Equity Risk Indicator is in Exuberant Territory

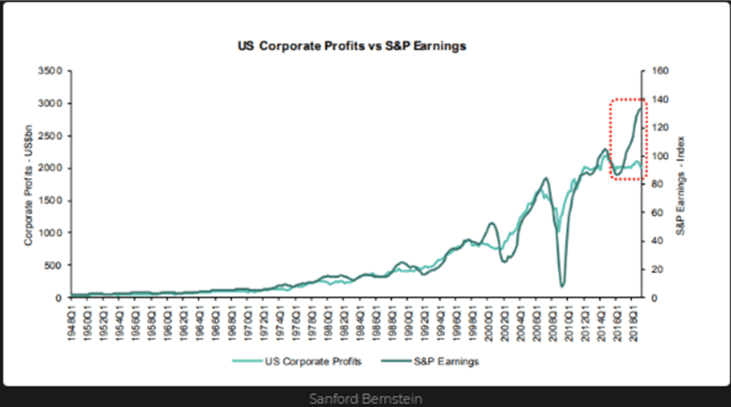

S&P 500 has risen based on eps growth. However, US corporate profits are flat in 2019; the rise just came from share buy backs. The S&P 500 is as well trading at the upper end of its trading range and the distance to its 200-day moving average is getting at extreme levels.

Normally, that is worrisome. At the same time, JPM’s equity risk indicator is in “exuberant territory”. I would argue that we might see a consolidation followed by higher prices and maybe a correction in H12020.

I would not sell right now equity, but consider adding some protection. Volatility is still low; therefore, options are not very expensive.

The key question for 2020: Is the secular equity bull market going to end or will it just take a break? I.e. a good buying opportunity.

With the latest new US tariffs against Brazil and Argentina, the worsen US dispute with China makes it impossible to predict what is next. However, based on this latest development and the weak US ISM data in 2020 more Fed rate cuts are in the cards. This might feed the bull….but remember this:

“You cannot predict it (i.e. the future and market cycle). But you can prepare for it.” Howard Marks

Source: https://www.linkedin.com/feed/update/urn:li:activity:6607564585903898624

Published: 03.12.2019 by Blackfort CIO Dr. Andreas Bickel

Disclaimer

These Market Business Reviews (further BR) are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate