Market Watch. February 2020 I

Russia’s fiscal fundamentals are excellent / Update on Coronavirus

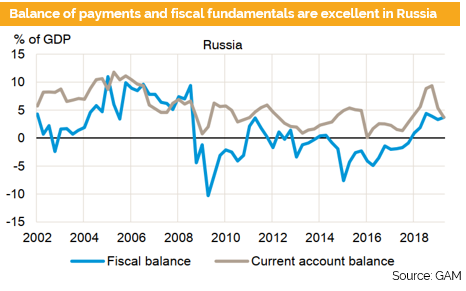

Based on Paul McNamara’s comments (leading expert for emerging market bonds) Russia is one of the few countries which has a surplus on both the current account and the budget at the same time.

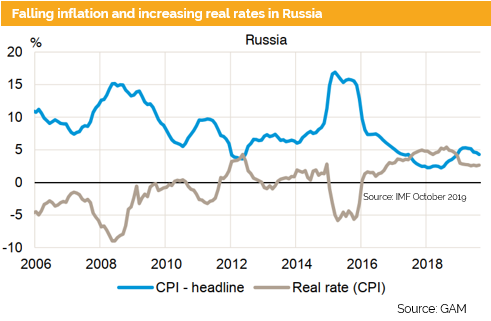

The Russian monetary policy has pushed inflation down while at the same time the real rates have risen. The real rates are now compared to other emerging market countries offering an attractive yield.

Due to a shrinking labor force and decreasing labor supply as a result, GAM (Global Asset Management) estimates that the potential GDP growth for Russia is reaching the zero level. Thus, equilibrium real rates could be far lower than the actual level. This holds true as well for the US. Based on that we can expect that official rates and government bond yields will stay at very low levels.

This offers attractive short-term opportunities for the Russian state and its state-owned companies to finance their investments at these low rates. On the other hand further capital gains are very likely for investors as well in 2020.

Fiscal stimulus acts as a part of Putin’s game plan to make the country more competitive.

Furthermore, state-owned companies were forced to increase their payout ratio. Latest figures show that the payout is around 50%. Experts say that the target for 2020 is set at 70%.

The dividend yield stands at 6.5% and might slightly increase. It is important to notice that this situation is reflected in corporates by high ratings and strong balance sheets. Unfortunately, this has pushed bond yields below 5%, but we consider such companies interesting to invest on both the corporate debt and equity sides.

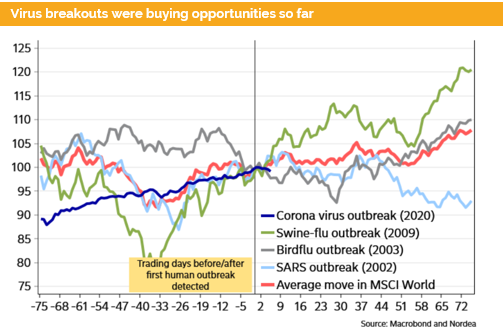

Since some weeks, the coronavirus dominates the news flow. What we know so far is that the number of infected people keeps rising and although each individual case is tragic, the number of people who died from it is still very small. Therefore the virus is comparable to a normal flue.

Nevertheless, this will be reflected in low growth in Asia in Q1. Still, market participants do not care. Equities have slightly sold off but are now almost back to where they have started.

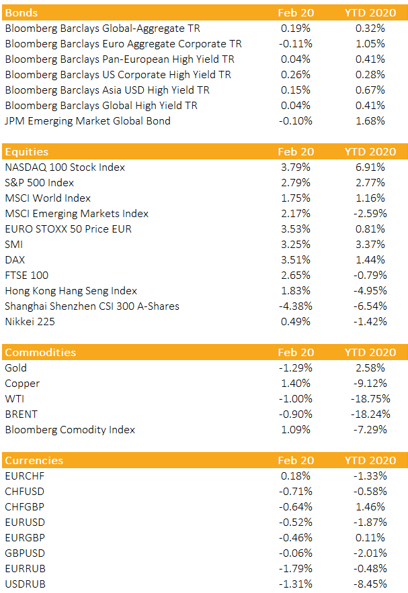

Corporate bonds held up well, except for oil and China related bonds. Indices are still showing mostly positive returns for 2020.

Currencies, Commodities, Equity & Bond Indices

Risky assets had a roller coaster ride due to the corona fear. Government bonds, however, rallied. The US yield curve was inverted again due to the flight into risk free assets.

Gold was a bad fear hedge. This came for most market participants as a surprise. Nevertheless, it took only a few hours until investment banks were publishing reports with explanations that such a behavior is normal during a global virus breakout.

Having said that, a virus breakout has been a buying opportunity in the past. Sor far, risky assets behave exactly this way. Since the beginning of February we have almost regained all the losses which occurred during the 2nd part of January. Some markets, such as Nasdaq 100, Dax or SMI are trading at all time highs.

Oil on the other hand lost sharply due to the temporary lack of Chinese demand and coronavirus is again to be blamed for this.

A V-Shape market correction?

Liquidity

The Swiss franc appreciated significantly due to the fear of the corona virus. The SNB has intervened to weaken the swiss franc.

The US dollar keeps appreciating. Meanwhile, its movement against JPY is interesting. First, we have seen as one must expect a sharp change in JPY to be followed by a surge.

Equities

Asian equities (especially Chinese) sold off sharply after some Chinese cities were put under quarantine. At the beginning of February experts announced that the virus is less damaging than previously feared. Starting from the US we have seen a V-shape market recovery after it.

A lot is still unclear, but the huge amount of money which was parked on the sideline is pouring into the market. The sell off was minor so far. For instance, the S&P 500 went down only to the 50-day average and has recovered since then all the losses and trades at new record levels.

The latest global PMI data confirms that an acceleration lies ahead of us, but the surveys were conducted before the coronavirus dominated the news flow. We must therefore expect more volatility in the coming months and probably another test of the 200-day average.

Fixed Income

Spreads have slightly widened over the last weeks. Corporates which are exposed to the negative effect of the still stand in China might offer interesting buying opportunities. For instance, oil related companies or airlines offer now attractive yields.

On the other hand we have seen a lot of new issues which were easily absorbed by the market. For instance, a Turkish bank was able to issue a 5-year bonds at a coupon more than 50 basis points below its first guidance. Couple of months ago such a company would not be able to afford such a behavior.

We keep our preferences for emerging market corporates but are surprised how little on average the market has sold off during the last weeks at the same time.

Alternative Investments

Gold: The gold price has not passed the resistance at USD 1’600 for an ounce. By the contrary, it sold off to around 1’550 during the corona crisis.

REITs: During the equity sell off we have seen REITs going up, Mainly driven by lower government bond yields. German residential real estate gets expensive. The new hot spot is UK REITs. We keep arguing that the prices are too depressed, and a recovery lies ahead of us.

Cooper and DRAM Prices: Dr. copper lost around 13% during 13 trading days in a row. Since equites rise, we will see a recovery as well. Nevertheless, DRAM (dynamic random access memory) prices serve as a leading indicator for some analysts. To our surprise the price was stable over the last two weeks and is still up more than 20% compared to its low in December 2019.

Investments covered:

Credit Bank of Moscow 4.7% 2025

Centrais Eletricas Brasileiras 3.625% 2025

Arconic Rolled Products Corporation 6.125% 2028

Microsoft Corporation

Disclaimer

These Bond Recommendations (hereafter «BR») are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate