Market Watch October 2023

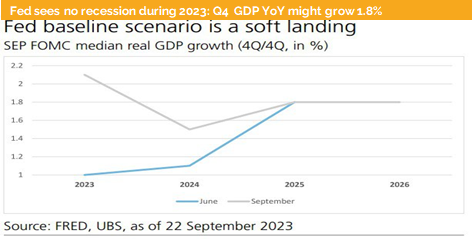

Soft landing: US GDP might grow 1.8% for the entire 2023

The Federal Reserve has caught the markets off guard, not only with a positive economic outlook but also by signaling that there will be no interest rate cuts before September 2024. Additionally, they have also scaled back their expectations for the number of rate cuts in 2025.

The hawkish stance conveyed by the Federal Reserve was primarily influenced by a significantly improved economic outlook. Additionally, it was driven by the anticipation of a persistently tight labor market and the projection that inflation will not return to the 2% target before 2026.

The Federal Reserve’s updated economic outlook aligns with encouraging PMI data. It’s possible that the onset of the next recession may be deferred well beyond 2025. Nevertheless, it’s worth noting that several prominent Swiss banks have published pessimistic assessments of both the U.S. and global economies.

This, however, presents a contradiction not only to the Federal Reserve’s forecast but also to recent communications from the European Central Bank (ECB) and the Swiss National Bank (SNB). Interestingly, the ECB anticipates a soft landing for the Eurozone, although they predict a mild recession for Germany. While we may concur with the first part of their assessment, we find the outlook for Germany to be surprising.

The German economy has experienced contraction for three consecutive quarters. We acknowledge that this negative growth rate can feel quite different for the average person compared to what the statistics suggest. However, based on the recently published German PMI data, both the services and industrial PMI indicators are pointing towards an acceleration of growth. This suggests that we may soon witness an end to this mild recession in Germany.

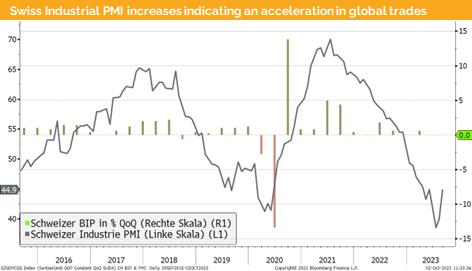

The Swiss National Bank (SNB) took the market by surprise by not only abstaining from raising interest rates but also by presenting a growth outlook that exceeded expectations. They also reaffirmed their stance that inflation would not dip below 2% until the close of 2025. We suspect that this rate decision was influenced by the strength of the Swiss franc and concerns regarding the potential for Switzerland’s export sector to experience further contraction.

In China, we have witnessed a fourth rate cut, which, once again, appears to have had minimal impact on the markets. This is largely attributed to the fact that the country is grappling with a balance sheet recession, and addressing this would likely require a well-planned fiscal stimulus strategy to revive the economy. Nevertheless, it is noteworthy that the official PMIs for September have shown a slight increase, and there are indications of potential fiscal support for the real estate sector.

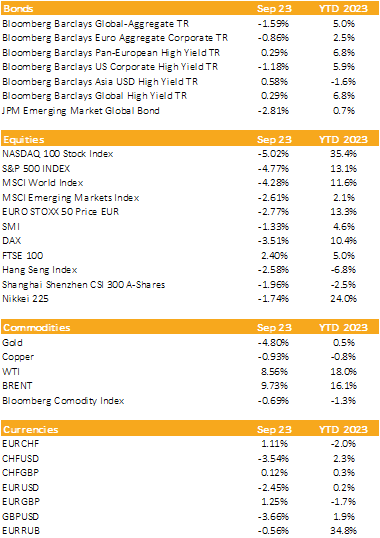

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: US markets are oversold, we expect at least a mean reversion

Liquidity

The Swiss Franc depreciated against both the Euro and the US Dollar following an unexpected decision by the Swiss National Bank (SNB) not to increase its policy rate.

The Euro’s decline against the US Dollar persists, driven by the more positive economic outlook in the US and the potential for a final rate hike by the Federal Reserve.

The USD, as measured by the DXY, has appreciated approximately 2.5 since our last publication and around 6.5% since the middle of July.

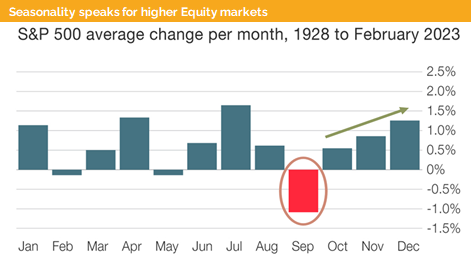

Equities

Following its seasonal pattern, the S&P 500 recorded another decline in September. Notably, the market did not breach its 200-day moving average. According to the Relative Strength Index (RSI), the market is oversold, indicating a potential for mean reversion. Additionally, throughout the pullback in September, market volatility, as measured by the VIX, remained below 20%.

We anticipate that this relief rally could extend into Q1 2024. Aggregated EPS estimates for 2024 and 2025 indicate growth of approximately 12% for both years, following this year, which might conclude with zero growth. Nevertheless, zero growth is a positive surprise, especially considering that many market strategists had anticipated an earnings recession, which appears to be not materializing at all.

Fixed Income

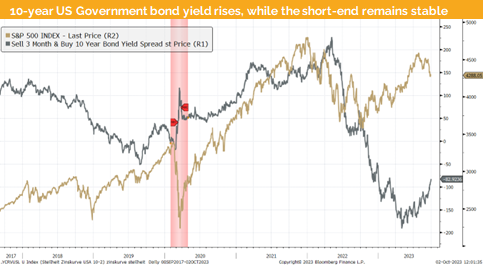

US 10-year government bond yields have continued their ascent, and we observe a further steepening of the yield curve. This phenomenon, known as bear steepening, where short-term rates remain stable while long-term rates rise, often signals an economic recovery. Additionally, the bond markets seem to acknowledge that equity markets may be on the right track with their optimistic outlook.

Corporate bond spreads in the global bond indices have not risen, indicating a lower risk of recession. This atypical trend also suggests that the worst may be in the past regarding economic growth.

Alternative Investments

The price of gold has undergone a substantial decline following the Federal Reserve’s press conference, primarily due to increasing yields. Despite the expectation of persistently elevated inflation, the impact of rising yields has dominated price movements throughout September, with testing at levels around $1800 per ounce.

The price of copper continues to exhibit volatility, staying within the trading range of USD 8200 to USD 8600. In contrast to August, the price declined in the first half of the month but experienced a rally following the Federal Reserve conference. It’s possible that copper may see a gradual increase in the coming months, influenced by the rising US yields driven by a more positive economic outlook.

Both oil futures prices have continued their upward trend, thanks to decisions by both Russia and Saudi Arabia to further reduce their production. With the heating season approaching, there are concerns that oil prices may continue to rise.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate