Market Watch. January 2020 I

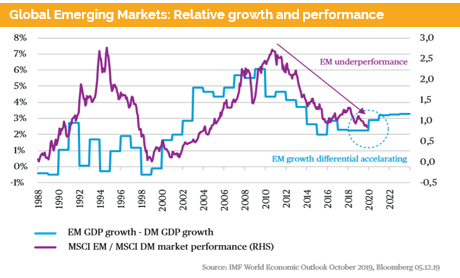

Emerging Markets growth will outpace Developed Markets

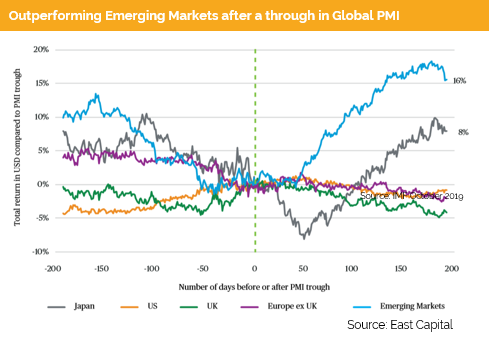

PMI’s continue to improve. We expect a modest growth acceleration supported by accommodative central bank policy. In such environment, emerging markets are expected to outpace the developed world in various aspects.

The growth differential between the developed world and emerging markets will get wider. The USD is expected to weaken against most emerging markets’ currencies.

After a through in global PMIs emerging market equites are expected to outperform. Therefore corporates of such countries are expected to perform well. We expect no significant changes in corporate spreads. Therefore, we expect only little additional return form spread movements.

The latest industrial production figures from China have shown that the export activity has unexpectedly improved in Q4 2019. The implemented fiscal stimulus combined with the loose monetary policy seem to work well.

In Germany, the latest indicators point to an acceleration of activity in Q4. The German export-oriented industry will profit from the faster growth in emerging markets.

The phase one trade deal was singed, and Mr. Trump could sell this mini deal as a great success. Supported by positive macro data, US financial assets have rallied. We would argue that after zero corporate earnings growth in 2019 and an expected 7-10% growth in 2020 the US corporate bond markets and US equity markets have rallied too far in a too short period of time, i.e. they are disconnected from the underlying growth trend and both markets are therefore very expensive.

In Q4 in the UK the economy came to a stand still. Due to BREXIT new investments are postponed. So far there is no majority for a next rate cut at BOE, but we expect that this will change over the upcoming months.

Italy, Spain and France are all having growth problems.

However, the latest economic surprise indicators show improvements for the US, emerging markets and, surprisingly, the Eurozone.

The ECB is facing a challenge – Germany won’t need monetary stimulus, while France, Italy and Spain would need not only monetary, but also fiscal stimuli. In Spain however, the new government is raising taxes, while Italy and France simply do not have enough growth for fiscal spending without breaching the Maastricht criteria (compulsory requirement for Eurozone).

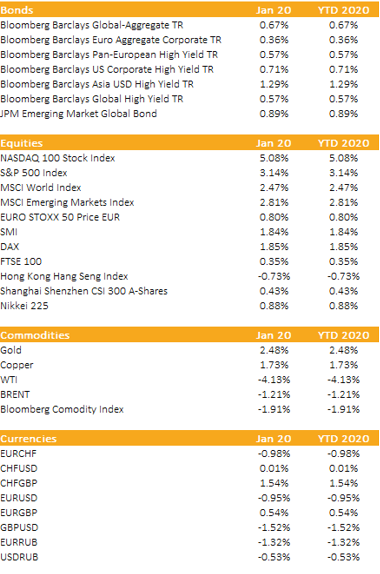

Currencies, Commodities, Equity & Bond Indices

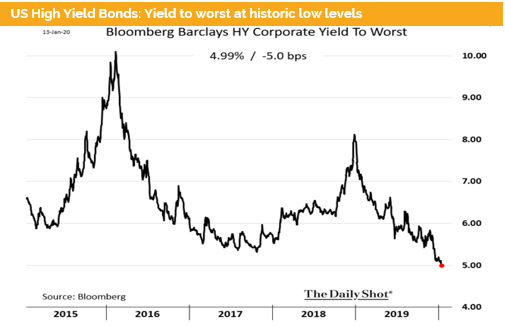

Risky assets have rallied over the last weeks. US high yield bonds have reached extremely low yield levels. Yield to worst of 5% does not seem very attractive.

Corporates from emerging markets have on average a better rating than US high yield bonds and their yield level is around 1-2% higher, while their risk is similar.

Equities have strongly risen in the US. We have seen the three major indices closing several times in a row at new record levels. The indices trade at 10% above its 200-day average, this will sooner or later be corrected.

Meanwhile, gold is rising and looks very interesting from a technical standpoint. The fundamental drivers are the tensions in the middle east. If, as we expect, the loose monetary policy stance continues, the natural demand will stay in place.

Risk-on after Brexit and a Phase I Trade Deal

Liquidity

Currency manipulators: China is of the list while Switzerland is under surveillance. The Swiss frank has appreciated since this announcement. The EUR/CHF has reached levels which put pressure on Swiss exporters. The SNB might intervene, but that would then be the last ingredient for the US to brandmark Switzerland as a currency manipulator.

Based on Goldman’s outlook, the Euro is still an interesting funding currency for dollar investors. We keep having some demand for loans in Euros and using the proceeds to invest in USD dominated corporate bonds..

The US dollar is overvalued. Most strategist expect it to weaken, which is a supporting factor for our emerging market call.

Equities

Since our last pre-Christmas report, the “risk-on” mode is ongoing. The S&P 500 and the Nasdaq 100 have risen sharply and are now trading more than 10% above its 200-day average. The market has run ahead of its fundamentals. It is therefore a question of time until we should see a mild correction.

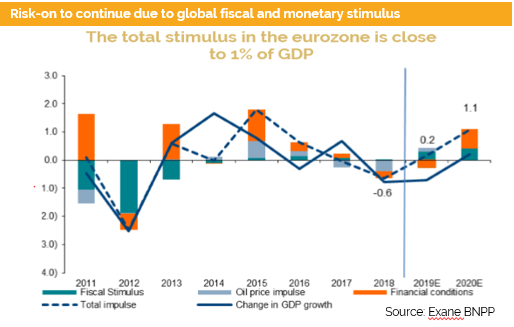

We prefer Emerging markets over US and would allocate less to the Eurozone. However, the latest estimates for fiscal and monetary stimulus in the Eurozone are indicating that around 1% of GDP will be added. In such conditions normally equites continue to rise.

Fixed Income

The above-mentioned stimulus might push yields further down and bonds cloud rally (partially through the ECB’s acquisition of bonds). The 10-year bund has a yield of -0,2% and the 10-year Greek government bond trades at a yield level of +1.4%. Both are by far too low, but this is deliberately driven by the monetary policy.

What holds true for emerging market equities is our base case for corporate non-investment grade bonds. We prefer Emma bonds over US high yields. European high yields, compared to US and Emma corporates, offer unattractive yields. Nevertheless, opportunities do show up from time to time.. For a 11.5 month maturing note we can achieve a 6% coupon in USD. The company has only one bond outstanding with a yield to maturity of 1.75% for 4 years in Euro. Therefore, such dislocations should be used to pick up yield.

Alternative Investments

Gold: The gold price has broken out of its sideways trading channel. The crisis in the middle east was the catalyst. Surprising fact is that both Gold and equities continue to rise although the geopolitical risks have increased.

REITs: German residential real estate offers an interesting opportunity, as over the last 5 years there were not enough flats built. The market has started to price this in, German and other European REITs have risen over the last weeks.

Copper: Dr. copper keeps creeping up. Recent PMI and other economic data confirm that there is a modest acceleration in industrial production. At the annual Goldman Sachs strategy conference, we were informed that the investment bank has changed its outlook for cooper to positive, which is in line with our expectations.

Investments covered:

HBIS Group 3.75% 2022

Future Retail Limited 5.6% 2025

Unifin Financiera 7% 2025

Activision Blizzard

Disclaimer

These Bond Recommendations (hereafter «BR») are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate