Bi-Weekly. May 2022 I

Macro Update: Fed’s 2nd rate hike raises the risk of the US economy hard landing

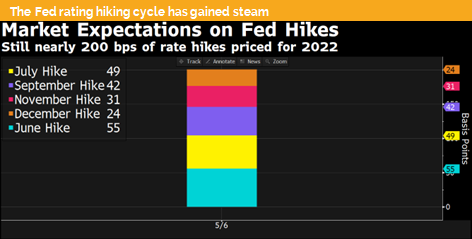

The US Fed has risen its policy rate by 50 basis points. This was mostly expected by the markets and analysts. However, only after the Fed chair M. Powell said “no” to a 75-basis point increase in the future equity markets started to rally.

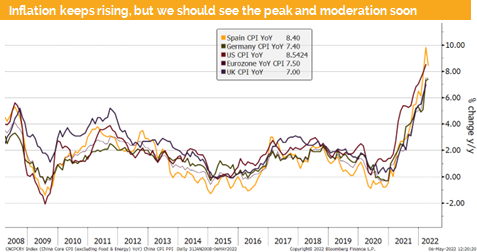

Meanwhile US PMI data decreased to around 55 and is expected to fall further. The Fed is in a perfect storm situation where inflation is above 8%, mostly driven by a supply shook, i. e. the potential monetary policy is can not be effective. In addition, we do have further negative growth impulses from further lockdowns in China and the implemented sanctions against Russia in various economical sectors.

Therefore, it is almost impossible for the Fed to avoid a hard landing, i. e., a recession. Having said that the situation in Europe looks much worse. We have inflation at around 7.5% while soft economic indictors point to a further slowdown. Meanwhile the ECB is still not hiking. We expect that the ECB will start with its hiking process over the coming 2-4 months, while the economy might already be in a stagflation phase. The risk for a recession in Europe is therefore even higher than in the US.

If we turn to China which is still following a zero-tolerance policy when it comes to COVID-19 we see on one hand lookdowns in the capital and in more then 200 lager cities but on the other hand, we see that the government is further stimulating the economy with credit programs and other monetary and fiscal measurements.

There are so many container ships standing in the south China sea that the outlook for global growth has significantly worsen over the last 4 weeks.

It is interesting that we do see a tight labour market in the US and in Europe, which tells us that the economy is surprisingly resilient but at the same time we must expect some pressure from wage inflation which will keep inflation at a sticky high level.

Until the end of the year the Fed rate should go up to around 2.5% which compares to an actual inflation level of around 8.5%. The 10-year treasury might go further up towards 3.5%. But for both yield levels the real yield is negative. This situation can be observed as well for CHF, GBP and EUR yield levels. We expect that this situation will last into 2023 and most likely beyond that.

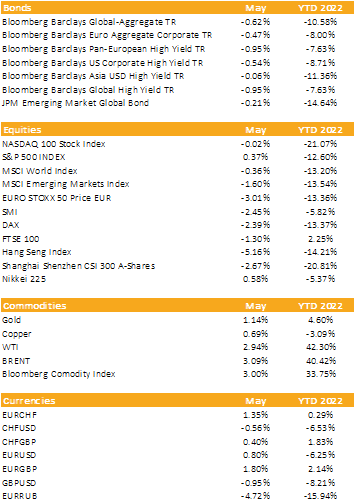

Markets in 2022: Currencies, Commodities, Equity & Bond Indices

Investment Outlook: US equity markets are at an inflection point

Liquid

The CHF has been on a roller coaster against the EUR since March. But after having almost reached parity we are back to 1.04, slightly higher compared to our last publication. The big move happened against the USD where we have seen an increase from around 0.925 to above 0.98. The USD is profiting from a solid US growth outlook and a central bank which finally rises policy rates at a much faster pace than previously communicated.

The EUR has further depreciated against the USD. The ongoing Ukraine conflict, the Fed rate hike cycle and the ECB which is still waiting to start its hiking process have all pushed the EUR further down.

The USD measured by the DXY index has significantly risen over the last month, from around 98 to above 103.5 now, reflecting its status as global reserve currency.

Equities

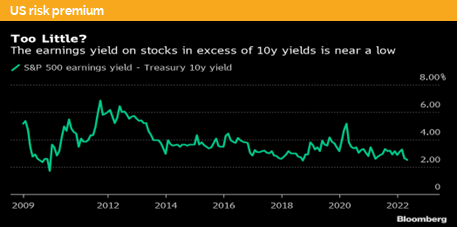

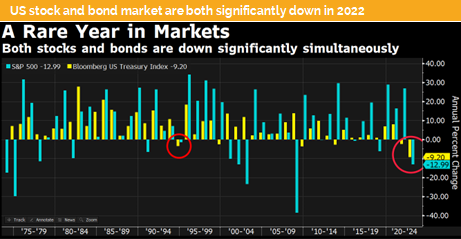

Global equity markets have continued to correct. The US market has seen a very strong and unusual relief rally after the 50-basis point rate hike followed by an even stronger selloff the following day. We are now in a secular equity bear market (fat and flat as Goldman calls it).

The earnings outlook for the US is slightly positive for 2022, but the valuation of the market is still very high. We must therefore expect that the PE multiple will contract, which most likely will involve lower price from where we stand as of this writing.

Fixed Income

The US 10-year treasury yield has risen over the last 30 days from around 2.6% to above 3.05%. Short-term we might see a mean reversion towards 2.95%, but mid-term the yield will probably continue to stay above 3%.

In the corporate bond space, we have seen spread widening due to the expected global economic slow down. The US high yield index has now a yield to worst of more than 7%, US high yield bonds do look quite attractive compared to US equities. Although we must add that rising US yields will hurt these bond prices too.

Alternative Investments

Gold has sold of while both the 10-year treasury yield and USD index have risen. The headwinds for gold will stay in place but we continue to expect higher prices over the coming months.

Copper has sold of from levels above 10’600 to below 9’600 mainly driven by a weaker global growth outlook. However, the case for an insufficient supply of copper over the coming 3-5 years is still valid and mid-term higher prices are in the cards.

Uranium has sold of with global equites as recession concerns have risen. However, the case for uranium stays intact.

Oil futures have spiked after the announcement of the European Union to ban Russian oil imports by the end of 2022. At the OPEC+ conference a small supply hike was announced, which however was sized in a way that oil futures continued to rise further up.

Investments covered:

Take-Two Interactive Software 3.55% 2025

Usinas Siderurgicas de Minas Gerais 5.875% 2026

LVMH Moet Hennessy Louis Vuitton

Disclaimer

This document has been issued by Blackfort Capital or its affiliates and / or associates (hereinafter “Blackfort”) for informational purposes only and should not be construed under any circumstances as an offer to sell or a solicitation for any offer to buy any securities or other financial instruments. This document is not an invitation to provide any services, advertising, or an offer to conclude any deals or agreements. All materials are intended for use in this document, are indicative and intended for your use only. This document does not address investment goals, financial situation, or individual needs. The provision of information in this document is not based on your circumstances. This is not investment advice and Blackfort does not make any recommendation regarding any products or transactions referred to in this document, nor is it a preliminary determination of the risks (directly or indirectly) associated with any product or transaction described herein.

Blackfort and / or related parties may take a position, participate in the market and / or transact in any of the investments or related activities mentioned here and provide financial services to issuers of any other person mentioned here. The information contained in this document is based on materials and sources that we refer to as reliable, however Blackfort makes no representations or explicit implied obligations regarding the accuracy, completeness or reliability of the information contained in this document. Any prices or levels indicated in this document are presented only as preliminary and indicative data, unless preliminary data or offers are indicated. Opinions expressed as of the date of publication in this material. Any opinions expressed are subject to change without notice and Blackfort is under no obligation to update the information contained herein. Neither Blackfort nor its agents, representatives, agents, or employees shall be liable in any way for any consequential loss or damage arising out of any use of this document.

Factual statements, statistics, information about actual and perceived issues presented in this document, opinions expressed, and predictions or statements regarding various issues mentioned in this document do not necessarily represent an assessment or interpretation of Blackfort’s information. You should not treat the content of this document as advice on legal, tax, or investment issues. You must determine how you should rely on any data, statements or opinions contained in this document, and Blackfort is not responsible for them. It is recommended that you conduct your own due diligence.

© Blackfort Capital AG. All Rights reserved.

Media about us:

-

-

Capital for The Energy-efficient Renovation of Swiss Homes

Uncorrelated earnings in Swiss Francs and more capital for the energetic refurbishment of Swiss houses – In the interview Wanja Eichl, Managing Partner, explains why Blackfort launches the new Swiss Real Estate Debt Fund. Please check it out via the following INTERVIEW Blackfort Swiss Real Estate Debt_e

-

More Capital for The Energetic Refurbishment of Swiss Real Estate