Market Watch December 2023

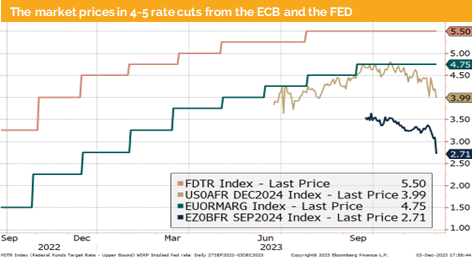

Headline inflation is falling faster than expected. Markets expect now at 4-5 rate cuts for 2024.

The Federal Reserve’s Beige Book indicates some softening in the US economy, prompting market participants to anticipate additional rate cuts by the Fed and ECB in 2024. Initially, 3-4 rate cuts were priced in, but there is now a shift towards expecting 4-5 rate cuts.

Fed Chair Powell addressed this in his latest speech, dismissing speculation about rate cuts in spring 2024 as premature. Furthermore, he reminded us that the fight against inflation is not won yet. Powell has emphasized several times in the past that the Fed will do everything in its power to avoid repeating the mistakes of the seventies, such as cutting rates too quickly and early. These mistakes led to a surge in Fed rates to around 20% and pushed the US economy into a deep recession.

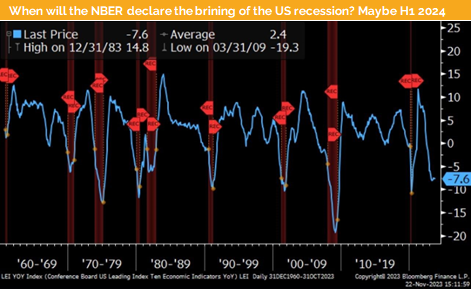

Annualized Q3 growth rate was increased from 5% to 5.2%. However, this news holds little significance for the markets. Examining the Conference Board’s Leading Economic Indicator (LEI), we observe a very low level that, historically, has always been accompanied by a recession. Our speculation is that the NBER might declare the beginning of the recession in H1 2024.

However, as the forecast for a US recession has been in place for months, we argue that in the event it is declared, markets won’t react negatively; instead, they may rally, as rate cuts are expected to stimulate the economy.

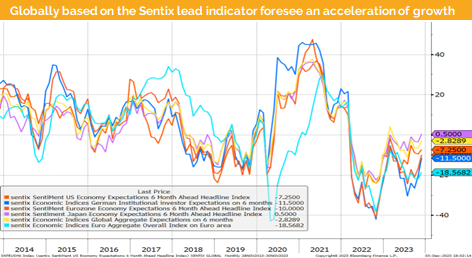

But we would like to draw your attention to the Sentix lead indicator, which has consistently risen across the globe. While it is still below or at zero from a strategist’s standpoint, the positive direction and its change are noteworthy. This is a bullish sign for both bond and equity markets. Even from an economist’s perspective suggesting the economy is not yet growing, one could argue that the rate of decrease has decelerated.

We, therefore, continue to foresee decent growth for the US and the global economy during 2024. Needless to say, the news flow may remain negative for a while, but that could be positive news for bonds, equities, and especially for potential rate cuts.

But let us add that we continue to anticipate a maximum of 2 cuts in the US and in the Eurozone, and perhaps only one cut from the Swiss National Bank due to the strong CHF and the low inflation rate in Switzerland.

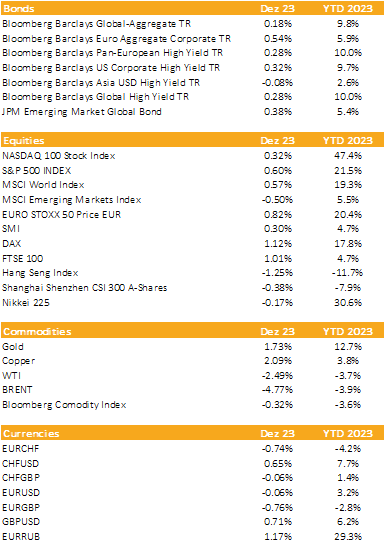

Markets in 2023: Currencies, Commodities, Equity & Bond Indices.

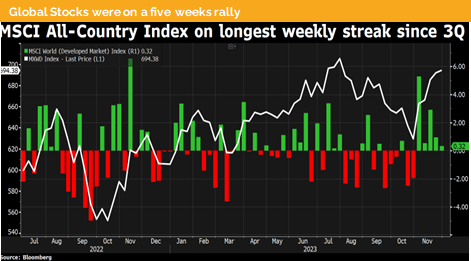

The Santa Claus rally arrived in November, accompanied by a surge in gold.

Liquidity

The Swiss Franc appreciated against both the Euro and the US Dollar. Main drivers were the rising expectations of faster and more rate cuts by the Fed and ECB.

The Euro appreciated for most of the last month and is currently consolidating after the sharp surge.

The USD, measured by the DXY, has depreciated and is trapped in a downward trading channel, suggesting the possibility of further weakness.

Equities

The S&P 500 continues to adhere to a seasonal pattern. October proved tricky and worse than expected, only to be followed by a very strong rally in November. If this trend persists, we might witness a positive December followed by a favorable January. However, it is impossible to foresee monthly movements definitively. From a fundamental standpoint, it is worth noting that the outlook for corporate earnings has not worsened in the US; more than a 10% EPS growth is still anticipated. Surprisingly, for Europe, around 7% growth is also expected.

We continue to believe that this relief rally could extend into Q1 2024. However, as valuations are high in some markets, there will be limits to the upward movement. We expect the US, driven by the technology stock rise, to lead. If the business cycle improves, small and mid-caps may catch up. Therefore, we foresee the potential for positive returns in 2024, and bonds might perform well, possibly supported by slightly falling bond yields.

Fixed Income

The US 10-year government bond yield has experienced a decline of more than 60 basis points in the last few weeks. Markets are anticipating rate cuts at the short end of the yield curve. However, due to this decrease, the curve has further inverted. We believe that markets may have overshot, and we would expect some mean-reverting behavior over the coming weeks.

Corporate bond spreads in global bond indices have decreased in tandem with the falling government bond yields. Consequently, both segments of the bond markets experienced a strong rally during November.

Alternative Investments

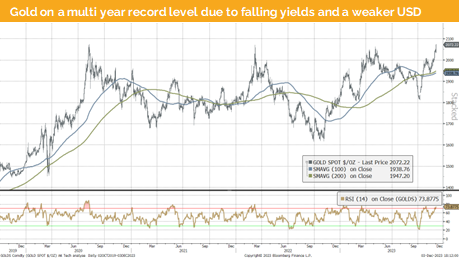

The price of gold has, at last, exceeded the record closing price set earlier this year and temporarily reached a new all-time high. The primary factors propelling this long-anticipated surge in gold include speculation about 4-5 rate cuts by the Fed and ECB. This speculation has resulted in a notable and sudden decrease in government bond yields, along with a depreciation of the US dollar.

The price of copper continues to exhibit volatility, still staying within the trading range of USD 8000 to USD 8600. In contrast to October, we are now at the upper end and might have even broken out. Notably, the surge from below 8000 USD per ton to above 8600 over the last 3 months could signify, akin to the Senitx indicators, that an economic recovery in 2024 is imminent.

Both oil futures prices have been range-bound and are slightly lower than they were one month ago. Surprisingly, the cut in oil production has had no significant impact; on the contrary, the dispute within the OPEC was interpreted as a signal that oil supply will remain plentiful.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate