Market Watch. November 2019 II

Market Watch. November 2019 (II)

Fund managers expect a better economy in 2020…

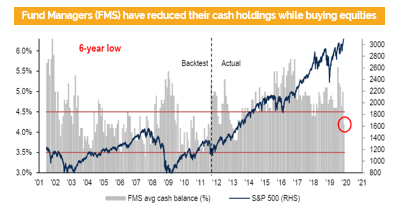

Based on the latest Bank of America Merrill Lynch (BofAML) Fund manager survey we see that money managers expect an acceleration of growth. This caused a risk-on mode, better known as a “Fear of Missing Out” rally. This can best be seen in the actual cash holdings of the fund managers which were reduced to around 4%.

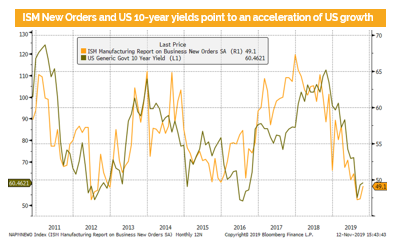

This view is supported by soft economic leading indicators, which have turned upwards, We need however to see a confirmation of that, i.e. the next two data points should as well be better than the previous ones. For instance the ISM new orders index has already gone up twice in a row.

This phenomenon is global, but at the same time almost all indicators stayed in the contraction area. i.e. we can expect only slightly marginal improvements. This contradicts the latest forecasts by the European Union. The jury is still out if the bond and equity markets are right or the cautious economists.

Nevertheless, these managers still fear the negative impact of the trade war on global growth as the number one risk. If we get a mini deal most global GDP forecasts would probably be revised upward, but it seems the bond and equity markets have already priced in such event.

Source: BofAML, FuW

In the US president Trump gave a speech at the Economic Club of New York where he basically pronounced his achievements peppered with a few digs at the Fed. Other than that there was no news which could impact the market.

The next event will be the public impeachment hearings. It is expected that there won’t be a majority to push Trump out of office. Nevertheless, the news flow will be very volatile.

In Asia a new free trade zone was installed, excluding India. India has a growth problem, the latest industrial production figure was disappointing. Most other Asian countries are growing at a solid pace supported by monetary and fiscal stimuli.

China is growing at around 6% but has put various measures in place to boost the economy. A mini deal seems to be the most likely outcome, but the time frame is constantly pushed out. It seems that the US president and president XI are playing cats and dogs. According to non confirmed news China has started to buy more US agriculture goods, although a deal is not singed. This might show that China values the food security higher than political tensions.

Source: BofAML, FuW

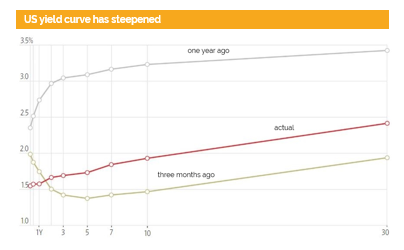

The US yield curve is now not any longer inverted due to the Fed rate cuts and the new bond buying program. The short end of the curve has decreased while at the same time longer dated US treasury yields went up.

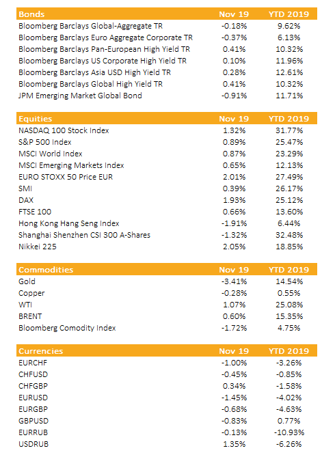

Simultaneously, corporate US dollar bonds rallied based on spread tightening. In particular emerging market corporates have outperformed US high yields.

Gold keeps falling due to higher US yields and the risk-on mode for risky assets.

Source: Tradeweb

Liquidity

The US dollar keeps appreciating since the Fed signaled that further rate cuts in 2019 are very unlikely. Mr. Trump keeps bashing on the Fed for the high rates and the strong dollar. Given that the US might again grow faster than 2% we would argue that the Fed has already done too much with three rate cuts in 2019.

The increasingly global political uncertainty has strengthened the Swiss Frank against USD and especially against the Euro. The SNB has prepared the ground for another rate cut in case the ECB is further easing or the Swiss Franc strengthens too much.

Equities

The S&P 500 has traded above 3100 and not even Bloomberg or CNBC TV made a story out of this new record high. This most hated rally is alive and might last until Q1 2020.

Meanwhile, European equites are outperforming the US. In particular the German Dax and small and mid caps in Germany and Switzerland. This happens mainly due to the car industry. But also other industrial names have recently outperformed the broader market. It looks like the expected industrial recovery, based, for instance, on the ISM New order index (chart on the right hand side), is priced in by market participants.

Fixed Income

The dichotomy in US dollar bonds continues. While longer dated US treasuries lost value, corporate bonds rallied.

The amount of negative yielding debts decreased from around 17 trillion dollar to around 12.5 trillion. This happened mainly due to rising government bond yields.

We prefer USD emerging market corporate over US high yields. The reasoning is that 10-year cumulative average default rate of 12.4% with average yield of 6.2% of EM HY looks more attractive than 23.4% default rate with 5.5% average yield of US HY bonds. Forward-looking we expect slightly more defaults in the US while the outlook for the emerging market corporate sector keeps improving.

Alternative Investments

Gold: The consolidation which started at the end of the summer is continuing. A ounce of gold costs around 100 US dollar less than two months ago. From a technical point this consolidation phase is not over. However, one might use the actual weakness to rebalance the gold holdings.

Oil: It continues to go up. The risk-on mode has pushed prices more than 10% up. In last trading days we have seen a consolidation. Given the only marginal better growth outlook we expect prices to fluctuate at around current levels.

Investments covered:

Guangxi Financial Investment Group 5,75 2021 (Guangxi Financial Investment Group 2021 5,75)

Mersin 5.375 2024 (Mersin 2024 5.375)

LPL Holdings 4.625 2027 ( LPL Holdings 2027 4.625)

Walt Disney Inc.

Disclaimer

These Business Reports (hereafter «BR») are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate