Market Watch September 2023

US outlook remains mixed, but 10-year government bond yield rise due to better outlook

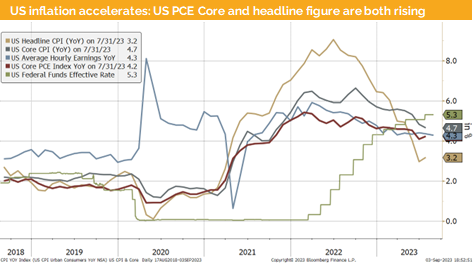

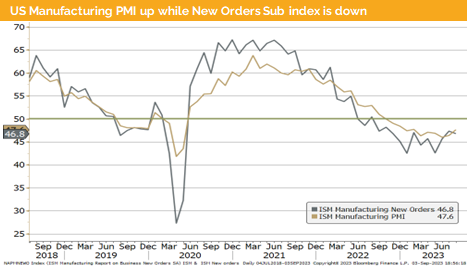

The latest macro data in the US has left us puzzled. The service sector continues to slow down, while the manufacturing sector shows initial signs of acceleration. However, the real surprise for most market participants was that inflation, measured by the Fed’s favorite core PCE, rose to 4.2%, while the headline inflation data also accelerated slightly.

The inflation situation in Europe and the UK, excluding Switzerland, presents a very similar and expected picture. However, as mentioned several times in recent months, both Europe and the UK are grappling with serious growth problems, while the US economy managed to grow at more than 2% during Q2 2023.

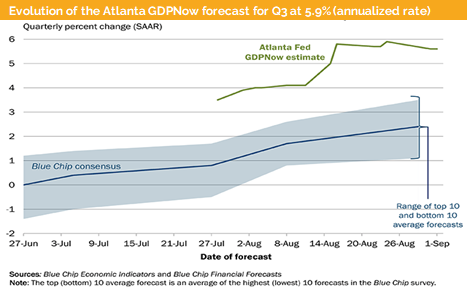

The most recent Atlanta Fed GDPNow forecast for Q3 2023 was revised three times in August and now suggests an annualized growth rate of 5.9% (approximately 1.55% per quarter). While we should approach this annualized figure with caution, there are still no signs that the US economy might enter a recession in Q3 or Q4 of this year.

This gives the Fed a lot of flexibility. They may pause in September but leave all options open for an additional rate hike in November. That being said, it also provides them with more space to potentially lower rates in 2024.

Turning to China, we observe a deflation issue, a slowing service sector, and, similar to the US, an initial uptick in the manufacturing sector. However, China’s primary concern lies in the private sector’s balance sheet recession resulting from the bursting of the real estate bubble.

A balance sheet recession is a specific economic downturn marked by extensive deleveraging and reduced spending by individuals and businesses as they strive to repair their compromised balance sheets. In China, this situation was triggered by a substantial drop in asset values, including real estate and stocks, coupled with excessive debt accumulation. In practical terms, this theoretical concept implies that all monetary stimulus measures are ineffective. Consequently, the last three rate cuts in August had no significant impact on the economy or asset markets.

The solution would involve encouraging individuals to spend more by providing them with fiscal stimulus money, such as vouchers that can only be used for specific consumption purposes. However, it doesn’t appear that the Chinese government is considering this approach in the near future.

Looking at Switzerland, we anticipate another rate hike from the Swiss National Bank in September, and we still do not foresee a severe recession. Here, we do observe initial signs of slight acceleration in the manufacturing PMI, though it remains at a very low level.

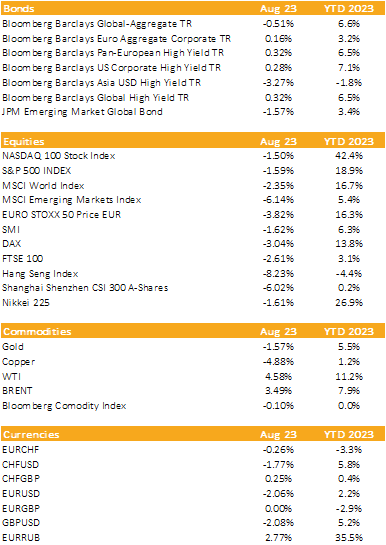

Markets in 2023: Currencies, Commodities, Equity & Bond Indices

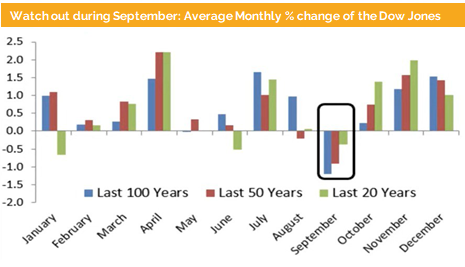

Investment Outlook: After a mini pullback in August a volatile September might lay ahead of us

Liquidity

The Swiss Franc has continued to strengthen against the Euro and the US Dollar due to lower inflation. We still anticipate the Swiss National Bank (SNB) taking the next rate-hiking step.

The Euro has weakened against the US Dollar due to the more favorable economic outlook in the US and the expected next rate hike by the Federal Reserve.

The USD, as measured by the DXY, has appreciated approximately 4% since our last publication. The primary driver behind this increase is the possibility that the Federal Reserve might raise its policy rate by another 25 b.p.

Equities

The S&P 500 experienced a pullback in the first three weeks of August but ended the month on a high note. From a technical perspective, there’s a potential for further downside to the 100-day moving average, suggesting a 4% drop. There’s also the possibility of a more significant decline to the 200-day moving average, which is approximately 10% lower. However, we maintain our belief that the current bullish trend will remain intact.

The period of Europe outperforming the broader US market appears to have reached its conclusion. We anticipate that the US, thanks to robust earnings growth in 2024, would surpass Europe. This shift in favor of the US is driven by deteriorating prospects in Europe, primarily due to higher inflation and anticipated tightening measures by the ECB.

Fixed Income

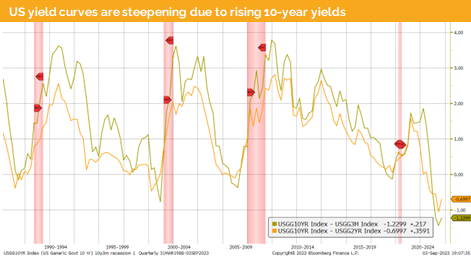

US 10-year government bond yields have surpassed the 4% mark, and the yield curve has steepened. This appears to indicate that the bond market is aligning with the equity market’s belief that there won’t be a US recession in 2023.

When we examine corporate spreads globally across all major emerging markets, spreads have not widened. Our preference remains with US investment-grade corporate bonds, as they offer yields of more than 5% for bonds maturing in less than 3 years. While US high yields provide an additional 2-3% yield, we prefer to take on such risk directly through US equities rather than via US high-yield bonds. As of this moment, the risk-return profile favors investment-grade bonds and US large-cap equities over US high-yield bonds.

Alternative Investments

The price of gold has experienced a roller coaster ride in the past month, driven by higher US yields and a stronger US dollar. However, recently released higher inflation data has provided support to the gold price. As of the current writing, we are trading around USD 1940 per ounce and maintain our anticipation that the USD 2000 threshold may be tested in the coming months.

The price of copper remains volatile, persisting within its trading range of USD 8200 to USD 8600. At the end of August, we find ourselves back where we were trading one month ago, near the upper end of the trading range.

Throughout August, both oil futures prices continued their upward trajectory, defying concerns. Saudi Arabia has once again reduced its output. Limited supply and increasing demand will bolster oil prices, and the approaching heating season will provide additional support for higher oil prices.

Disclaimer

This document has been issued by Blackfort Schweiz AG or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Schweiz AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate