Only the UK and China taking the right fiscal and monetary measures

After yesterday, the S&P 500 dropped below its Mondays close. But only to be followed by Mr. Trumps travel ban, which put pressure on global futures market.

Everybody was expecting that after the UK in the morning the US will follow with fiscal stimulus to support the FED.

There is no global coordination like we have seen in 2008. America first means there will be no global crisis management.

This will impact the US election process, so far Trump is a poor crisis manager for the US and the US is not intending to globally take the lead like in the past.

By the contrary every country looks only for themselves:

E.g. goods (a lot from China) are blocked in German harbors and not distributed in Europe. In Italy the public life came to a standstill while in UK beside fiscal and monetary measures not much more has been implemented to deal with the virus.

Today we will see the ECB announcing probably some monetary measures. BUT without fiscal stimulus we might see a similar effect like we have seen after the panic rate cat from the FED.

- Although in China all started the best corporate credit market and the best performing equity market can be found there!

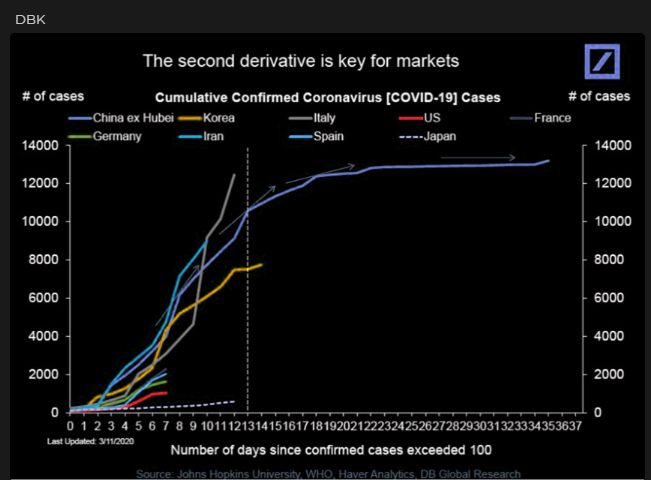

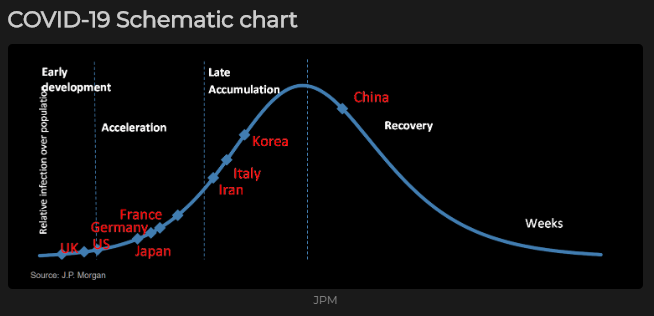

- China has reach the peak of new infected people, probably Korea will be there soon. Italy might arrive there in one week. I.e. the 2nd derivative (aka the slope of the line) reaches a horizontal line

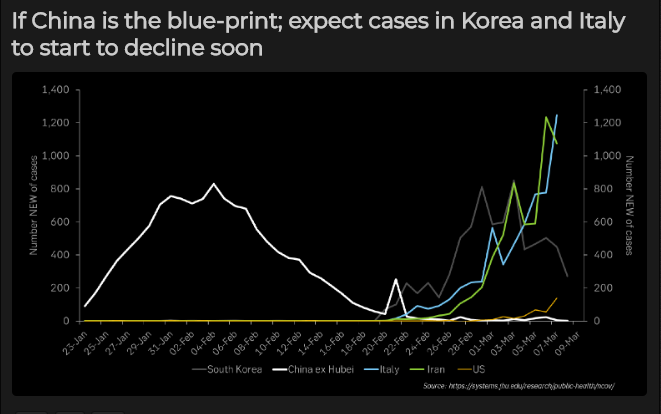

- If China is the blue-print Korea and Italy start to decline soon (3rd chart).

- COVID 19 (ill cases) from today paint a similar picture

- CDS in Italy are reaching levels last seen in 2018 during the political crisis

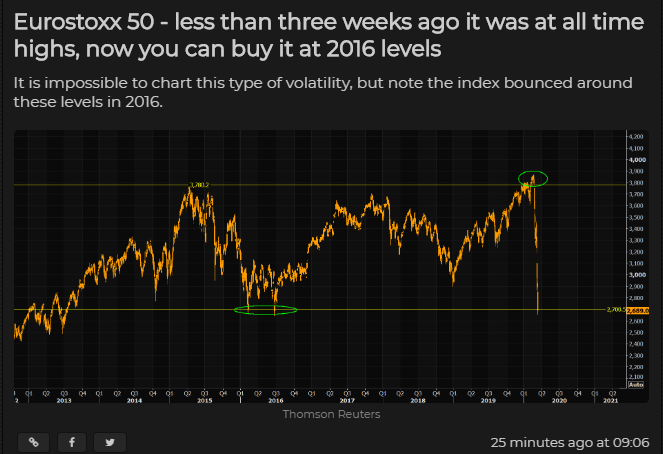

- EuroStoxx might soon reach a buying level

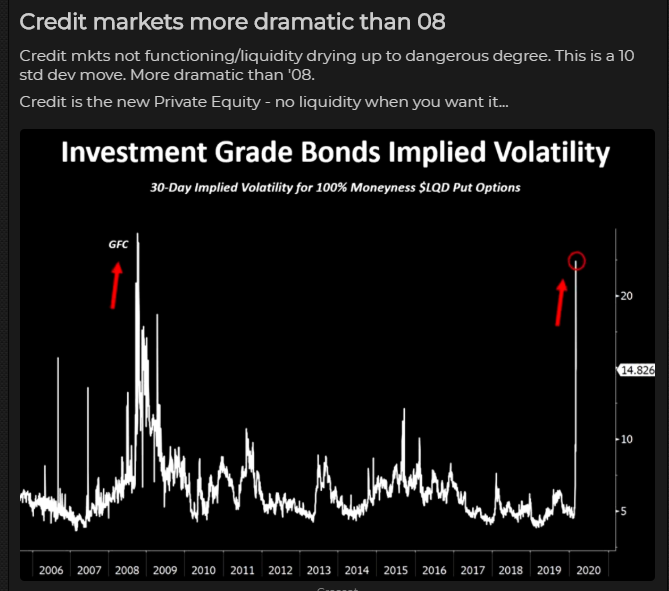

- Investment grade bonds (i.e. not junk or High yield bonds) trade now at spreads like in 2008! I.e. this as well indicates that a buying opportunity cannot be too far away

- Global growth might slow down to around 0% in Q1 2020, but so far for the whole year we cloud still see 2% (before the estimates were slightly above 3%)

Published: 12/03/20 by Blackfort CIO Dr. Andreas Bickel

Disclaimer

These Market Business Reviews (further BR) are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate