Market Watch September 2022

Macro Update: After 700 bps Rate Hikes Global Markets Tumble

The latest mini rate hiking cycle has brought us more than 700 basis points higher policy rates in developed countries. The Swedish risk bank has surprised with a 1% step while the Bank of England has disappointed with a too small step of 0.5%. Also, the Fed has increased less than market participants have expected.

They have sent out a clear message that much higher policy rates are needed, and they are willing to accept that the economy will fall into a recession before inflation falls back to an acceptable level.

The final news which has initiated a further sharp rise in yields globally and a strong depreciation of the pound was the communication of the mini-UK–fiscal-budget.

Market participants state that the Modern monetary theory (MMT) does not work! The MMT says that governments create new money by using fiscal policy and that the primary risk once the economy reaches full employment is inflation, which can be addressed by gathering taxes to reduce the spending capacity of the private sectors. But the UK has already high inflation and reduces taxes, meanwhile the BOE raises rates and buys now even bonds at the same time. Or as UBS has put it: this is ‘Hogwash’ (i.e., rubbish).

Current market conditions can trigger a forex change crisis and pushes the global economy further into a (deep) recession.

However, recent PMI data from the US and China do show some sings of a stabilization or even a recovery from low levels. Differently in Europe – all soft economic indicators are pointing towards a strong recession. Meanwhile, in the UK we might see not only inflation far above 10%, but also a sharp slow down of its economy due to the negative effects of Brexit and the possible sharp rate hike of the BOE. The UK regulator had to react to the market turbulences and has announced to delay its QT (Quantitative tightening) until the end of October and it will buy unlimited long dated UK government bonds. That is a clear sing of weakness and will put more pressure on the pound and create more inflation.

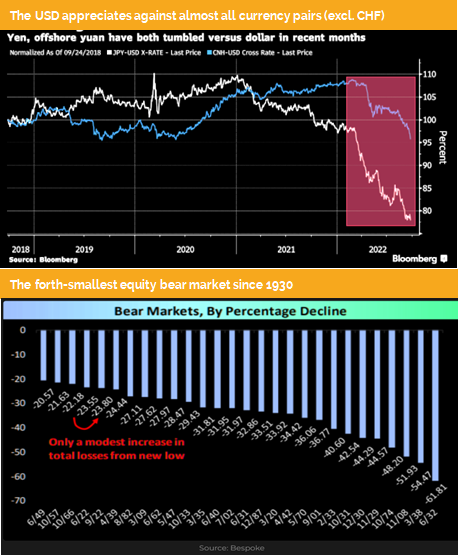

There are only two large countries which still have a loose monetary policy. In Japan the Yen has as a consequence fallen sharply and inflation has risen above 2.5%. In Turkey the currency continues to weaken and inflation stays above 80%.

It becomes now clear that inflation is here to stay until central banks communicate to bring it back down to around 2-3%. For the foreseeable future government bond yields will stay below inflation and institutional investors are forced to live with negative yielding assets.

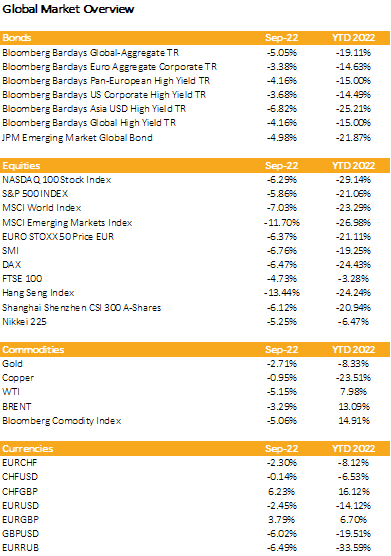

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

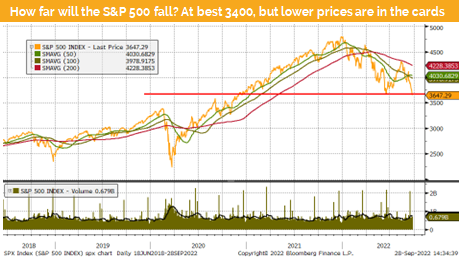

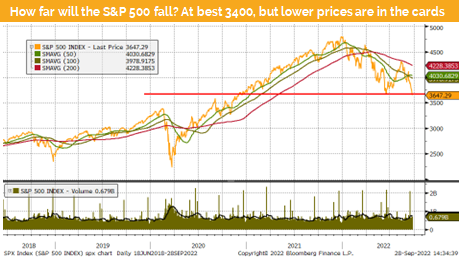

Investment Outlook: Make or break – S&P 500 at a pivotal level

Liquidity

The CHF has continued to strengthen against most currency pairs. Only against the dollar we see a roller coaster.

The EUR has dropped like a stone against the USD only to be outpaced by the pound. In both cases, central banks are accelerating the trend although they have hiked rates, but both are hiking less than expected.

The USD measured by the DXY Index has over the last weeks sharply risen due to the hawkish fed rate outlook and the poor policy reaction from the ECB, BOE or BOJ. We should see a consolidation but would still expect higher index levels over the coming weeks.

Equities

The S&P 500 has not overcome its 200-day average and has since then fallen back to recent seen year lows. We are now again at a pivotal level. Short-term a rebound could happen, but mid-term the risk for going below 3600 is very high.

The US market trades above 15 times PE ratio, which is at least 3 points too high for a recession phase and an environment where the fed rises its policy rate. Earnings estimates are still too high so that the PE ratio is distorted.

Europe trades below ten times PE and looks attractive, but due to the weak economic outlook and still to high earnings estimates we prefer Swiss or US equities. But it is still too early to buy the dip.

Fixed Income

Since the last fed rate decision US 10-year treasury yield has risen temporarily above 4%. But that impressive move was outpaced by the 2-year yield rise. We see a significant inversion of the US yield curve. The spread between the 2Y and 10y has fallen to minus 0.27%, such levels below zero have since the eighties always let to a recession.

Turning to the UK where we see that yields have risen faster and stronger than in the US due to a too small rate hike of the BOE and the new UK mini-fiscal-budget. That has triggered a selloff in government bonds and a depreciation of the pound by more than 10% in less than a week. The BOE has announced to temporarily buy unlimited UK Gilts (10-year government bonds) to calm down the situation. But we fear inflation will surge due to this contradicting actions.

Alternative Investments

The Gold price has fallen from around 1720 to below 1630 per once after the recent strengthening of the US dollar and the rise in global government bond yields. We expect that gold continues to trade range bound if government bond yields keep rising.

Copper has been falling from around 8000 to 7350 due to recession fears. Due to a weaker global growth outlook we expect only modest gains over the coming months but would still see higher prices mid-term due to an expected increase in demand triggered by the green revolution.

Both oil futures have been trading with high volatility. Due to a worsening economic outlook, we see now WTI trading below 80 USD and Brent at 86 USD per barrel. There is still a shortage of production if we exclude the Russian oil supply but that gets neglected by market participants. As long as risky assets keep falling and the economic news flow does not improve, we would expect that oil prices won’t significantly rise.

Investments covered

Ford Motor Company, 7.5%, 2026

Hilton Domestic Operating Company Inc., 4.875%, 2027

Nvidia Corporation

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate