Market Watch. November 2019 I

Market Watch. November 2019 (I)

Brazil and the US are growing at a moderate pace…

The FED cut rates by a quarter point for the third time this year and indicated a pause for further cuts as long as the economy is growing at a moderate pace and inflation stays around current levels.

Hours before the rate announcement US Q3 GDP was announced. The economy grew at 1.9% almost at the Fed target of 2%. The main driver was consumer spending.

The latest US PMI and the US job report were in line with the Fed’s view, namely that the US growth is slightly picking up, the job market stays tight but there is no wage inflation.

Worldwide we have seen rate cuts and consequently rising bond and equity markets. Meanwhile, real economic data came in weaker. The latest news was that Hong Kong is in a technical recession. This comes with no surprise after the continuous phase of protests and long lasting political instability.

The key question is if the steepening of the US yield curve and the modest global rise in yields indicates that the slowdown is behind us.

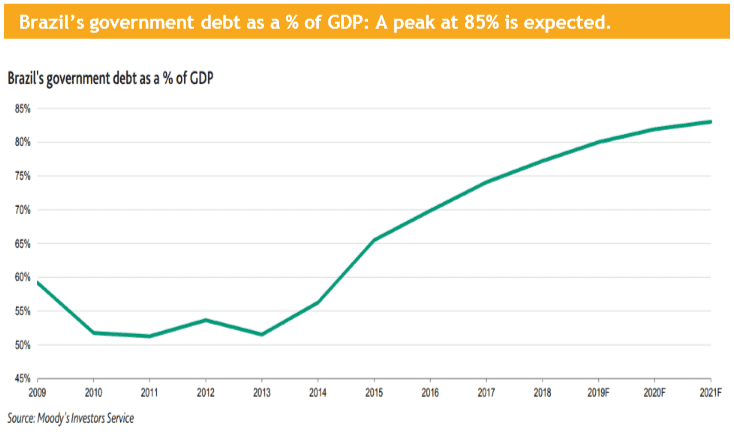

In Brazil the pension fund reform has passed the parliament and the subsequent law should be signed in the next weeks. This will significantly reduce government spending. However, market participants do expect more budget saving steps. This is as well reflected in the debt to GDP ratio which is stabilizing above 80%.

The Brazilian central bank (a.k.a. COPOM) is expected to cut rates by another 50 basis points. However, this is most likely already priced in as we have seen rising bond prices in the last weeks.

The consensus growth outlook for 2019 is slightly below 1%. More important an increase to 2% for 2020 is expected. This should support not only the bond market but also the equity market. So far the equity market has increased more than 22% while 10-year government bond gained around 15%.

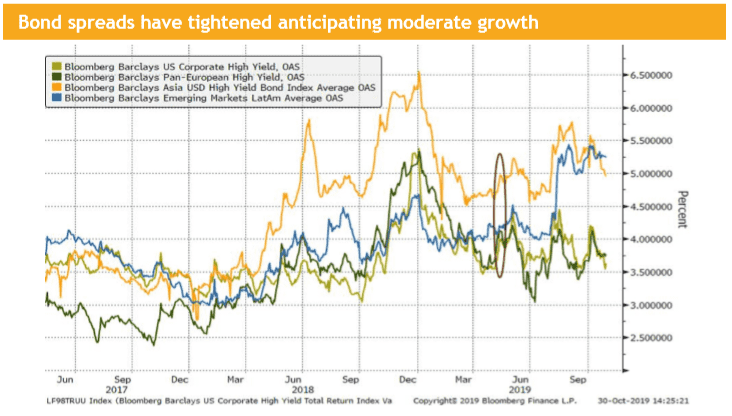

The US and global PMI data confirmed that the global economic growth is slightly accelerating. Continuously tightening global bond spreads are pointing into the same direction.

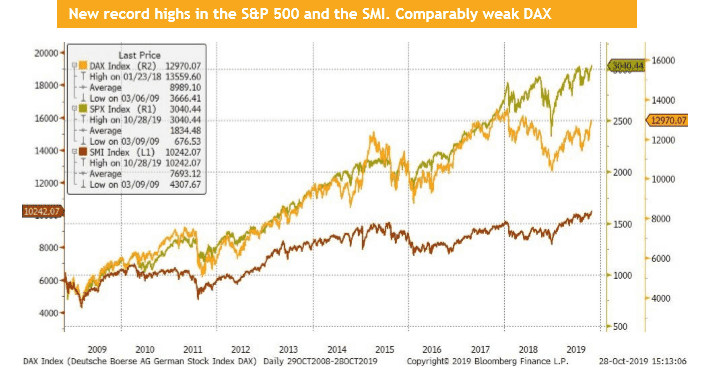

This week we have seen new records in the US and in Switzerland. While the latter is mainly driven by the big three defensive stocks (Nestle, Roche and Novartis) in the US rally is broader based.

Although most FAANG (Facebook, Amazon, Apple, Netflix, Google) stocks were lagging, other tech names filled the gap and pushed large caps to new highs.

Microsoft’s Q3 earnings beat across the board while Amazon’s numbers were disappointing. Nevertheless, we think Amazon’s new strategy to invest in new distribution concepts (one day delivery) makes it an interesting company. We would consider adding during weakness.

Liquidity

The volatility in cable (i.e. GBP) has risen over the last weeks based on the actual state of the BREXIT discussion. Overall GBP has appreciated and continues to rise.

The US dollar is slightly depreciating against Euro, CHF and JPY. This might be in anticipation of further expected rate cuts in the US and the muted growth outlook.

Equities

The US and for once the Swiss equity market have reached a new record high. A majority of US companies have beaten the low earnings estimates and continue to rise. Meanwhile, the guidance for revenue growth has been further decreased.

Although European equites have kept pace with the US during 2019, the valuation gap got wider. Nevertheless, we would argue that the growth outlook in Europe is weaker than in the US. We prefer therefore US and emerging market equities over European ones.

In case an investor wants to partially hedge his equity portfolio, an addition of value stocks or min. volatility ETFs could help to reduce risks.

Fixed Income

The steeping of the US yield curve continues. Soft economic US indicators start to reflect this as positive US fixed income market signal. We have seen losses in US treasuries by rising yields while at the same time US denominated bonds rallying was mainly driven by spread tightening.

Very positive fact is that the steepening of the US yield curve is continuing. The 2-year and 5-year buckets are slightly upwards sloping. The short end is still higher, but with the Fed buying bonds with a short maturity it is just a question of time until the whole US yield cure is upward sloping. Having said that we would argue that the US won’t face a recession.

Alternative Investments

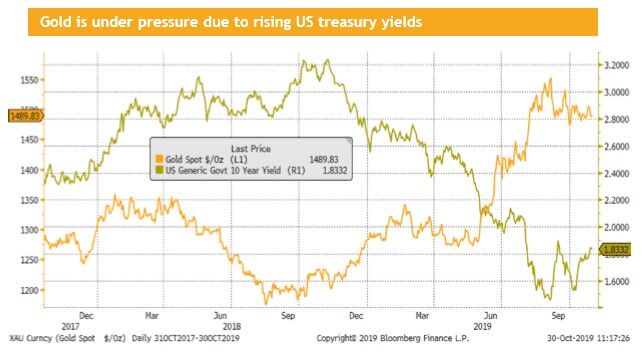

Gold: Although we have seen further rate cuts by central banks across the globe, the US yield curve for bonds maturing in 2 years or later has steepened. 10-year US treasury yields are now above 1.8%, while in September we have seen levels below 1.45%. Since then, gold lost some ground and is now consolidating.

Oil: Since the beginning of October the oil price is slightly increasing. The US Market PMIs have risen which partially explains the rise in WTI. Global New Orders PMI has risen and is supporting the oil price.

Investments covered:

Centrais Electricas Brasileiras SA-Eletrobas 5,75 2021 (Centrais Electricas Brasileiras SA-Eletrobas 2021 5,75)

CIFI Holdings Limited 6,45 2024 (CIFI Holdings Limited 2024 6,45)

Visa Inc.

Amazon.com Inc.

Disclaimer

These Business Reports (hereafter «BR») are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate