Market Watch August 2023

US GDP surprisingly grew at a rate of 2.4

The latest GDP data for the US surprised with a growth rate of 2.4%, prompting optimistic remarks from Fed chair Powell about the economy’s resilience and the potential to avoid a recession. However, he also mentioned that depending on the data post a pause in September, additional rate hikes cannot be ruled out.

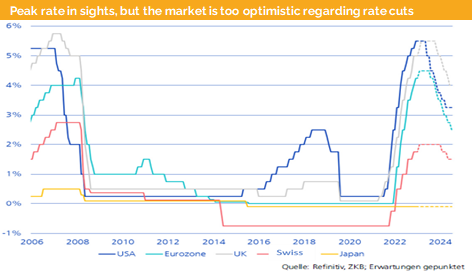

Nevertheless, the market seems to be overly optimistic, already pricing in more than a 200 basis points rate cut during 2024, which appears excessive.

The rate outlook for the Eurozone suggests one more hike followed by a 150 basis points cut during 2024. However, such a significant cut may not be advisable considering the expected weak economic development.

We find the policy rate outlook for the UK and Switzerland to be more realistic, as both countries anticipate fewer rate cuts. In the UK, this is due to the expected sticky inflation, while in Switzerland, it is attributed to the country’s resilient economic development.

Despite a surprising announcement from the Bank of Japan to loosen its yield curve control, the rate outlook in Japan remains unchanged. However, this decision prompted higher yields for the 10-year Japanese government bond and also let US 10-year yield rise by 20 basis points.

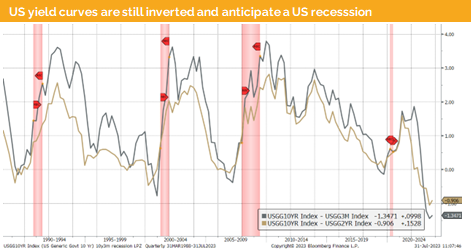

Despite the Fed’s announcement that there might be no US recession, the US yield curve remained inverted. Historical data depicted in the graph shows that such steep yield curves were always followed by a recession.

On the other hand, equity markets have already factored in next year’s monetary stimulus through anticipated rate cuts. This viewpoint is partly supported by the US conference board leading indicator and the industrial PMIs.

As a result of these developments, we observed a further weakening of the dollar against the Euro, indicating that FX markets, like the equity market, are betting on a faster and stronger rate cut cycle in the US compared to the Eurozone.

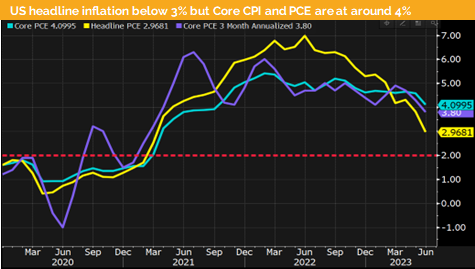

Across the US, Eurozone, UK, and Switzerland, the 10-year government bond yields are not only lower than the 2-year or policy rate but also lower than the headline inflation. Consequently, we see limited opportunities for these 10-year yields to drop significantly over the next 18 months.

However, it is important to stress that core inflation remains above headline inflation, and we do not anticipate these core measures reaching the 2% target of the Fed or the ECB anytime soon. This implies that the expected rate cuts discussed at the beginning of this text will not be as substantial as markets currently anticipate.

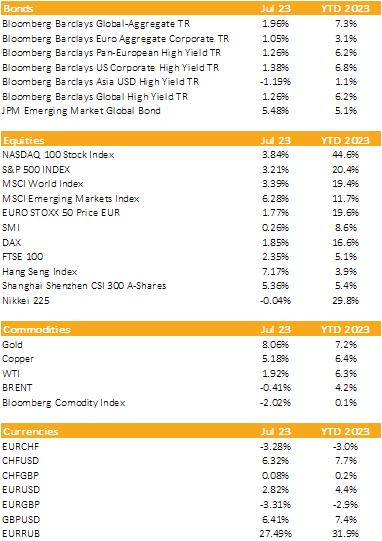

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

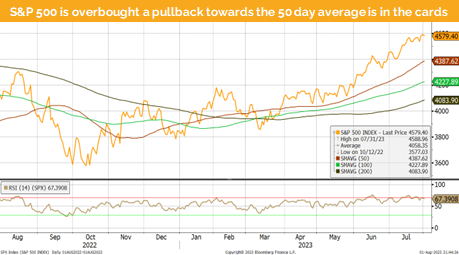

Investment Outlook: A pullback in US equity is overdue but the rally broadened and might last

Liquidity

The CHF has continued to appreciate against the EUR and then USD due to lower inflation and the less hawkish rate outlook form the Fed and ECB.

The EUR-to-dollar exchange rate remained mostly unchanged over the month, but during the first half, the Euro appreciated before facing a depreciation following the ECB’s announcement of a potential pause at the next meeting in September.

The USD, as measured by the DXY, fell below 100 initially, but after the Fed press conference and the announcement of a potential absence of recession in the US, we witnessed higher prices.

Equities

The S&P 500 is currently trading less than 80 points below its all-time high reached in January 2022. Despite being overbought, the market is fueled by better-than-expected earnings and a broadening rally, suggesting a potential test of the previous record level soon. We anticipate the market to rise further until year-end, but a pullback in the meantime wouldn’t be surprising.

Japan continues to surprise with its ongoing rise. Supported by robust economic data and a weaker yen, the market may continue to climb further.

Europe experienced consolidation, but towards the end of the month, most markets started rising in sync with the US markets.

Fixed Income

During July, both the ECB and the Fed increased their policy rates by another 25 basis points. Despite higher inflation in Europe compared to the US and facing a high recession risk, the ECB surprisingly announced that they might pause in September.

The Fed is in a relatively stronger position in the US. They, too, announced the likelihood of a pause in September, but it was their statement about the possibility of no severe recession that pleasantly surprised the markets.

In both regions, the yield curves are inverted, but there’s a chance that the bond markets in the US might be wrong in predicting an anticipated recession, and the positive stance from the equity side could prove to be accurate. However, it is still too early to make such a definitive assertion.

Alternative Investments

The price of gold has now surpassed $1900 per ounce. Following the Federal Reserve’s decision to raise its policy rate by 25 basis points, we witnessed some fluctuations in the market, leading to higher gold prices. However, the Federal Reserve has also signaled its intention to likely pause any further rate increases in September which might nudge gold further up.

Copper price remains volatile, ranging from 8200 to 8900 USD. In July, it surged over 10% due to anticipated economic recovery and rate cuts in H1 2024, now reaching the upper end of the trading range.

In July, both oil futures prices surged over 15% due to supply cuts and the anticipated economic recovery in the next 12 months. The deliberate reduction in supply by OPEC+ leads us to expect a gradual increase in oil prices in the upcoming weeks.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate