Market Watch November 2022

Macro Update: More sings of a significant economic slowdown in the US

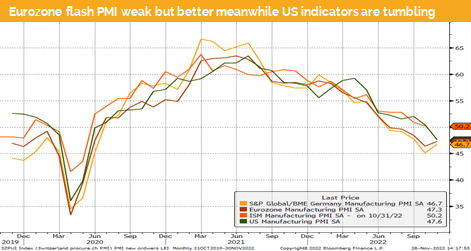

The latest US flash PMI data points towards a significant economic slowdown, which gives the fed room to slow down its rate hiking pace. However, the US economy still sends strong signals out about the recent economic development. Strong durable good orders and a resilient consumer are just two of them.

At the beginning of December, we will see if the US job market data finally starts to reflect the expected economic downturn.

The fed might get support from the finally falling inflation data. The recent small drop in US core CPI has triggered a rally not only in US equities but also in US treasuries. 10-year yields have fallen from around 4.3% to below 3.7%.

We see as well falling commodity prices led by oil futures. For instance, the WTI futures price has fallen from around USD 95 per barrel to below USD 75. Besides the expected global slowdown, the recent COVID lockdowns and the unrest in China were the main drivers.

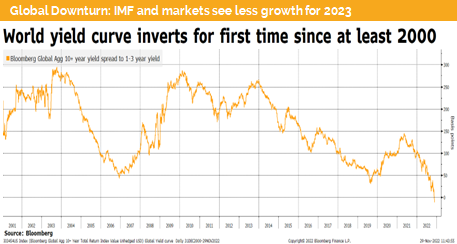

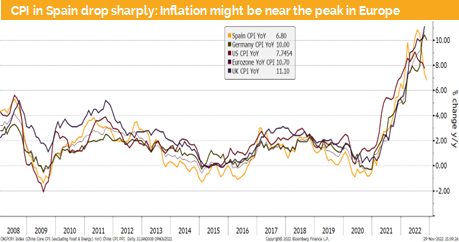

While in the US we might see a slightly less hawkish central bank we do see a completely different picture in Europe and the UK. For both areas inflation is still above 10% and might only drop slowly below 10%. On top we must expect that both areas are already in a recession and a further economic slowdown is very likely.

To make matters worse the total debt to GDP has reached levels last seen after World War II and will force the BoE and the ECB to further hike rates and therefore to worsen the recession.

We believe that both central banks might be forced during 2023 to choose between accepting a higher than target inflation or to push the economy into a deep recession. We therefore expect that inflation will come down during 2023 but not towards 2%, it will rather stay in range of around 3-6%.

In the European Union we do see most countries to support their economy with fiscal measurements and to offset partially the monetary tightening of the ECB.

In most European countries banks are forced to lend money to companies with weak balance sheets. But the governments have informed them that in case of a credit event the state will compensate the banks for any possible losses which might occur due to default of credit takers.

Analysts estimate that around 40% of all German loans, around 70% of all French and even 100% of all Italian loans are guaranteed by the state. This will lead to sub optimal capital allocation and higher deficits. Therefore, it is in the best interest of the states to accept inflation above 2% in order to slowly over time inflate the debt to GDP problem away.

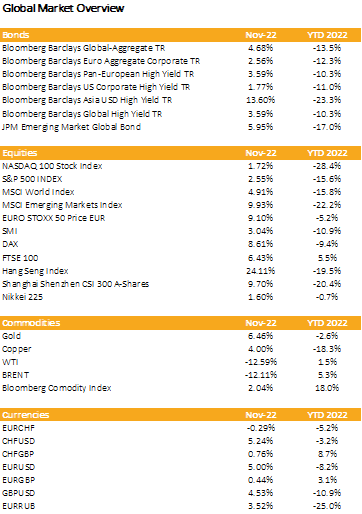

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: A continuation of the early Santa equity rally before lower markets

Liquidity

The CHF has continued to depreciate against the EUR. The euro got stronger due to the expectation that the ECB will hike in December 75 bps. Meanwhile we have seen a reversion to the mean against the USD, i.e., the US dollar has fallen from around one to one to 0.94 which is the lower trading range. It might rebound from the current level.

The EUR has recovered and continues to strengthen against the dollar as markets expect that the ECB will hike more than the fed in December.

The USD measured by the DXY has fallen to its lower trading range due to the expectation that the fed will slow down its rate hiking path.

Equities

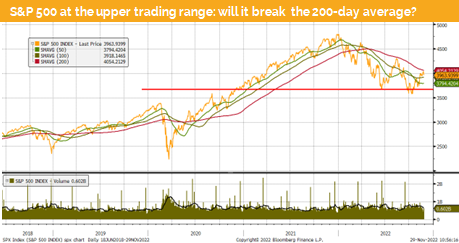

The S&P 500 has continued to rally above its 100-day average and has unsuccessfully tested its 200-day average. After this more than 10% rally we are in a consolidation phase. It is possible that after the next fed meeting and a possible 50 bps rate hike that we could rally a bit further.

But with a PE ratio around 18 times US large caps are very expensive. We expect a significant economic slowdown during 2023 and therefore would expect that the US market should rather trade at a PE multiple of 14 times. That implies a correction below 3600 or if you will a drop of ten percent or more.

Fixed Income

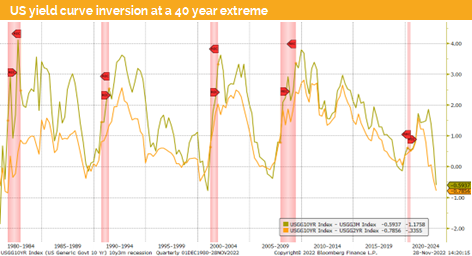

US treasury yields have after the weaker than expected US inflation data fallen to below 3.7%. US treasury future markets do imply that during next year we will see treasury yields trading below 4% for most of the time.

The New York fed chief; John Williams, has announced that the market is underestimating the fed terminal rate and especially that the fed will keep rates steady for longer than the consensus estimates. We are in the camp of Morgan Stanley and believe that the fed might wait until 2024 to start with rate cuts. This non-consensus view would mean that both equites and bonds would do well.

But the fed could also be forced by markets to start talking about rate cuts during H2 2023. This however depends on the development of US inflation, which we expect to stay far above the 2% target during 2023 and possibly also in 2024.

Alternative Investments

The gold price has gained more than 100 USD per ounce after US core CPI data came in weaker than expected. Meanwhile we have seen a drop in treasury yields and a weaker dollar. If we are right that inflation will stay at sticky high levels above 4% gold might further rise over the coming months..

LME Copper future has risen almost 15% during the first half of November to around 8500 USD. As of this writing we trade around 8000 which is still 6% higher than one month ago. Dr. copper seems to anticipate an economic recover later during 2023.

Both oil futures prices have seen a further decline due to weaker a global economic outlook, further lockdowns in China and rumors that OPEC+ might increase the oil supply.

Investments covered

Equinor ASA , 7.15%, 2025

Bath & Body Works, Inc., 9.375%, 2025

AstraZeneca Plc.

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate