Market Watch July 2023

The Fed and ECB will raise rates at their next meeting while the economy cools down

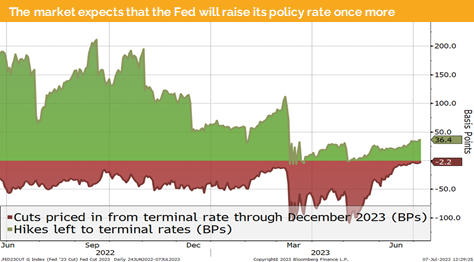

Central banks find themselves in a difficult situation where the economy is experiencing a slowdown, yet core inflation is not falling as much as anticipated. In the light of this, both the ECB and the Fed have declared during the central conference in Portugal that they will proceed with raising their policy rates at the upcoming meetings, despite the weakening state of the economy.

However, in the United States, the situation appears relatively better compared to the Eurozone. Inflation has decreased to 4%, and although the job market indicates signs of cooling down, it continues to grow sufficiently to suggest that the country might only experience a mild recession.

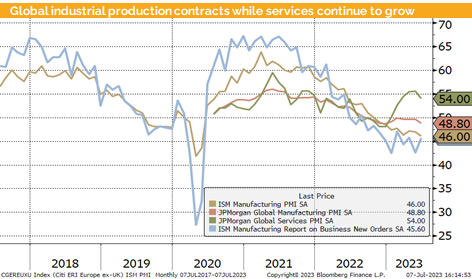

In Europe, inflation remains at a consistently high level, and the largest economy, Germany, is already experiencing a recession. However, the ECB has communicated its preference to continue its efforts to combat inflation, even if it means pushing the economy further into a recession. Despite this, the recent PMI data in Europe was exceptionally weak. As a result, we still anticipate that the ECB will take steps to stimulate the economy over the next 12 months, even if inflation does not reach the 2% target.

Due to Germany’s strong reliance on global industrial production, the pressure from workers to safeguard their jobs is expected to increase significantly and nudge the ECB to cut rates.

At first glance, the situation in the US may appear similar to Europe. However, upon closer examination, when we consider details such as the new orders sub-index, we believe that the lowest point of this slowdown may be already behind us. This is evident as the index has experienced a consecutive increase for the second time.

In contrast to Europe, the US is also benefiting from a robust and continuously expanding service sector.

This puts the Federal Reserve in a favorable position to consider cutting rates more decisively and from a higher level during 2024. In hindsight, this helps to explain why US equity markets have continued to rise while yields on longer-maturity bonds have recently also experienced a significant rally.

On the other hand, Europe is also confronting a slowdown in the service sector, which further complicates the situation for the ECB. As a result, our expectation is that inflation in 2024 and 2025 will not reach the ECB’s or Fed’s 2% target. However, both central banks might still consider cutting rates, even if their inflation targets have not been met.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate