Market Watch December 2022

Outlook 2023: Central banks might reach their terminal rate in H1, but no cuts are in sight

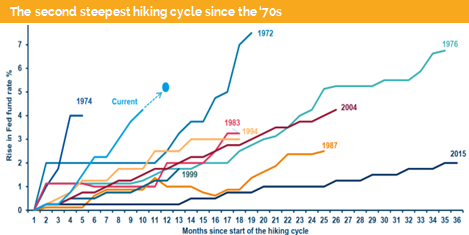

The latest rate-policy-outlook from the Fed, the SNB and the BOE were all saying we keep rising and in inflation will be sticky. But the hawkish surprise was the ECB. Finally, they admitted the obvious. Not only will inflation stay at a high level, but also, they will raise rates much more than previously guided, i.e., to 3.5% or 1.5% higher the current level is now forecasted.

For the US and Switzerland, we expect a significant slowdown but only a mild if any recession at all. But for the UK the recession is a given and in Europe it looked before the last PMI and IFO data like that too. Meanwhile the PMI data might have found a bottom and the IFO is surprisingly strong. Therefore, it is possible that the Eurozone recession might be just a mild one.

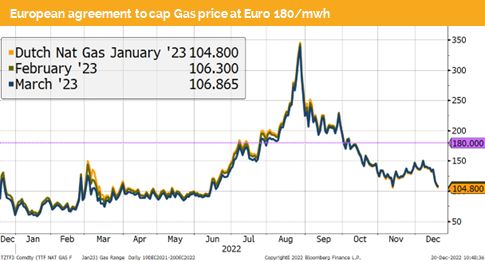

On the positive side the German Chancellor Schulz has just inaugurated a new LNG-terminal in Wilhelmshaven. Germany’s dependency from Russian gas imports have reached an unexpected low level, which supports the case for a positive business outlook. Due to the substitute of Russian gas the market gas price in Europe has fallen to below 110 EUR/mwh, which is significantly lower than 350 EUR/mwh price at the end of this summer.

European nations have agreed on a so-called gas market correction mechanism. A “deal to cap natural gas prices at €180, ending months of political wrangling over whether to intervene in an energy crisis that has risked pushing the region into a recession.” The cap price is significantly lower than an earlier proposal by the European Commission, which stood at EUR 270/mwh.

The impact on economy and inflation is uncertain, but we expect that more OTC trades will be conducted in case the market price rises above EUR 180/mwh.

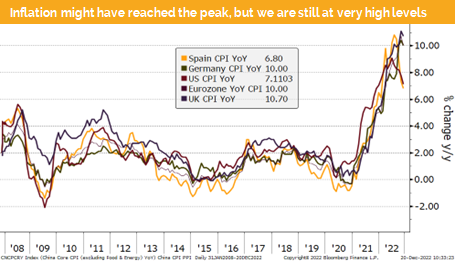

Turning to inflation we do see that in most regions we might have seen the peak and a disinflation process has started. But the levels are still far too high. For instance, we still have CPI above 10% in Europe and in the UK.

Inflation is sticky as around 50% of the increase is structural due disrupted delivery chains, de-globalisation and the impact of the conflict in Ukraine.

Meanwhile government bond yields stay at moderate levels. In most countries we do see inverted yield curves where the 2-year yield is higher than the 10-year government bond yield.

During 2023 we expect that markets will look through the recession phase and an economic recovery might start in H2 2023.

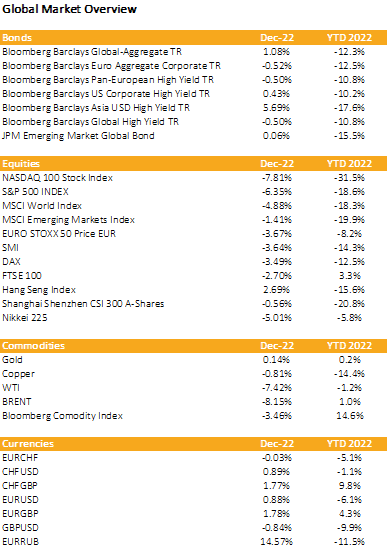

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: After the latest central bank rate outlook equity markets decrease

Liquidity

The CHF has continued to depreciate against the EUR and then USD. This process is well supported by the Swiss National Bankrate policy outlook.

The EUR continues to strengthen supported by the latest ECB hawkish policy stance.

The USD measured by the DXY continues to decrease. Since the fed has slow downed its rate hiking speed, we see a regime change where the dollar can further weaken.

Equities

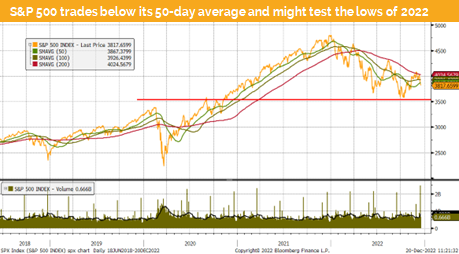

The S&P 500 has twice touched its 200-day average but did not as expect overcome that threshold. We have probably started the next downturn. Morgan Stanley even claims we will go straight down towards 3000-3200 over the coming 3 months.

Fundamentally, that is justified as we would reach a PE ratio of around 14x which is a reasonable level for a mild US recession. However, depending on data and market sentiment we can see a rally starting from around 3400 or an overshooting to the downside. Either way we must expect more downside for equities over the coming weeks.

Fixed Income

US treasury yields have after the fed rate outlook risen from below 3.45% to around 3.7%, which means we are unchanged compared to one month ago. Remarkable however is that futures price have fallen further, and market participants do expect slightly lower yields during 2023.

Fed chair Powell has informed that they do no plan to cut policy rates during 2023 and that the terminal rate will be above 5%. Which is basically what the New York fed chief John Williams, has announced one moth ago or what we have at the same time written. Remarkable is that also the fed fund futures rate have after the fed announcement slightly fallen and stayed below 5%. Both future markets seem still not to believe what the fed keeps telling us since the late summer. The policy will have a significantly negative impact on the job market and the US economy, but this message so far has not been fully priced in.

Alternative Investments

The gold price has established itself above 1800 USD/ounce. We have seen some volatility after the fed has made it clear that they see the terminal rate above 5% and they will keep rates stable at that level for a very long time. Supportive are the weaker dollar and the ECB outlook for inflation, which implies that it will take up until 2025 to reach the ECB inflation target of around 2%.

The copper price fluctuates between 8200 to 8600 USD. We haven’t seen any major pullbacks as copper is a scarce good and we do know about the significant shortage of supply for implementation of the green revolution.

Both oil futures prices have seen a further decline until the 12 of December followed by a more than 5% gain after China has announced the end of the zero-tolerance policy. The WTI discount to brent narrows and is now the smallest since mid-June. For 2023 we might see a significant increase of China’s oil demand due the positive impact on growth after the end of the zero COVID tolerance policy.

Investments covered

ArcelorMittal S.A., 6.125%, 2025

UniCredit S.p.A., 7.83%, 2023

AT&T Inc.

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

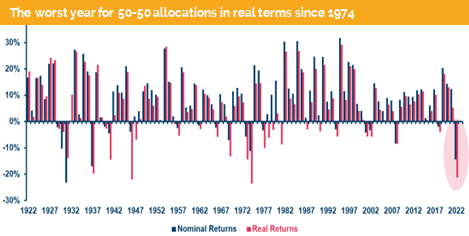

More Capital for The Energetic Refurbishment of Swiss Real Estate