Market Watch November 2023

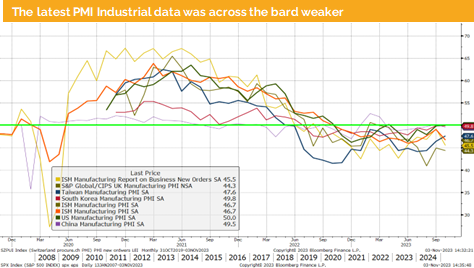

US GDP grew during Q3 by 4.9% but latest PMI were weak and we might see a slowdown

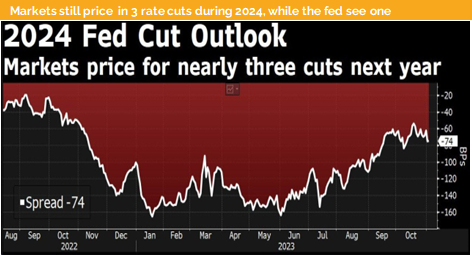

The Federal Reserve has surprised the markets with a less hawkish outlook, causing a rally in bonds. Unfortunately, this has further inverted the yield curve, indicating that the US government bond markets are now pricing in another economic slowdown that has yet to materialize.

The US Q4 GDP growth rate came in at 4.9% on an annualized basis, which is a robust figure and does not suggest an imminent recession. However, the economic outlook has deteriorated as the latest PMIs have been declining and now indicate that they are below the threshold for growth.

The Federal Reserve’s outlook suggests that certain segments of the US economy are indeed displaying signs of a slowdown. However, the job market is sending mixed signals, as there is an ongoing labor shortage, but salaries are not experiencing significant increases.

In Europe, the economic outlook has worsened, primarily due to PMI data. It’s worth noting that this survey was notably influenced by the conflict in the Middle East. However, it is not anticipated that this regional conflict will have a substantial impact on the global economy. While the impact on Europe may be slightly more pronounced than in the US, we do not currently foresee a significant negative effect on overall economic growth.

Indeed, the assessment is contingent on several factors, including the conflict remaining regional and the straits of Hormuz remaining open for shipping. It’s noteworthy that the oil futures markets have not witnessed a significant increase in oil prices following the commencement of the conflict, which suggests a belief that the straits will remain open and that the impact on global oil supply will be limited. However, it’s essential to continue monitoring the situation as it evolves to reassess its potential effects on the global economy.

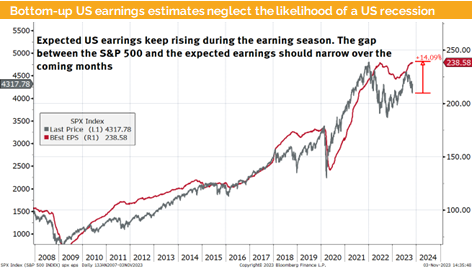

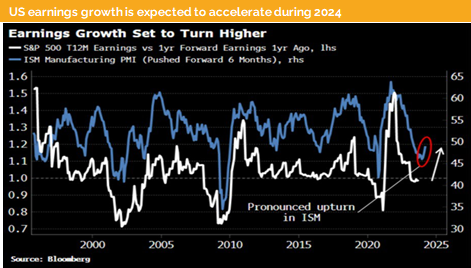

We observe that economists are still projecting a US recession in the coming months. Meanwhile, bottom-up equity analysts are indicating that corporate America is expected to experience a substantial increase in earnings, beginning with the current Q3 earnings season.

We maintain a positive outlook and align with the equity analysts, anticipating a 10% earnings growth for 2024 and 2025. However, it’s essential to monitor whether the PMI data will rebound in the next two months. The recent weakness appears to be primarily attributed to the psychological impact of the war and may not have a lasting effect on the real economy.

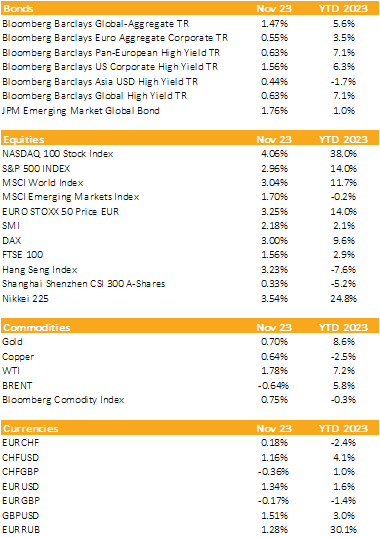

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: US equity markets have mean reverted, but will we see more upside?

Liquidity

The Swiss Franc has experienced a slight appreciation against both the Euro and the US Dollar. We anticipate no significant price changes in the near future.

Since October, the Euro has remained range-bound against the USD, while against the Swiss Franc, we have observed a significant appreciation (or mean reversion) following the sharp decline in September. We anticipate a slightly stronger Euro against the CHF.

The USD, as measured by the DXY, appreciated until mid-October. However, due to a less hawkish Fed and the decline in government bond yields, the dollar index has been trading sideways and may continue to remain range-bound.

Equities

Following a good and expected start to October, equity markets turned negative due to the Israel-Hamas conflict. After the Fed press conference and weak PMI data, US yields dropped sharply, and the S&P 500 gained more than 5% within 48 hours.

The earnings season is solid not only in the US but surprisingly in Europe as well. We expect that over the next two years, EPS for all S&P 500 companies will grow around 10% each year.

Therefore, we do expect positive market developments into Q1 but would expect a correction of more than 10% to unfold over the summer.

Fixed Income

US 10-year government bond yields had exceeded 5%. However, after the release of weak PMI data and a less hawkish Federal Reserve press conference, we observed a decline in yields of approximately 0.35%. Our expectation is that US 10-year yields will remain within a range of 3.8% to 5.2%, which resembles the trading range that existed before the global financial crisis.

Investment-grade corporate bonds still offer good value. However, for traders looking to take a long position in government bonds and capitalize on potential yield decreases, it can be a risky yet potentially profitable strategy.

Alternative Investments

The price of gold has seen a sharp rise following the outbreak of the Israel-Hamas conflict. As of the current writing, it is trading just below $2000 per ounce. We maintain our expectation that gold will surpass the $2000 threshold in the coming months.

The price of copper remains volatile. After testing the lower end of its trading range at around $7,900, we have observed a mean reversion, and it is currently trading at approximately $8,200. The upside potential is limited as long as the economic outlook does not improve, despite our knowledge of a supply shortage in the years ahead.

Both oil futures prices have mostly declined throughout October and are currently trading within a narrow range of 2-3 USD. This is quite surprising as we would have anticipated a significant impact on oil prices due to the ongoing conflict in the Middle East, although, at least so far, this has not been the case.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate