Market Watch April 2024

Policy rates: FED on hold, ECB under pressure and SNB surprises

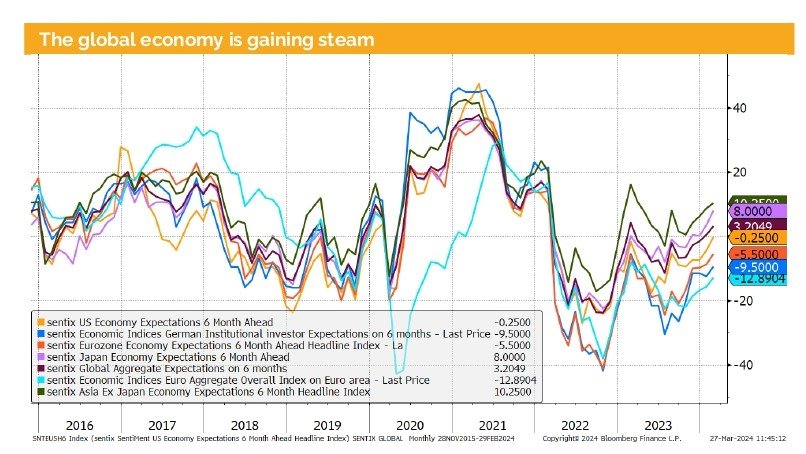

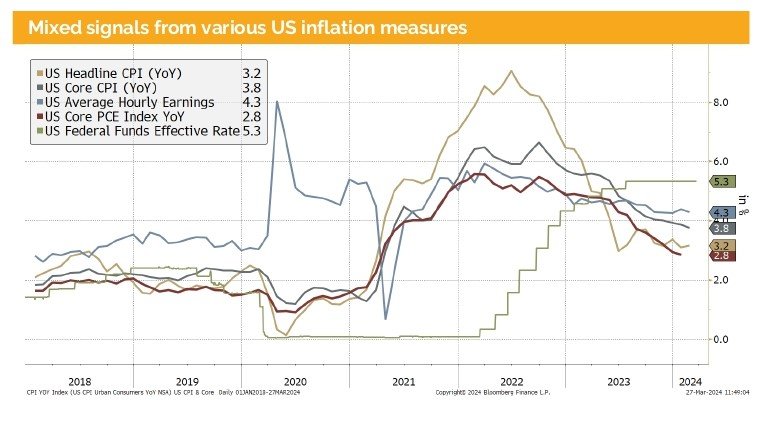

The peak in global rate hikes is behind us, at least when considering the four major central banks (Fed, ECB, BoE, and SNB). Based on the latest Fed press conference, the economy is healthy and growing at a solid pace. The labor market remains tight, and wage inflation (average hourly earnings) is contained but at an elevated level of 4.2%.

Fed Chair Powell added that the FOMC believes inflation will come down over the coming months, although recent releases of US CPI and PPI have shown some signs of strength. Therefore, the committee still guides towards three rate cuts during 2024. This led to the strongest one-week gain in the S&P 500 during 2024.

The SNB, which held its quarterly review one day later, surprised the market with a 25 basis point rate cut. Inflation in February further decreased to 1.2%; therefore, the SNB has utilized its flexibility to cut rates, as the export industry is suffering from a strong Swiss franc. This will not only weaken the currency but also boost the economy.

Meanwhile, the ECB has postponed the first rate cut to June. The two largest economies, France and Germany, are facing headwinds in their industrial sectors. Therefore, the pressure is now on the ECB to initiate its rate-cutting cycle..

On the positive side for the Eurozone, the latest leading indicators mostly show signs of improvement. The latest German IFO data was surprisingly strong, so together with the expected ECB rate cut, it might be sufficient for the German economy to exit its stagnation phase later in 2024.

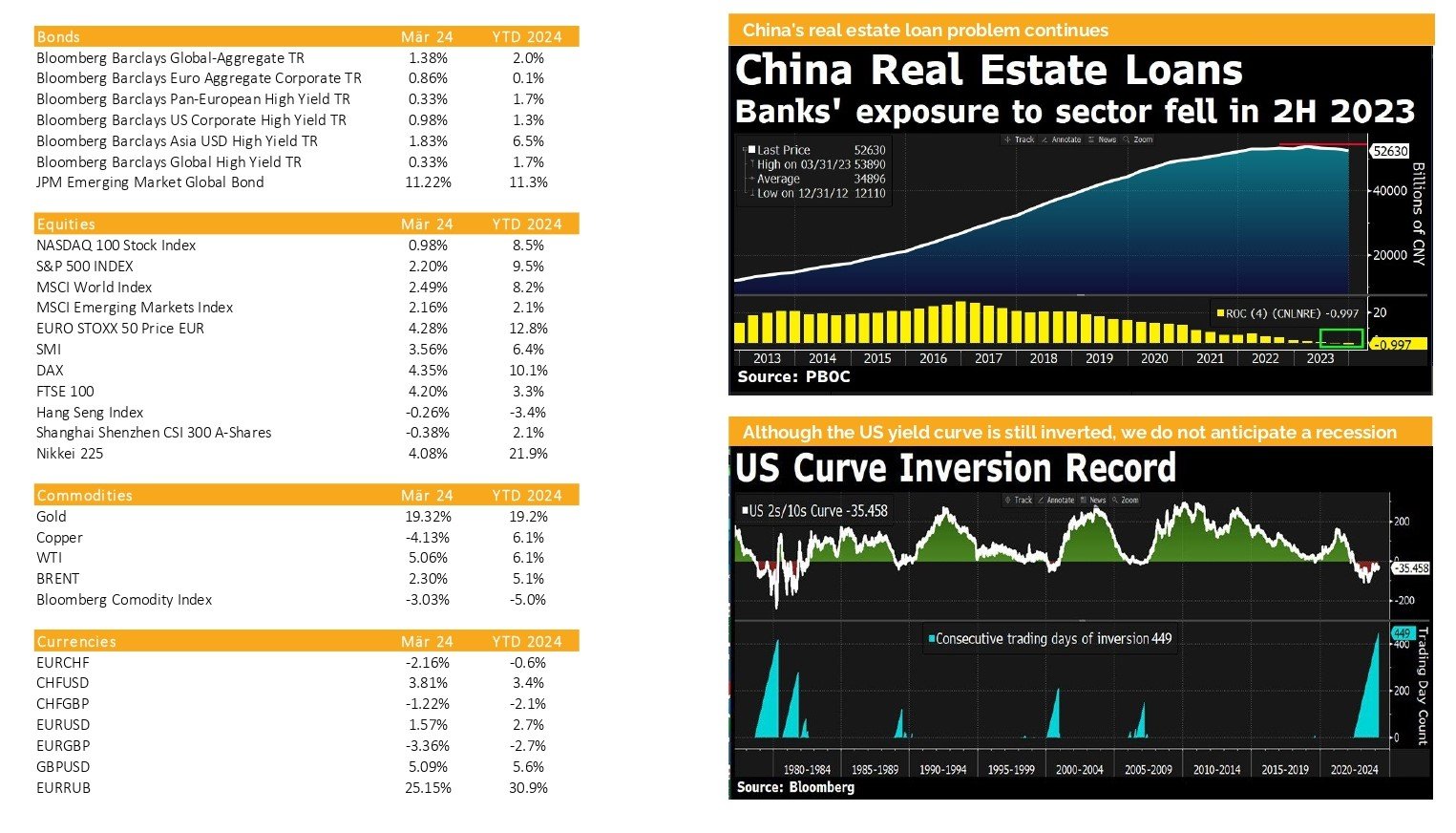

In China, which faces a balance sheet recession, we see that monetary stimulus is being used to repair private balance sheets, as demonstrated by the latest real estate loan data. However, there is a chance that once the Fed and ECB cut their rates, China might start implementing other measures to stimulate its economy as well.

In Japan, we have witnessed the first policy rate hike since 2007. This step was expected and is not anticipated to significantly impact the economy. The yen, which has been declining for months, might experience a slight mid-term appreciation against the Euro and US dollar.

Markets in 2024: Currencies, Commodities, Equity & Bond Indices

The US equity markets have reached new records and might further rise

Liquidity

The Swiss Franc has experienced further depreciation against both the Euro and the US Dollar. After the SNB rate cut, the depreciation has gained some momentum

The Euro has continued depreciated against the USD, influenced by better economic data in the US..

The USD, measured by the DXY, was range bound within a narrow trading range.

Equities

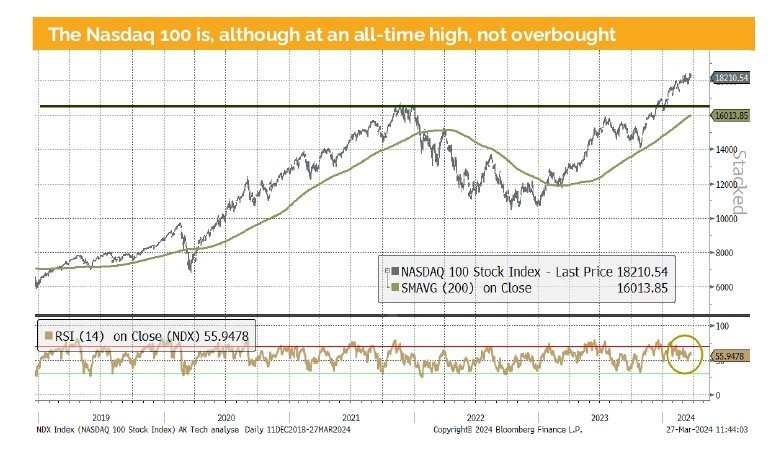

The S&P 500 consolidated for two weeks in March, followed by the biggest one-week gain in 2024 after the Fed press conference. Surprisingly, from a purely technical standpoint, both the Nasdaq 100 and the S&P 500 are not overbought.

Sentiment indicators such as the CNN “Fear and Greed Index” continue to show greed. Similarly, the GS market indicator. Although such red flashing indicators are present, markets can continue to climb the wall of worry. FOMO and ‘buy the dip’ are back on the agenda. Therefore, we expect that any market pullback will be used to chase the rally.

Fixed Income

Treasury yields were rising before the FOMC meeting. However, since then, we have observed a downward shift in Treasury bond yields, further exacerbating the already inverted yield curve. Due to Covid-19 measures such as fiscal stimulus and helicopter money, the traditional signal that the yield curve normally sends is not functioning as expected. Consequently, we do not foresee a US recession nor a normalization of the yield curve anytime soon.

US and European high-yield spreads have continued to tighten over the last weeks. Additionally, the expected pickup in default ratios has not occurred. In the corporate bond sector in both regions (US and Europe), we cannot observe any stress and therefore do not perceive a high risk of recession. This comes as a slight surprise, particularly for Europe, but it aligns with our constructive macro outlook for both areas.

Alternative Investments

Since our last publication, gold has risen from around USD 2000 to touch below USD 2100. We still expect that the gold price will continue to rise due to anticipated rate cuts, but the upside might be limited from the current level

The price of copper continues to exhibit volatility but has broken above the old trading range of USD 8,000 to USD 8,600. After a spike above USD 9,100, we are currently testing the support above USD 8,600. Copper should benefit from the expected global growth pickup

Both oil futures prices trade around USD 5 per barrel higher than one month ago. There was no particular news behind this upward shift apart from the improving global growth outlook.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein. Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document. Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate