Weekly Market Update – 17.04.2019

Bond Markets Weekly 17.04.2019

Key takeaways from the Cbonds EM bonds conference in Hong Kong

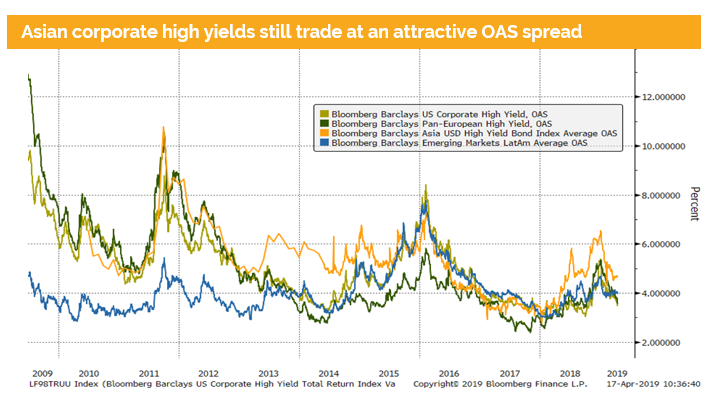

- Blackfort Capital was invited to participate at the Cbonds EM bond conference in Hong Kong. One key question was if the actual credit cycle will continue or not. If we just look at the actual levels of the OAS corporate high yield spreads globally, we can see that Asian bonds do still offer higher yields than the other areas.

- We can as well see that the spreads were around 100-150 basis point tighter at the beginning of 2018. Most market participants fear that the spreads might widened like last year. We would add that this depends on how the global economy will develop over the coming months. The latest Chinese export statistics show an increase of more than 13% and the first GDP estimate came in at 6.4%.

- Mid-term we expect that the tax cut in China, which is estimated to be larger than 6.5% of Chinas GDP will have a significant impact. We therefore continue to believe that a reacceleration of growth in Asian economies and the US is going to support both corporate (HY) bonds and equities.

- We are therefore overweight in Asian corporates followed by American corporate bonds. The least preferred region is Europe due to its weak growth outlook, structural risks and political uncertainties.

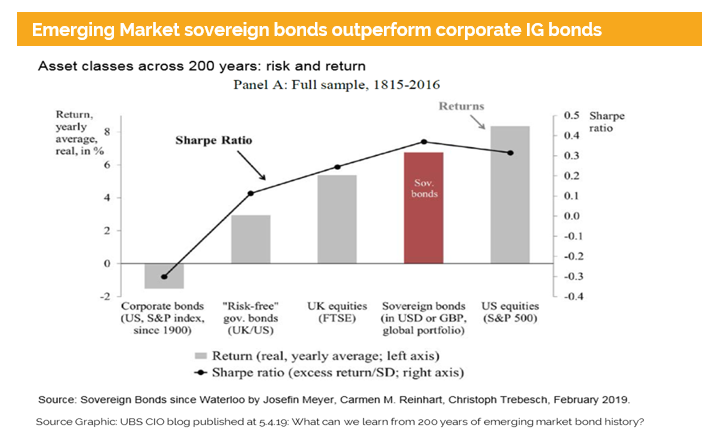

- In one of the latest UBS CIO blogs an interesting study regarding real returns and risk was published.

- Over 200 years emerging market sovereign bonds have delivered 6.8% real return almost reaching the level of equities. Remarkable is, however, that on a risk adjusted basis they have outperformed equities as they show by the highest Sharpe ratio.

- Around 70% of the return was achieved by collecting the coupons and 30% came from capital gains. The sample includes all periods, i.e. defaults and bond crisis over the last 200 years.

- The 2nd important point is that corporate investment grade US dollar bonds have delivered negative real returns. Furthermore risk adjusted (using the Sharpe ratio) they are the worst performing asset class.

- High yield bonds have as well outperformed the risk free rate, i.e. government bonds in USD and GBP.

- We are therefore comfortable for the future that corporate high yield bonds will continue to deliver goods returns. We expect that until the end of 2019 an investor should at least earn the attractive coupons and spreads might trade sideways.

- For predicting the credit cycle we believe it is key to foresee if there is a recession in the US and in China. In China fiscal stimulus in 2019 will be larger than 6.5% of GDP so a recession is very unlikely.

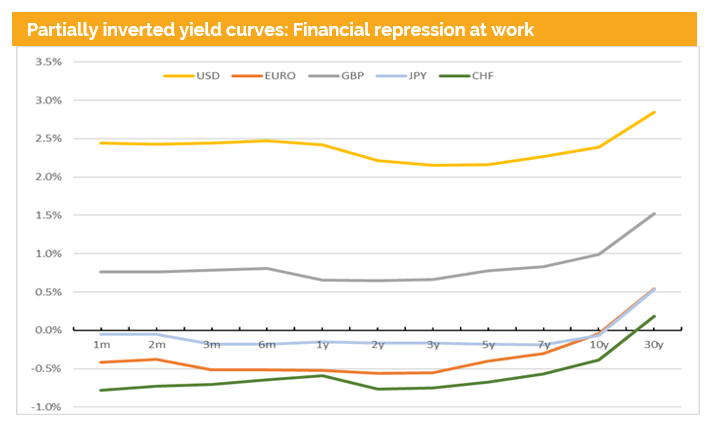

- For the US the best predictor of a recession is the 10-year 3-months spread. It has became negative in recent weeks but so far only for a very short time.

- Since the mid-1980 the yield curve has inverted seven times, only resulting in a recession on three occasions. So far we strongly believe that this time cloud be another false signal, as the inversion happened when the Fed announced it will most likely not hike in 2019 and that in October 2019 they will stop shrinking the balance sheet.

- In October the Fed starts therefore with its implicit QE (i.e. to stop shrinking the Fed balance sheet means reinvesting coupons and maturing bonds).

- With this they will restart with financial repression, i.e. to manipulate the yield curve. Most market participants expect that the Fed will concentrate its buying effort in the 1-month to 2-year bucket, as the yield curve is still partially inverted.

- The author believes that since 2012 we live in a regime of financial repression and that this will keep rates low for much longer. The final target is to create inflation and to reduce the debt to GDP ratio.

- Therefore we believe that this credit cycle is not over yet. That asset bubbles are a unwelcomed side effect and that emerging market hard currency bonds are a good way to deploy money under such a regime.

Definition of Financial Repression (based on a Rothschild research paper from 2012):

“In our usage, financial repression describes a situation where interest rates are kept artificially depressed. This works through governments intervening directly in the market for public debt, and via the knock-on effects of their actions on the monetary authorities. It takes a wide range of forms, including central banks directly buying government bonds (which pushes yields and borrowing costs lower),

Financial repression works best when combined with modestly elevated rates of inflation that persist for a number of years. This means headline inflation rates around 1% to 3% above official targets”

Disclaimer

These Business Recommendations (hereafter «BR») are provided for information purposes only and for the use by the recipient. This document was produced by Blackfort Capital AG (hereafter «BF») with the greatest of care and to the best of its knowledge and belief. Although information and data contained in this document originate from sources that are deemed to be reliable, no guarantee is offered regarding the accuracy or completeness. Therefore, BF does not accept any liability for losses that might occur through the use of this information. The BR does not purport to contain all of the information that may be required to evaluate all of the factors that would be relevant to a recipient considering entering into any transaction and any recipient hereof should conduct its own investigation and analysis. In addition, the BR includes certain projections and forward-looking statements. Such projections and forward-looking statements are subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control. Accordingly, there can be no assurance that such projections and forward-looking statements will be realised. The actual results may vary from the anticipated results and such variations may be material. No representations or warranties are made as to the accuracy or reasonableness of such assumptions or the projections or forward-looking statements based thereon. This document is expressly not intended for persons who, due to their nationality or place of residence, are not permitted access to such information under local law. It may not be reproduced either in part or in full without the written permission of BF.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate