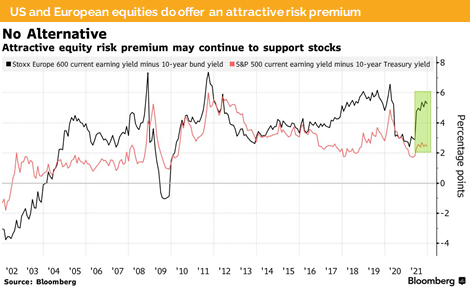

We therefore expect equities to deliver roughly their EPS growth plus the dividend. For the US it means 8% growth and 2% dividend yield. The risk of this forecast lays in the development of inflation We expect it to come down during summertime and for the US to be back below 5% or may be even 4%. This could however mean that EPS might inflate, and the nominal growth could exceed the expected 8%. Therefore, with a PE ratio of around 20 times for 2022 we consider US equities and global equites as attractive. Similar conclusions can be drawn from the equity risk premia, which is still high for all markets.

We’d rather buy real assets such as gold, commodities (and mining shares), real estates (REITs) besides equities. Convertibles bonds and other asymmetric investment which extract an equity risk premia from the market are as well part of our investment universe. It could therefore well be that 2022 will be the 2nd year in a row where equites will do well, and high-quality bonds will do poorly.

Disclaimer:

This Market Watch (hereafter «MW») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. MW does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the MW includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate