US economy is bouncing back

Phili (Philadelphia) Fed at 18 months high and retail sales up almost 10%. The fiscal paycheck has reached the US economy. US consumers are back on track: they do what they like the most – they go out and consume. The latest retail sales figures rose 9.8% month over month. The service sector has been one of the main contributors to this rise as in most US states restaurant and other leisure activities have re-opened. Also, the business outlook has further improved. The Phili Fed index has reached a level last seen in 2011.

Fig. 1: Retail sales have risen 9.8% MoM

Fig. 2: Phili Fed business outlook at the highest level since 2011

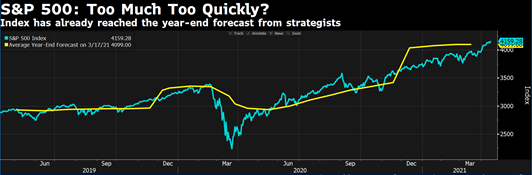

Also, the Philadelphia Fed 6-month business outlook rose from 59.9 to 66.6. This is based on the latest ISM PMI data (which we have covered in our last BFI) and is not a big surprise. So far, such strong data is well received in US equity and bond markets. However, the S&P 500 has already reached year end targets of most analysts. As usual we do see now upwards revisions. We stick to our assessment that the distance of US equity indices to their 200-day average is too high and that volatility at around 16% is too low. We expect that during the coming weeks this should mean revert. A pullback is overdue, but we expected for the time being that such a pullback will be used to buy the dip and that global equity markets will continue to climb the wall of worry.

Fig. 3: New records at the broad US equity market

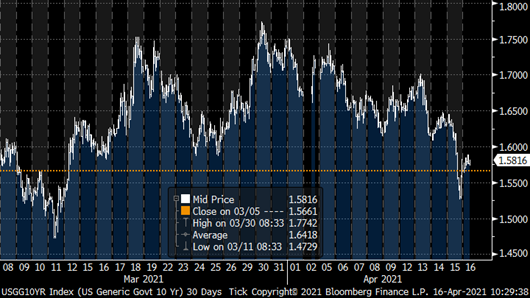

It is remarkable that US 10-year treasury yields have fallen below 1.6% The main driver was the publication of a statistic which shows that China and Japan have both significantly increased their holdings in US treasuries while the yield was around 1.7%.

Fig. 4: US 10-year Treasury yields fell intraday to 1.52%

During this treasury bond rally, we have simultaneously seen a rising gold price as the 10-year real yields became more negative. Also, the weakening USD supports the gold price movement.

Fig. 5: Gold is profiting from lower US yields and a weakening USD

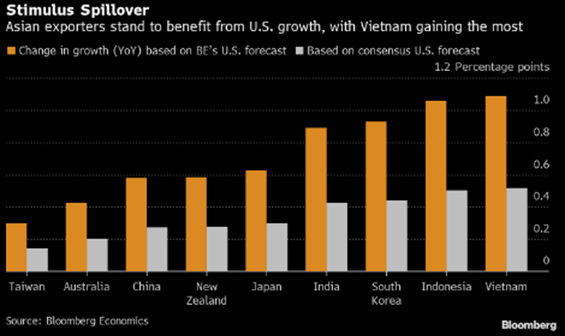

Fig. 6: Stimulus Spillover of US taxes to Vietnam and Asia Pacific

Speaking of investment, we do expect a pullback in US and European equity markets. Over the last 3 months we have seen a 15% correction in Chinese A-Shares. We expect that this underperformance comes to an end. Besides China A-Shares we have since an investment in Vietnamese equities which is at an all-time high. Bloomberg has estimated how big the spillover of the US fiscal stimulus might be for various Asian countries. Based on this analysis Vietnamese export companies are expected to profit the most. We stick to our allocation in Vietnam and have increased the allocation to China A-shares as they trade at their 200-day average.

Short-term there is a risk that we might break through this resistance level but mid-term the outlook for Chinese equities looks promising as the valuation is lower, and the growth expectation is higher compared to US and European equities. Geopolitical risks and a possible further escalation in the US China trade war can short-term interfere with markets, but all this will not hinder China and the whole Asian region to develop further. It is only a question of time until China overtakes the US in terms of total GDP.

However, forward looking we expect a global dual leadership as China and the US are the home of disruptive companies and sectors. There is already a high competition between the two countries, and we expect that to intensity, which should boost in both countries the growth outlook and offers investment opportunities, while Europe keeps lagging as very few enterprises in these disruptive sectors have their home on the old continent.

Therefore, our preferred investment regions for equites are the US and Asia. In the corporate hard currency bond area both regions do offer interesting opportunities. However, we do as well find interesting corporates in other emerging markets such as Mexico or Brazil.

Disclaimer: This Blackfort Insights (hereafter «BI») is provided for information purposes only. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur using this information. BI does not purport to contain all the information that may be required to evaluate all the factors that would be relevant for entering into any transaction and anyone hereof should conduct their own investigation and analysis. In addition, the BI includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be actualized. The real results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy, or reasonableness of such assumptions, or the projections, or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted to access such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate