Market Watch March 2024

More positive global economic signals

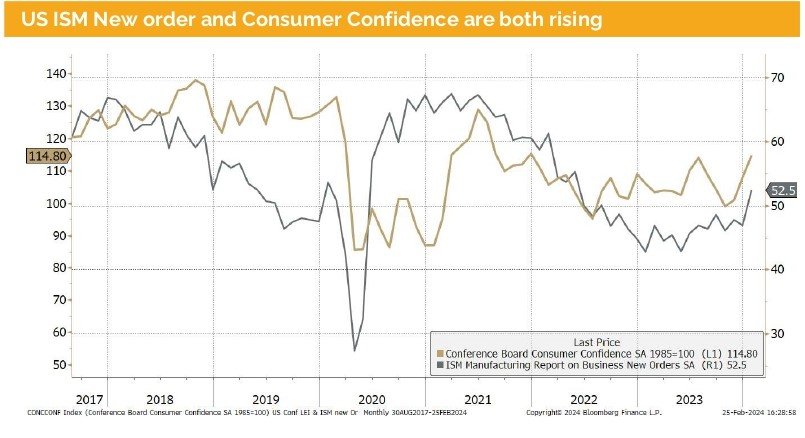

The macro outlook for the US has improved further based on ISM new order data and consumer confidence indicators. Additionally, the flash PMI shows more signs that the economy is accelerating.

The Fed has reacted to this situation and indicated that they most likely will not cut rates in March or May. Even a cut in June is not a done deal. The latest data on US job inflation was not as expected, decreasing rather than increasing. There are still roughly 1.5 jobs open for each unemployed person. However, the qualifications of the unemployed do not often match the requirements. Therefore, the job market remains tight, and with the expected acceleration of the US economy, it might worsen.

Therefore, it’s little surprise that Larry Summers, former US Secretary of the Treasury, brought up the idea that the Fed might not need to cut rates but should rather consider one more hiking step.

If you agree with us that stock markets are leading indicators of the economy, or at least of the expected EPS growth of listed companies, we must take notice that all three major US indices are at new record levels. Furthermore, domestically oriented mid-caps have started to outperform (international) large caps. This is just another sign that the US economy will not fall into a recession any time soon.

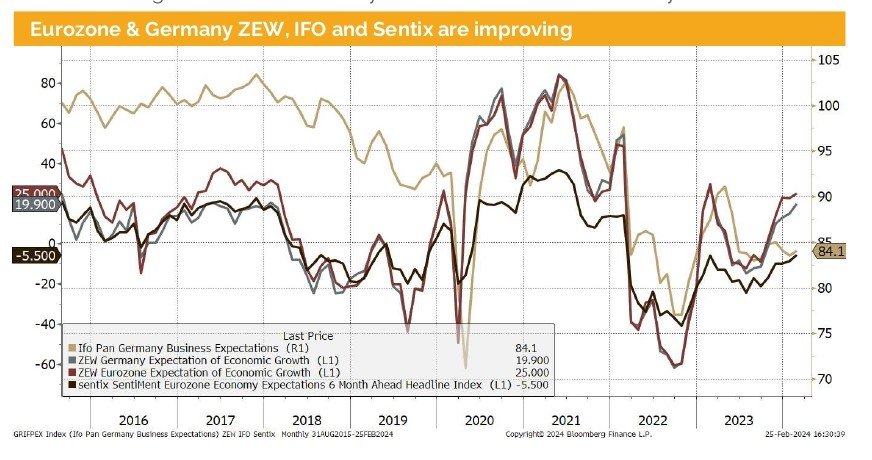

Surprisingly, the picture for Europe, excluding Germany, looks very similar. ZEW and Sentix leading indicators continue to rise. Meanwhile, the Stoxx Europe 600 has also reached a new record level.

The situation in Germany is more complex. The latest IFO and ZEW indicators, after a blip, have regained momentum. However, the industrial PMI has fallen to such a low level that we must conclude that the German economy continues to stagnate as a whole and is shrinking in the industrial area.

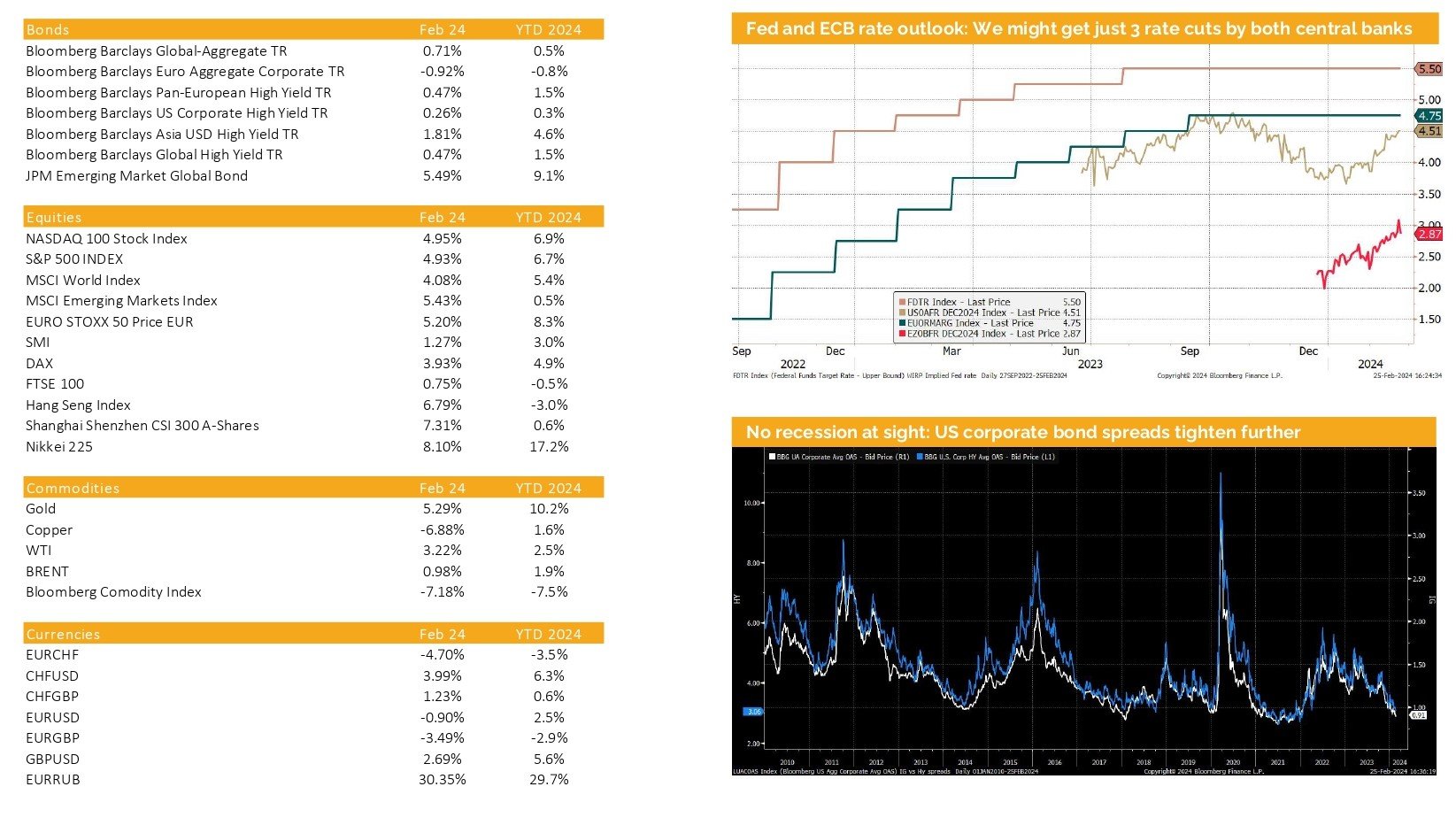

Meanwhile, the ECB has changed its narrative and is now indicating that they might only start cutting rates in the summer if the inflation data continues to decrease.

However, based on the latest PMI data, France and Spain are showing a resilient economy, which gives the ECB room to wait with their first rate cut. Especially as most of the problems in the largest economy (Germany) are domestically generated and may not be solved with monetary stimulus.

China, on the other hand, continues to stimulate with monetary measures, which we believe may not be effective as the economy faces a balance sheet problem. However, recent news indicates that they are addressing the credit problem in the real estate sector.

Markets in 2024: Currencies, Commodities, Equity & Bond Indices

The US market has reached new records and might further rise

Liquidity

The Swiss Franc has continued to depreciate against both the dollar and the Euro, largely influenced by the lower CPI. This situation provides the Swiss National Bank (SNB) with greater flexibility in adjusting their policy rate compared to the European Central Bank (ECB) and the Federal Reserve (Fed).

The Euro remained range-bound against the US dollar, while against the Swiss franc, we observed a continued trend of depreciation.

The USD, as measured by the DXY index, has traded within a narrow range.

Equities

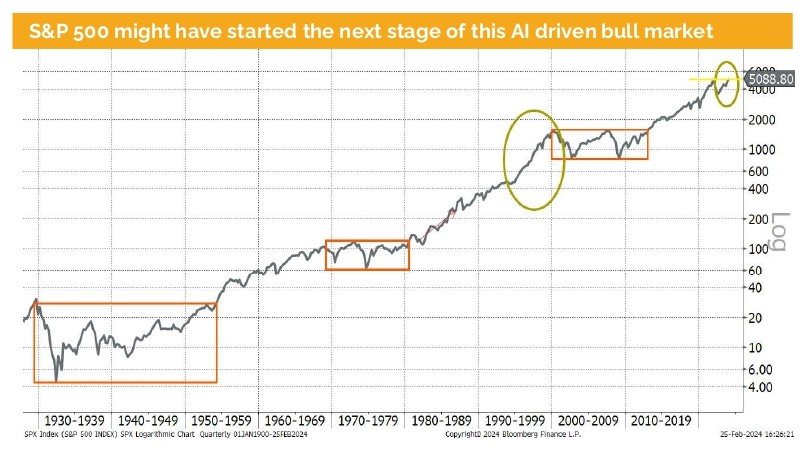

As of this writing, the S&P 500 has reached a new record closing for the 14th time. The earnings outlook for 2024 remains promising, with an expected EPS growth of over 9%. Estimates for 2025 have risen even higher, surpassing 13%. Therefore, we believe there is significant upside potential.

The crucial question, however, is whether we are merely in a Goldilocks environment or at the dawn of the new Roaring Twenties. The definitive answer will only be unveiled in the distant future. However, we believe that this AI-momentum rally has the potential to unfold similarly to the dot-com rally. Therefore, we restate our belief that the secular equity bull market is alive, and we anticipate that, after some turbulence, the market will be at a higher level at the end of 2024 compared to its current trading level.

Another noteworthy aspect is that not only have the three major US indices reached new records, but also the Stoxx Europe 600, the Dax, and the Nikkei. Apart from Japan, this remarkable rise has largely gone unnoticed by mainstream media. Until the taxi driver—or in older times, the shoe-shining boy—begins to offer investment advice, I believe we are still far from experiencing euphoria or a bubble, if you will.

Fixed Income

The US corporate spreads for investment-grade and high-yield bonds compared to government bonds have further narrowed. The corporate bond sector does not anticipate a US recession. It has been our opinion for months, but it has now become consensus, that the Fed will likely cut rates three times this year. The controversial view is that, due to a strong economy, especially in the US labor market, the Fed might instead opt for an additional rate hiking step. We do not believe that, but we acknowledge the fact that the economy is very resilient.

Alternative Investments

In February, gold tested its USD 2000 resistance level, influenced by a strengthening US dollar and market adjustments regarding the Fed’s expected rate cuts, which are now anticipated to be fewer than initially priced in January. However, as of this writing, gold is trading around USD 2030 USD per ounce. It appears that the gold market is adjusting well to this new rate outlook

The price of copper has once again been trading within a narrow range since our last publication. While it still displays volatility, it has remained within the trading range of USD 8,000 to USD 8,600.

Both oil futures prices have been trading within a narrow range over the last month. With no significant news flow and the end of the heating season following a very mild winter in the northern hemisphere, market movements have been relatively subdued.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein. Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document. Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate