US and China tech stocks before a rebound?

US and China tech stocks before a rebound?

In global equity markets we do see a continuation of the sector rotation. But as US and Asian tech stocks have both reached their lower trading range, we would expect that these stocks will mean revert. Most stocks in the FANG+ index have shown strong sales and earnings growth in Q1 and might start a recover rally from current levels.

We would however still prefer cyclicals and small caps. Globally released Q1 earnings were mostly beating their IBES consensus forecast. Market participants have used this opportunity to sell on good news, which is mirrored in slightly lower index levels. On an index level the trailing 12-month PE ratio has therefore came down due to a rise in earnings and due to the minor market pullback.

Fig. 1: FANG+ Index before a rebound?

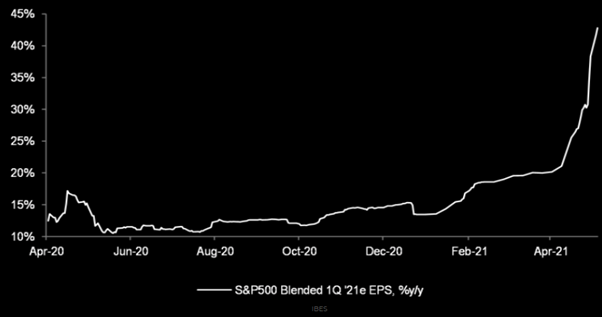

US Q1 earnings surged more than 40% compared to one year ago. The aggregated 2021 IBES EPS estimates have risen from around USD 189 to around USD 205, which results in a current PE ratio of around 20 times, which is significantly lower compared to a level of above 25 times in January. We would like to add that we still believe bottom-up equity analysts do underestimate the strength of the recovery in H2 once the US completely reopens. Therefore, now equites do offer a better value than they had offered in January, although the index trades around 10% higher.

Fig. 2: S&P 500 Q1 YoY earnings growth surged more than 40% YoY

Fig. 3: USD is weakening and might break through its lower trading range

Meanwhile we do see a weaker USD as expected, which is on one hand supporting gold and on the other hand should support emerging market economies together with higher commodity prices.

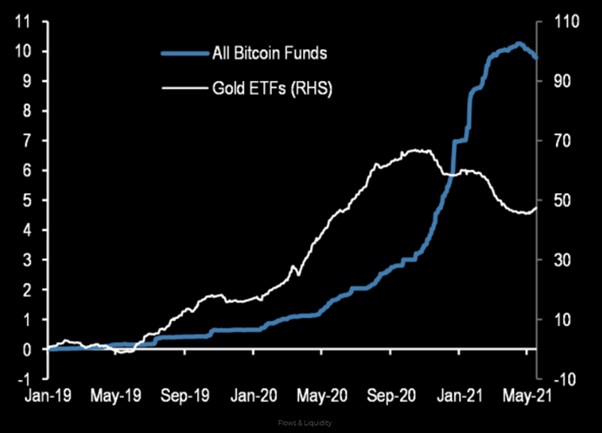

Gold has successfully overpassed its 200-day average and might retest this level in the coming days. We believe that due to inflation fears and weaker USD in mid-term and due to outflows from bitcoin funds into gold ETFs short-term gold prices might be pushed higher. In longer term we hold gold to protect wealth from inflation and a possible market selloff in global equities and corporate bonds.

Fig. 4: Gold is now overbought, but trades above its 200-day average

Fig. 5: Will the reallocation out of Bitcoin into Gold ETFs last?

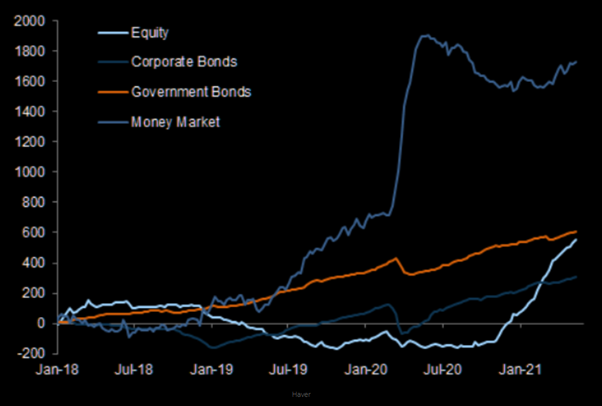

The latest money flow statistic shows inflows into all major asset classes. Where does this additional money come from? The answer comes from all major central banks which print money and buy bonds. We still expect that cash which is parked in money market products will find its way into bond and equity markets. Therefore, equity market weakness most likely will be used to buy the dip.

Fig. 6: There is still a lot of Cash parked on sideline, which might be deployed during pullbacks

Overall, our assessment that corporate bond and equity markets have moved to levels where a correction must be expected any time stays unchanged. In the equity space so far, we do see a continuation of the sector rotation. Different to our last Blackfort Insights we do expect now a rebound in US and Asian tech stocks but continue to expect that mid-term cyclicals and values will continue to perform well.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate