Bi-Weekly. April 2022 I

Macro Update: The Fed might push the US economy into recession

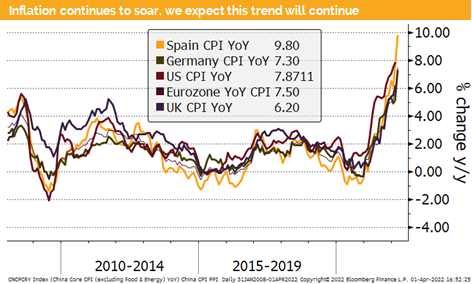

The US Fed has convinced the market that during the next 6 meetings in 2022 there will be 7 rate hiking steps. Therefore, we might see 2% at the end of the year. However, in the light of US inflation of 7.9% this interest rate level would still be rather low.

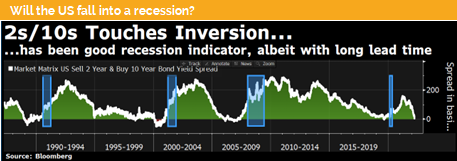

The risk that this tightening process will push the US economy into a recession in 2023 has risen significantly. The US treasury market does tell us a similar story. The 2-year 10-year spread has inverted, which points to a recession over the coming 18-24-months.

However, the 3-month 10-year spread has risen further and points to an acceleration of growth during the coming months. Based on Fed internal research this yield spread does a better job predicting possible recessions. However, due to the conflict in Ukraine it is rather difficult to judge the accuracy of these two indicators.

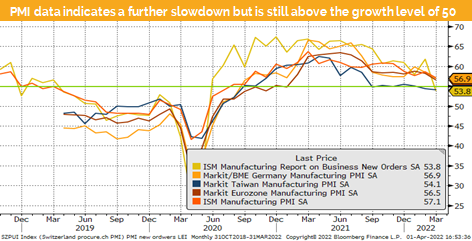

It is therefore amazing that the latest PMI survey data for Europe and the US stayed mostly around the acceleration level of 55. Although the trend is falling as expected, we do not see (yet?) a steepening of the indicator curve.

We have various effects which are overlapping and partially offsetting each other, like the corona opening-up effect versus the Fed hiking cycle.

The ECB has announced that they might start their tightening process later during 2022 to fight against inflation. The latest inflation data from Spain with 9.8% and Germany with 7.3% have added pressure on the ECB to step in quicker than they have communicated so far.

As in Europe most corona measurements are now discontinued, we do see a stimulating effect while the economy is reopening.

China is stimulating their economy at three different levels: credit impulse, monetary and fiscal stimulus. Meanwhile its PMI data has fallen below the growth level, together with lockdowns in large cities we expect more stimulus during the coming months.

Meanwhile most developed and emerging market countries continue with their tightening process.

We therefore expect for 2022 a global slowdown but no recession. However, for Europe stagflation during 2022 might be the most likely outcome. For 2023 some countries might fall into a recession, unless we see a reactivation of fiscal or monetary stimulus later during 2022.

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: Equity markets will fluctuate more due to scarce liquidity

Liquidity

The CHF and the USD have stayed strong over the last weeks. The CHF stayed range bound against the USD but strengthened against the EUR. The SNB has announced that they will let the CHF strengthen against the EUR if the inflation differential between the Eurozone (CPI at 7.5%) and Switzerland (CPI at 2.4%) will stay at such elevated levels. We might therefore see a new test of the EUR to fall below 1.00 against the CHF soon.

The EUR has fallen. It has dropped to around 1.08 against the USD followed by a relief rally to around 1.12 only to fall back to 1.10 were it stood 4 weeks ago. We expect that the EUR stay weak against the USD.

The USD measured by the DXY index has reached a new higher trading range of around 98 to 99.5. If the geopolitical tensions are ongoing the USD should continue to strengthen against other major currencies.

Equities

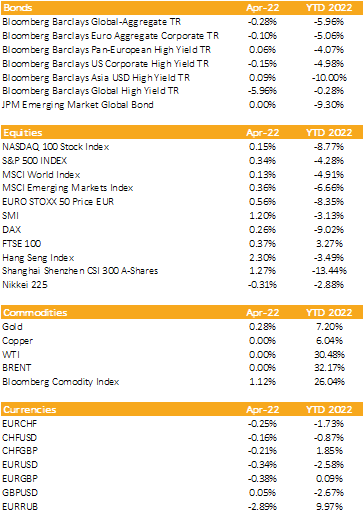

Global equity markets have recovered around 2/3 of their initial losses over the last 4 weeks. As of this writing, the Nasdaq composite is down around 8% after initially losing 20%.

During the beginning of a Fed hiking cycle equity markets do normally perform well. This time however, the Fed is behind the curve with hikes while we expect an economic slowdown at the same time. Central banks must choose between fighting against inflation or pushing the economies into a recession. Therefore, there are several hedge fund managers who expect that the Fed will have to stimulate the economy in 2023 to overcome the economic slowdown.

Fixed Income

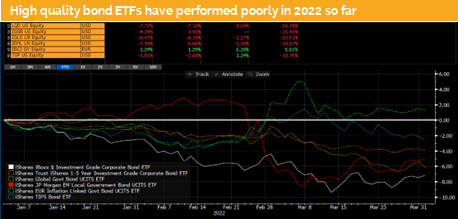

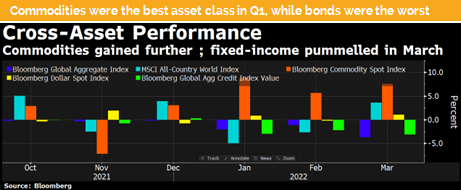

The US 10-year treasury index lost almost 6% in Q1 which is a record loss. It has underperformed the S&P 500 which lost a touch less than 5%. It is now the 2nd year in a row where bond holders lose money.

It is therefore astonishing that many German investors keep buying long only high-quality bonds or even worse bond ETFs replications of IG bond indices. Both investments will not serve you well during 2022, but on top inflation will reduce your purchasing power further.

Alternative Investments

Gold has surged to around USD 2’050 during March. Since then, we have seen a mean reversion. However, so far gold stayed above the USD 1’900 threshold. We expect that gold will reach new record levels over the coming months.

Copper has had a similar price pattern like gold. It surged to USD 10’845 per tone followed by a pullback to around USD 10’350. The upwards trend is intact, and we do see a lack of supply which supports higher prices.

Uranium has continued to rise and is trading at levels last seen at the beginning of the last decade. We stick to our investment case, but short-term markets might continue to fluctuate in an erratic way.

The WTI futures has fluctuated in a wide range of around USD 95 to 130 per barrel. Since the US has announced the release of some oil from its strategic reserve, we see prices at around USD 100. As of this writing the European Union is discussing to sanction oil imports from Russia which would push prices much higher.

Investments covered:

NatWest Markets 3.479% 2025

OneMain Holdings 6.125% 2024

Apple Inc

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate