Market Watch February 2024

Mixed economic signals but Sentix Indicators keep on rising

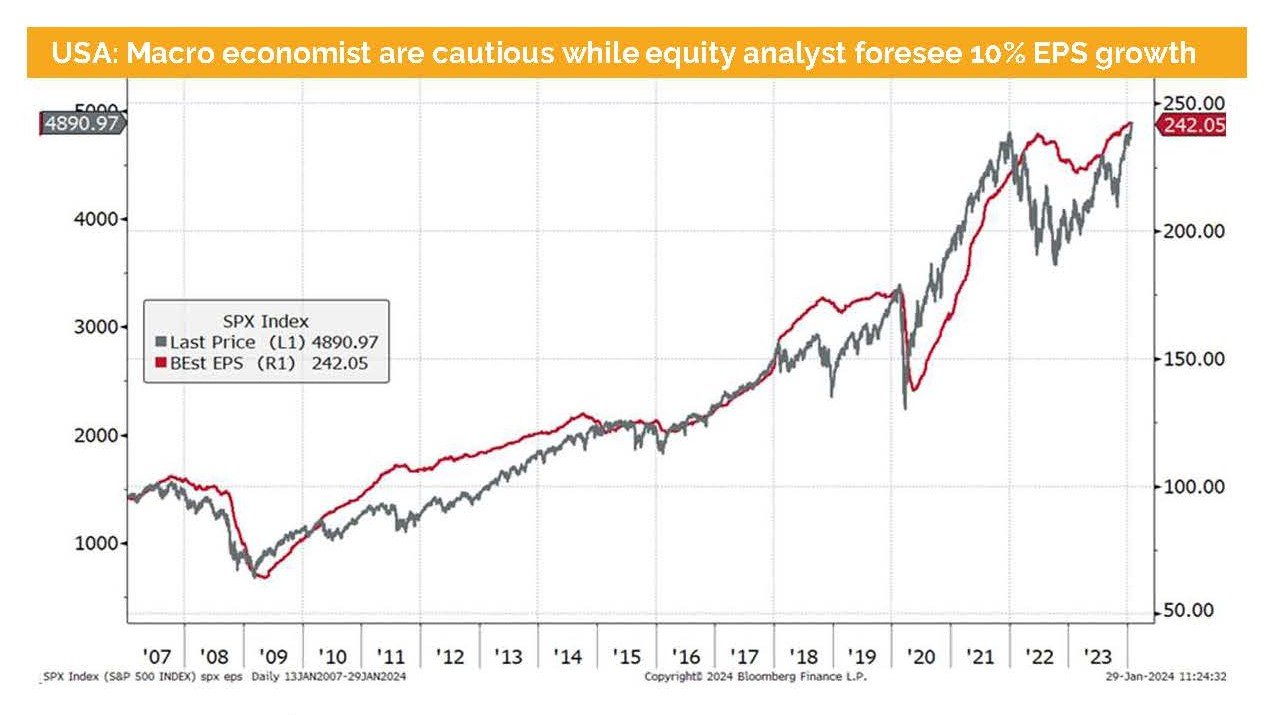

The macro outlook for the US appears bright if we base our analysis on the projected EPS growth of the largest US companies. However, it seems rather bleak when consulting most US macroeconomists. Additionally, the outlook appears somewhat mixed when considering leading indicators.

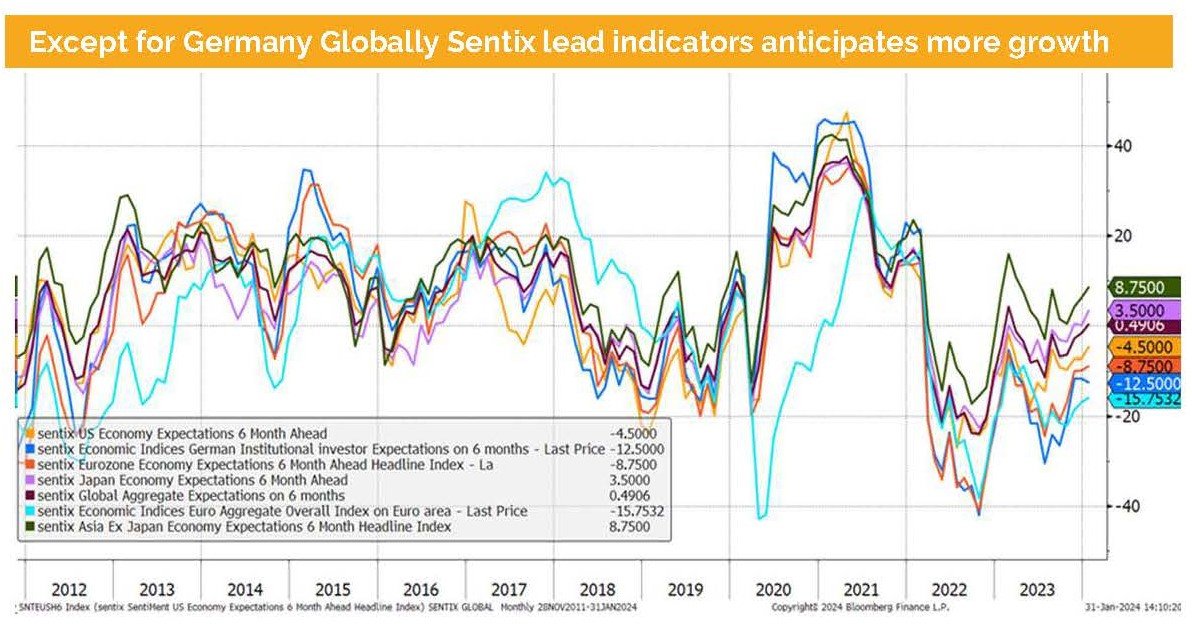

Sentix and PMI data continue to depict an improving picture for almost the entire world, with the exception of the German economy. However, in almost all cases, the PMI level is at or below the growth threshold. Our take is that the US might grow at around 2% and will especially see a faster pace during H2 2024.

If we examine the macro outlook from central banks, we observe on one hand the Fed painting a robust picture of the economy, while on the other hand, the ECB is grappling with the dilemma of sluggish growth for the entire Eurozone. However, upon closer examination of the details, we observe that the German economy continues to contract, while Spain and other countries in the south exhibit a resilient economy.

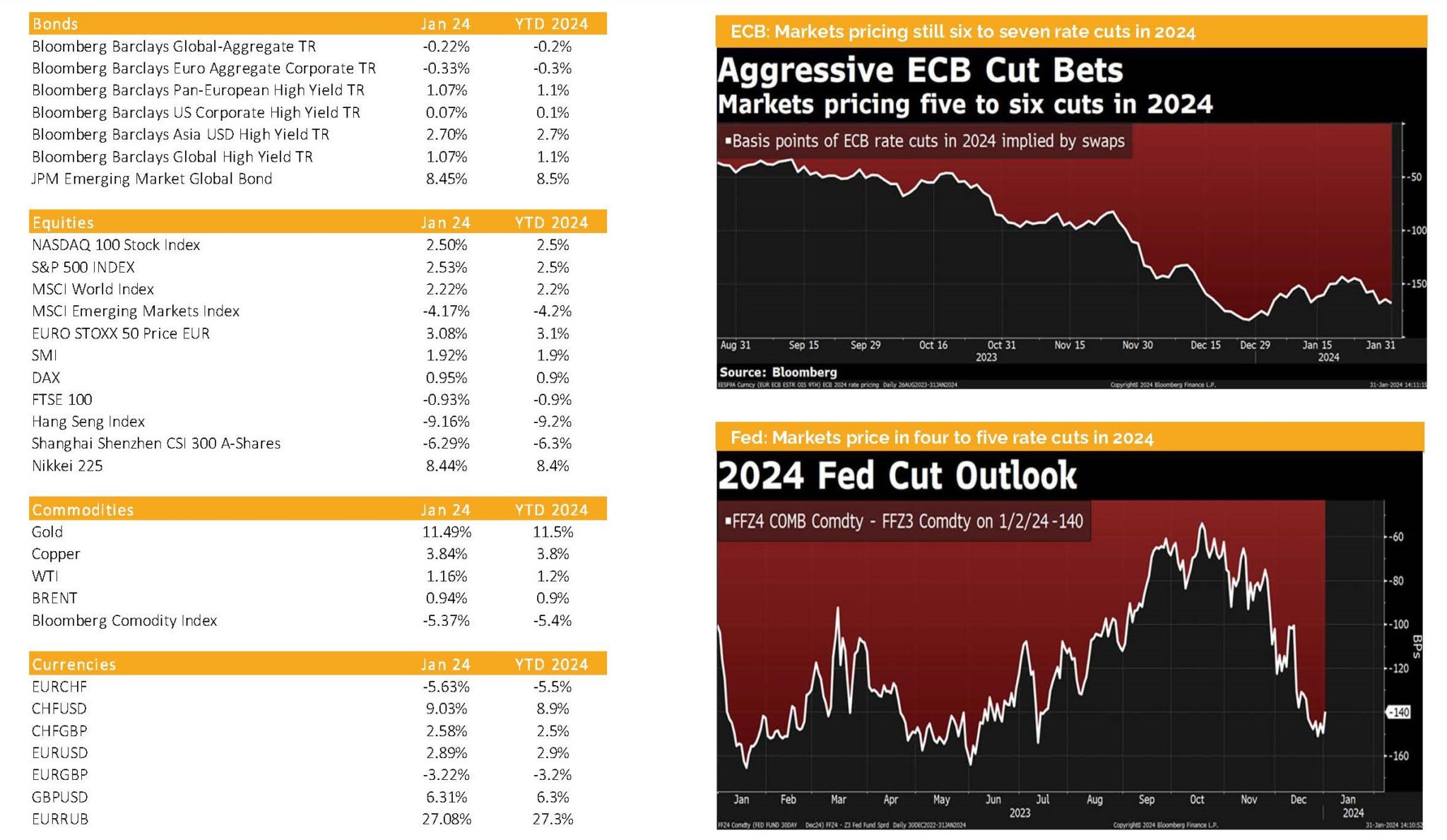

It is therefore not a surprise that we continue to see a disconnection between the announced rate cut cycle and what market participants keep pricing in.

We still believe that the Fed will exercise patience in cutting its rate, but they might make an early start in spring and thereafter maintain an accommodative stance, as the US election in November should not be significantly influenced by Fed policy. Consequently, we anticipate 3-4 rate cuts until the end of 2024, rather than the four to six as indicated by future markets.

When it comes to the ECB, we observe that Mrs. Lagarde and her chief economist communicate different timelines. Our perspective is that in the summer, the ECB might start cutting rates, but they will definitely not cut six to seven times, as market participants currently expect.

In China, we face the opposite problem, as their central bank continues to cut rates to boost the economy. However, there has been no positive effect on the economy so far. This should not come as a big surprise, as China is in the midst of a balance sheet recession. The only remedy that can solve this issue would be a smart approach to fiscal stimulus. However, if history repeats itself, it is a matter of time until this next step (a kind of fiscal stimulus) might happen, as it did in the past.

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

The 3-month rally might be followed by a minor pullback in February

Liquidity

The Swiss Franc has experienced a slight depreciation against both the Euro and the US Dollar. The somewhat hawkish tone adopted by the ECB and the Fed has provided support to both currencies.

The Euro has depreciated against the USD, influenced by better economic data in the US and mixed signals from ECB representatives.

The USD, measured by the DXY, has further appreciated but remains confined within its trading channel, albeit on the upper end.

Equities

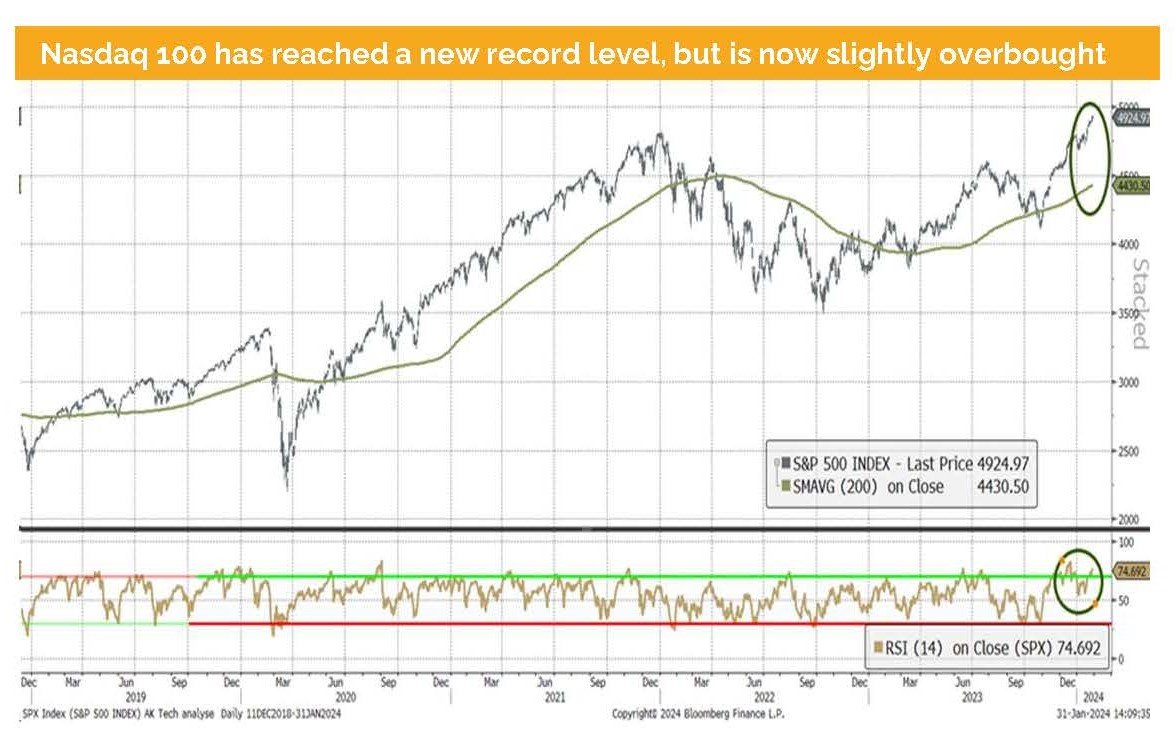

The S&P 500 has continued its rally in January, which began at the start of November 2023. The US earnings season is so far solid, but with a beat ratio below 70%, it was somewhat on the weak side. We anticipate that seasonality might continue to play out, translating into a minor pullback in February to digest the recent surge. However, we still expect US markets to end 2024 at a higher level compared to our current trading position.

Looking forward, we expect Europe to underperform the US as the earnings outlook has weakened. However, we still see an EPS growth rate of around 3- 5%. In comparison to the US, where 10% is expected, we anticipate that Europe will not replicate its strong performance from 2023.

Chinese equities are currently extremely cheap. However, until we witness a fiscal stimulus package, we remain cautious and would not increase our current allocation.

Fixed Income

The US 10-year government bond yield has remained above 4%, while the expectations of Fed rate cuts stand at roughly 140 basis points. We continue to believe that the Fed will cut less, but at the same time, we indicate that if we are correct, the yield curve would normalize by witnessing falling yields up to 5 years and a slight increase in bond yields at the longer end of the curve. This reflects our positive outlook for the US economy on one hand but also signals our expectation that US GDP will grow below its potential of around 2%.

Alternative Investments

As of this writing, gold has established itself above the USD 2000 threshold. We expect that the gold price will continue to rise due to the anticipated rate cuts by the Fed and other major central banks.

The price of copper continues to exhibit volatility, remaining within the trading range of USD 8,000 to USD 8,600. We are, like one month ago, back at the upper end of this trading range. Dr. Copper somehow reflects the mixed signals we are getting from global leading indicators.

Both oil futures prices have risen by around 5% since the beginning of 2024, with no significant new information. The main drivers were the additional demand during the current heating season in the northern hemisphere and the ongoing dispute within OPEC.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein. Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document. Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate